Sample Letter for Lien Notice

Description

Definition and meaning

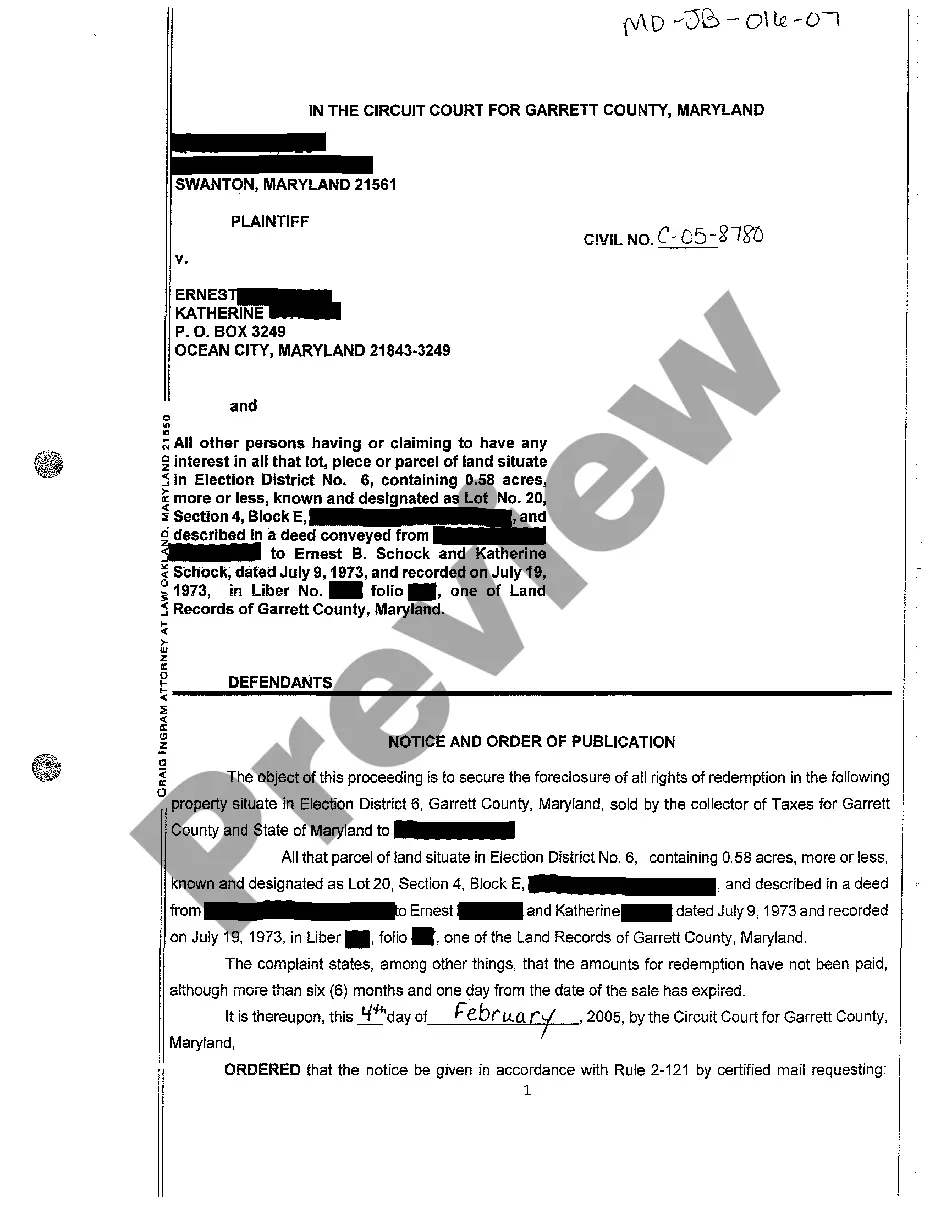

A Sample Letter for Lien Notice is a formal document used to inform a property owner of an outstanding debt or obligation that has led to the filing of a lien against their property. This letter serves as a notification that legal action may be pursued if the amount owed is not resolved within a specified period. The document typically outlines the reasons for the lien, the amount due, and the potential consequences of failing to address the matter promptly.

Who should use this form

This form is intended for creditors, such as contractors, suppliers, or lenders, who have a legitimate claim against a property owner due to unpaid debts. It is also useful for legal representatives acting on behalf of such creditors. If you are owed money for services rendered or products provided and are considering enforcing a lien, this letter is an essential first step in the legal process.

Key components of the form

A well-structured Sample Letter for Lien Notice generally includes the following components:

- The sender's information, including name and address

- The recipient's information, including name and address

- A subject line indicating the purpose of the letter

- A statement of representation, if applicable

- The amount due and a description of the debt

- A deadline for payment to avoid legal consequences

- A mention of potential legal actions that may follow if payment is not made

- Contact information for any discussions regarding the matter

Common mistakes to avoid when using this form

When preparing a Sample Letter for Lien Notice, be mindful of these common mistakes:

- Failing to provide accurate and complete information regarding the debt

- Not specifying a clear deadline for payment

- Using overly complex language that may confuse the recipient

- Neglecting to include contact information for further communication

- Not keeping a copy of the letter for your records

What documents you may need alongside this one

To effectively use a Sample Letter for Lien Notice, you may need the following documents:

- Invoices or statements that detail the debt

- Contracts or agreements related to the services/products provided

- Any previous correspondence regarding the debt

- Proof of delivery for the goods or services rendered

How to fill out Sample Letter For Lien Notice?

Use US Legal Forms to get a printable Sample Letter for Lien Notice. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most comprehensive Forms catalogue on the web and offers cost-effective and accurate samples for customers and lawyers, and SMBs. The documents are categorized into state-based categories and many of them can be previewed prior to being downloaded.

To download samples, users must have a subscription and to log in to their account. Hit Download next to any form you want and find it in My Forms.

For those who don’t have a subscription, follow the tips below to quickly find and download Sample Letter for Lien Notice:

- Check out to make sure you have the proper template in relation to the state it is needed in.

- Review the document by looking through the description and by using the Preview feature.

- Hit Buy Now if it’s the document you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it many times.

- Make use of the Search field if you want to find another document template.

US Legal Forms provides a large number of legal and tax samples and packages for business and personal needs, including Sample Letter for Lien Notice. More than three million users have already utilized our platform successfully. Select your subscription plan and have high-quality forms within a few clicks.

Form popularity

FAQ

Serving a mechanics lien, or providing a copy of the lien to interested parties, ensures that they receive notice and can promptly recognize and pay your claim. In most states, mechanics liens lien may be served through the mail, usually by sending it via certified mail sometimes with return receipt requested.

A Lien Demand Letter or Notice of Intent to Lien is a formal demand for payment.A lien demand letter puts a debtor on notice of your intent to lien the job site property by a specific date deadline. Increase your odds of getting paid with a lien demand letter.

Someone who is owed money is generally not able to just put a lien on property without first securing a judgment. Securing a judgment requires the creditor to sue the debtor. This may be through circuit court in many jurisdictions. If under a certain dollar amount, this suit may be through the small claims court.

A lien is a claim on property to ensure payment of a debt. When you borrow money to purchase a car, the lender files a lien on the vehicle with the state to insure that if the loan defaults, the lender can take the car. When the debt is fully repaid, a release of the lien is provided by the lender.

A Lien Demand Letter or Notice of Intent to Lien is a formal demand for payment.A lien demand letter puts a debtor on notice of your intent to lien the job site property by a specific date deadline. Increase your odds of getting paid with a lien demand letter.

Be sure to include the following pieces of information in your lien: The name, company name and address (including county) of the property owner against whom your lien is filed; the same information about the delinquent client, if different; the beginning and ending dates of the unpaid service; the due date for payment

Who you are. The services or materials you provided. The last date you provided the services or materials. How much payment should be. The date on which you will file a lien if you do not receive payment. How the debtor should pay.