Irrevocable Funeral Trust - Prearranged Funeral Trust Account

Definition and meaning

An irrevocable funeral trust, also known as a prearranged funeral trust account, is a financial arrangement designed to cover the costs of funeral services in advance. This type of trust ensures that funds set aside for future funeral expenses are not subject to change or withdraw by the trustor, providing peace of mind for both the trustor and their beneficiaries.

The trust funds are typically managed by a financial institution, and the designated funeral service provider is the beneficiary of these funds when the time comes.

How to complete a form

Completing the irrevocable funeral trust form involves several straightforward steps:

- Identify the Trustor: Fill in the name of the person creating the trust.

- Provide Account Details: Include the account number where the trust will be established.

- Designate the Bank: Write the name and address of the bank that will serve as the trustee.

- Choose a Beneficiary: Indicate the name and contact information of the funeral service provider who will benefit from the trust.

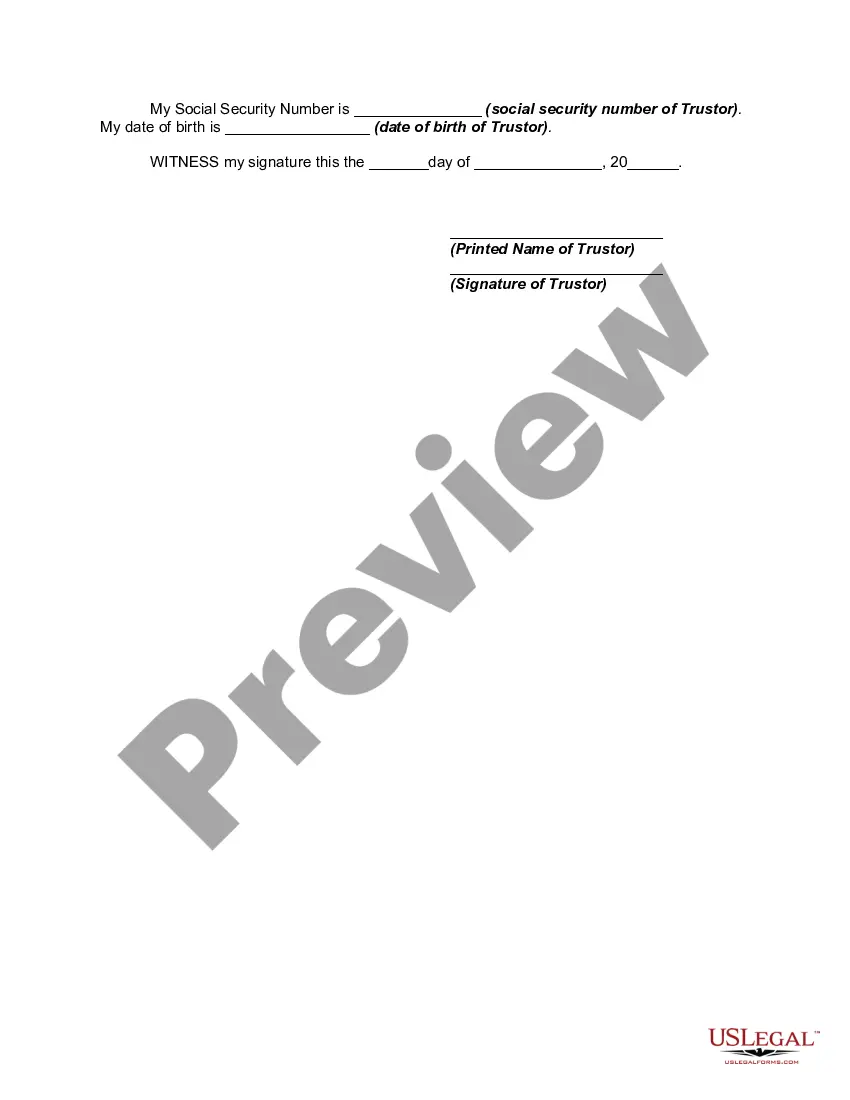

- Sign and Date: The trustor must sign and date the form to make it legally binding.

Ensure all information is accurate to avoid issues in the future.

Key components of the form

The irrevocable funeral trust form includes several essential components that outline its structure and function:

- Trustor Identification: The full name and Social Security number of the trustor.

- Bank Details: Information about the bank serving as the trustee.

- Beneficiary Information: Data regarding the funeral service provider.

- Withdrawal Restrictions: A clause stating that withdrawals cannot be made during the trustor's lifetime.

- Successor Trustee Arrangements: Designations for any successor trustees if the original trustee cannot fulfill their role.

These components ensure that the trust operates smoothly and that the funds are utilized as intended.

Benefits of using this form online

Using the irrevocable funeral trust form online offers several advantages:

- Convenience: Users can complete and submit the form from the comfort of their home.

- Accessibility: Online forms are readily available, allowing users to access them 24/7.

- Guidance: Many online platforms provide helpful instructions and resources for completing the form accurately.

- Reduced Errors: Online forms often include validation features to minimize mistakes during completion.

These benefits simplify the process and help ensure that the trust is established correctly.

Common mistakes to avoid when using this form

While completing the irrevocable funeral trust form, users should be cautious of the following common mistakes:

- Incorrect Information: Ensure all details, such as names and account numbers, are accurate.

- Missing Signatures: The trustor’s signature is essential; without it, the form is not valid.

- Ignoring Instructions: Follow any specific guidelines provided with the form to avoid errors.

- Not Designating a Successor: Always include a successor trustee to handle the trust if necessary.

Avoiding these pitfalls will help facilitate a smoother process for establishing the trust.

What documents you may need alongside this one

When preparing to complete the irrevocable funeral trust form, it is beneficial to have the following documents ready:

- Identification: A government-issued ID for the trustor.

- Bank Information: Documentation from the bank that includes the account number and details regarding the trustee.

- Funeral Provider Contract: An agreement or estimate from the funeral service provider, if available.

- Social Security Number: The trustor’s Social Security number for identification purposes.

Having these documents at hand can streamline the process and ensure that no critical information is overlooked.

Key takeaways

The irrevocable funeral trust is a useful tool for planning funeral expenses ahead of time. Key points to remember include:

- The trust is irrevocable and cannot be changed once established.

- Funds held in the trust are strictly for funeral expenses.

- Understanding the form's components is crucial for proper completion.

- Using online resources can simplify the process significantly.

Taking the time to understand the irrevocable funeral trust can ease the burden on loved ones during a difficult time.

Form popularity

FAQ

There are two kinds of prepaid funeral contracts: revocable and irrevocable. Revocable means you can cancel the contract and get most of your money back. Irrevocable means you cannot cancel the contract, but you can transfer it to a different funeral home if you want to.

Typically, a funeral home or cemetery will help you set up a trust when you are entering into a contract with them. You can open an individual trust account with a bank and deposit your money in a savings account or certificate of deposit. Bonds or life insurance may also be used to fund the trust.

The Internal Revenue Service defines a funeral trust as a 'pooled income fund' set up by a funeral home/cemetery to which a person transfers property to cover future funeral and burial costs. Funeral trusts allow people to pay funeral expenses in advance, and that can spare survivors a lot of difficult decisions.

A funeral trust, or qualified funeral trust, is a special financial vehicle that allows you to set aside money for anticipated funeral costs. When you establish a trust, you make arrangements with a cemetery or funeral home to provide services upon death. The beneficiary of the trust is the funeral service provider.

The Internal Revenue Service defines a funeral trust as a 'pooled income fund' set up by a funeral home/cemetery to which a person transfers property to cover future funeral and burial costs. Funeral trusts allow people to pay funeral expenses in advance, and that can spare survivors a lot of difficult decisions.

Definition: Irrevocable Funeral Trusts A trust is a legal agreement in which an individual (called the Trustmaker or Grantor) sets aside a certain amount of money for a specific purpose or person.Irrevocable means the trust cannot be changed, reversed, or dissolved for any reason.

Paying the Bills Powers of a trustee or executor include paying bills for funeral expenses incurred by a decedent's estate. This means a trustee can write checks using the estate's bank accounts to satisfy funeral costs, including paying for a burial plot and any viewing time at a funeral home.