Offer to Purchase Commercial Property

Definition and meaning

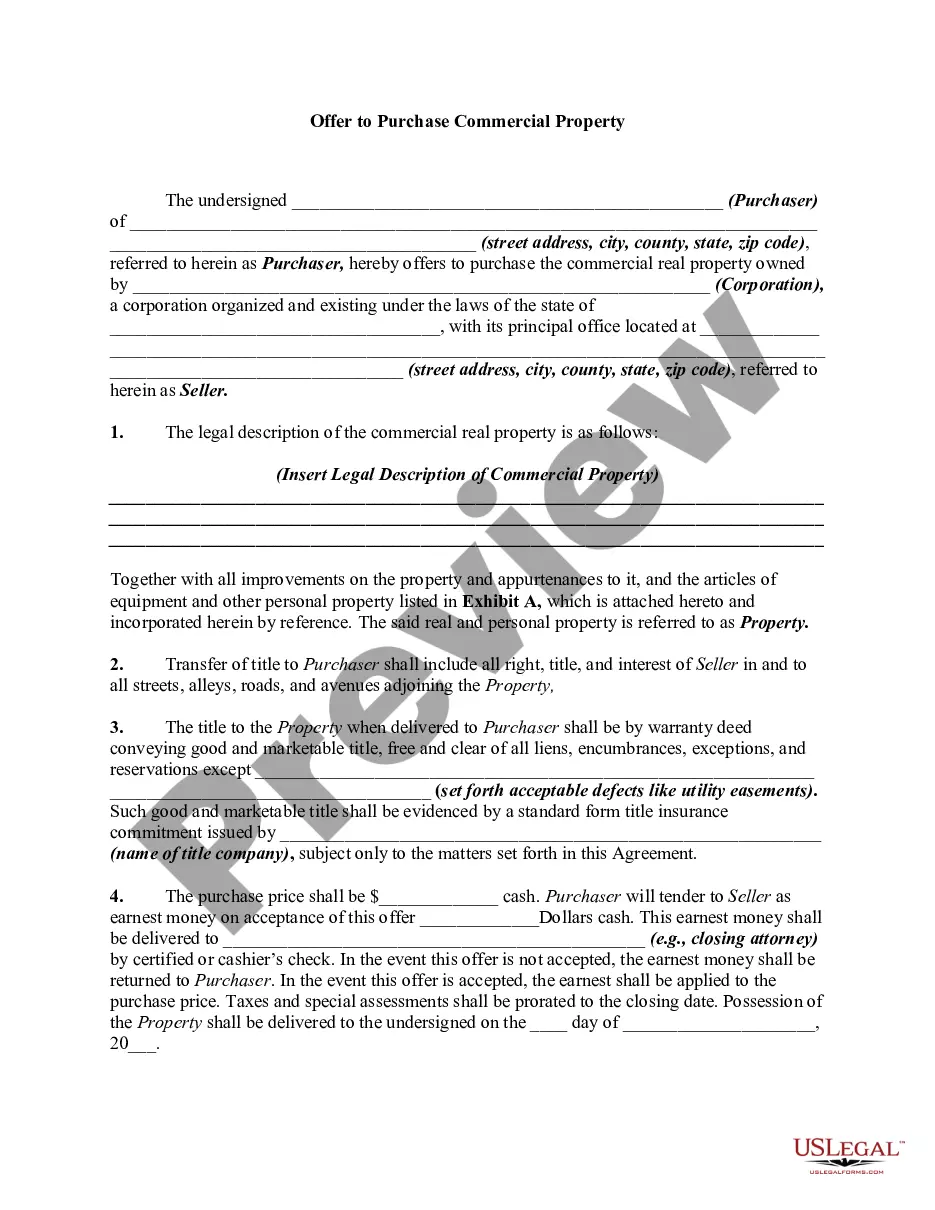

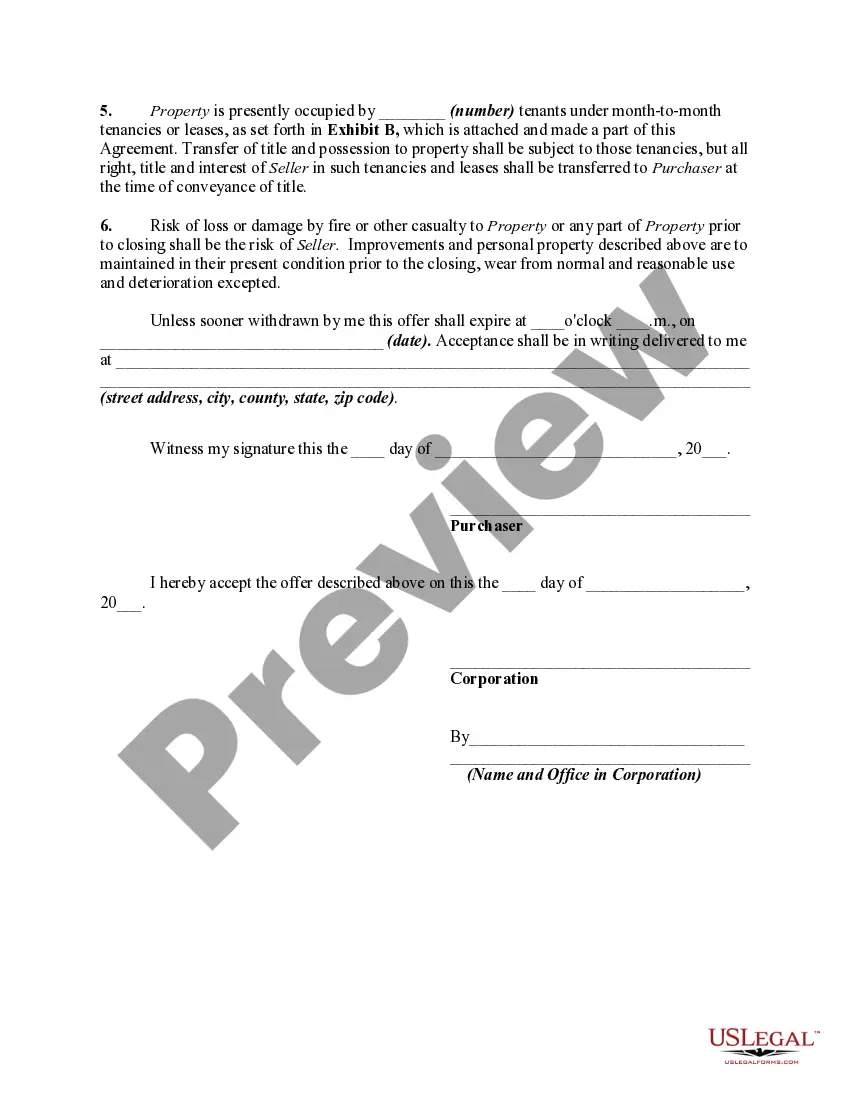

An Offer to Purchase Commercial Property is a formal document used by a potential buyer to propose the terms under which they intend to purchase commercial real estate. This document outlines significant details about the transaction, including the purchase price, terms of payment, and any conditions that must be met before the property can be sold. The offer serves as an initial step in the real estate transaction process, which, upon acceptance by the seller, leads to further legal documentation and arrangements.

How to complete a form

Completing an Offer to Purchase Commercial Property involves several steps:

- Enter Purchaser Information: Provide your full name, address, and contact details.

- Identify the Property: Clearly define the property you wish to purchase, including its legal description. This can often be found in public records.

- Set Purchase Price: State the offer amount you are willing to pay for the property.

- Include Terms: Outline the terms of payment, such as earnest money deposits and contingencies.

- Specify Closing Details: Indicate the desired closing date and any conditions required for the sale.

After filling in the necessary information, ensure you review the document for accuracy and sign it appropriately.

Key components of the form

The Offer to Purchase Commercial Property includes several essential components:

- Purchaser and Seller Details: Names and addresses of both parties involved.

- Property Identification: Legal description of the property to be purchased.

- Purchase Price: Total amount proposed by the purchaser.

- Earnest Money: Amount of money to be held as a deposit, confirming the purchaser's serious intent.

- Closing Conditions: Conditions that need to be met prior to finalizing the sale.

Each component is crucial for creating a legally binding agreement and clarifying the transaction's terms.

Who should use this form

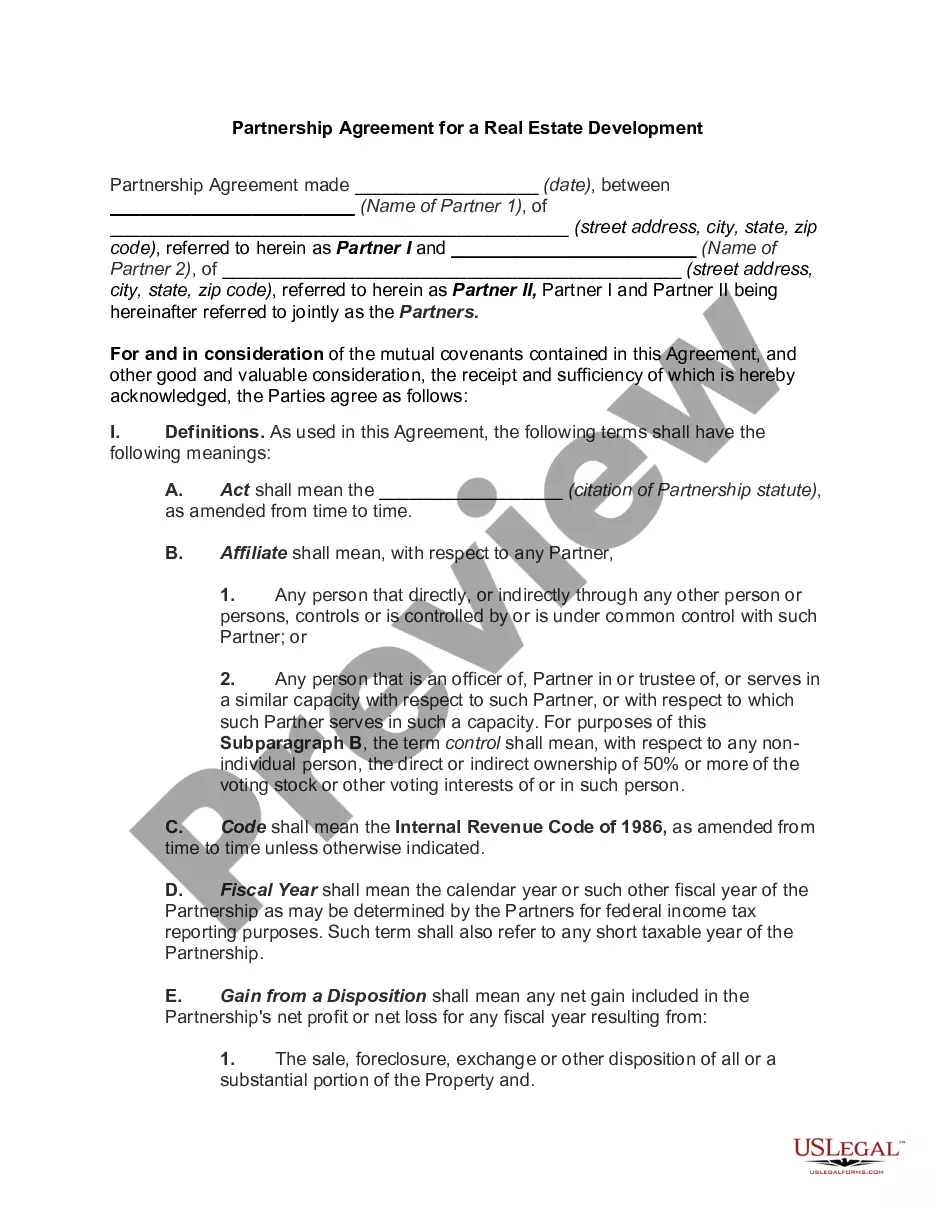

The Offer to Purchase Commercial Property is intended for individuals or entities interested in acquiring commercial real estate. This includes:

- Investors looking to purchase properties for rental income or resale.

- Businesses seeking new locations for operations.

- Developers who plan to renovate or build on the property.

This form can be employed by both experienced real estate professionals and first-time buyers looking to navigate the commercial property market.

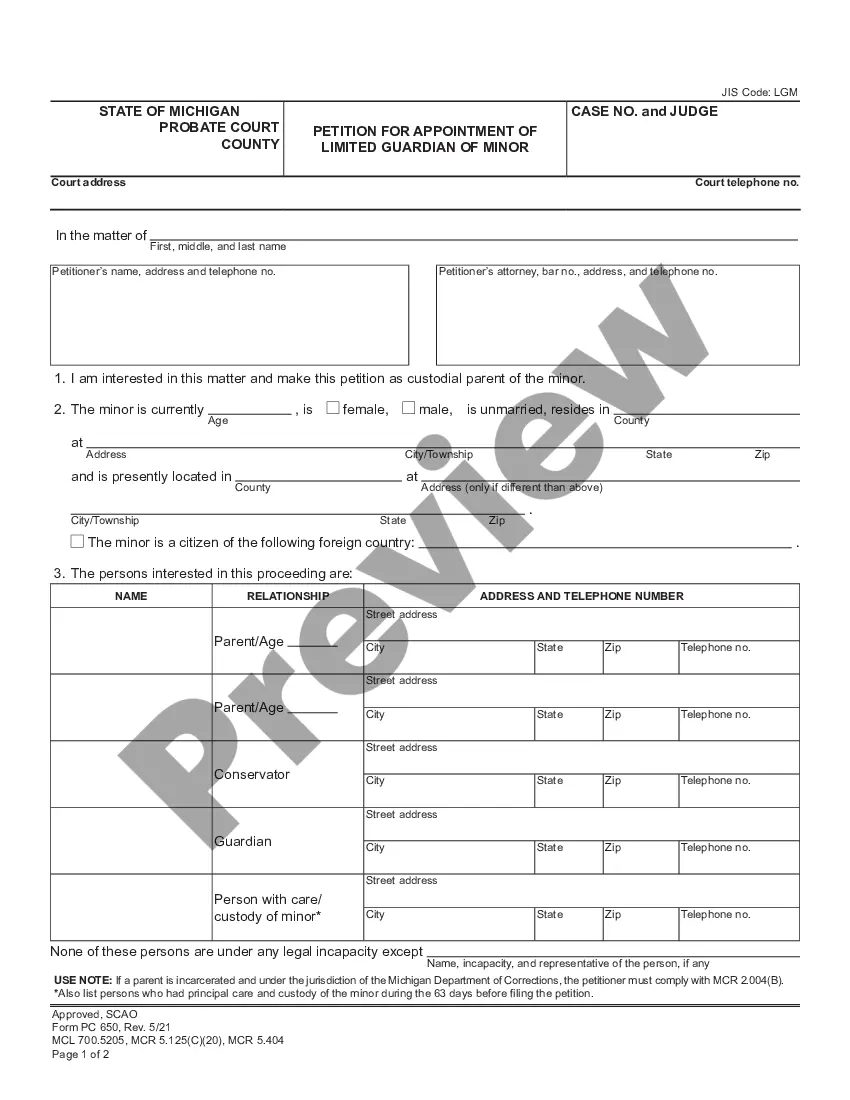

Common mistakes to avoid when using this form

When filling out an Offer to Purchase Commercial Property, be cautious of the following common pitfalls:

- Incomplete Information: Failing to include all necessary details can lead to misunderstandings.

- Neglecting to Specify Conditions: Not outlining conditions or contingencies may result in issues later in the process.

- Incorrect Legal Descriptions: Providing inaccurate property descriptions can invalidate the offer.

Taking care to avoid these mistakes will help ensure a smoother transaction process.

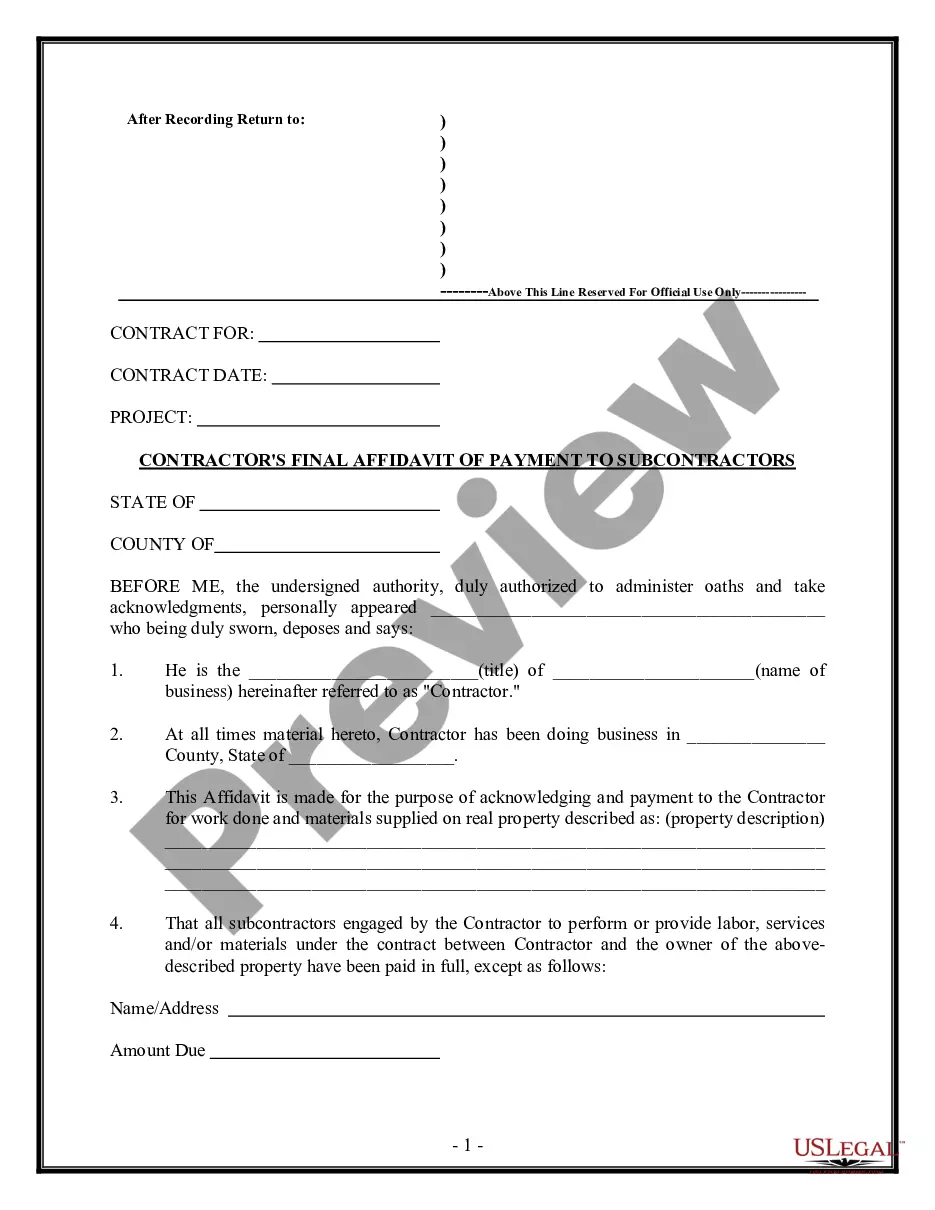

What documents you may need alongside this one

When preparing an Offer to Purchase Commercial Property, consider gathering additional supporting documents, such as:

- Proof of Funds: Documentation showing financial capability to complete the purchase.

- Property Appraisal: An evaluation of the property's value by a licensed appraiser.

- Inspection Reports: Any assessments regarding the condition of the property.

These documents will enhance your offer's credibility and demonstrate readiness to proceed with the transaction.

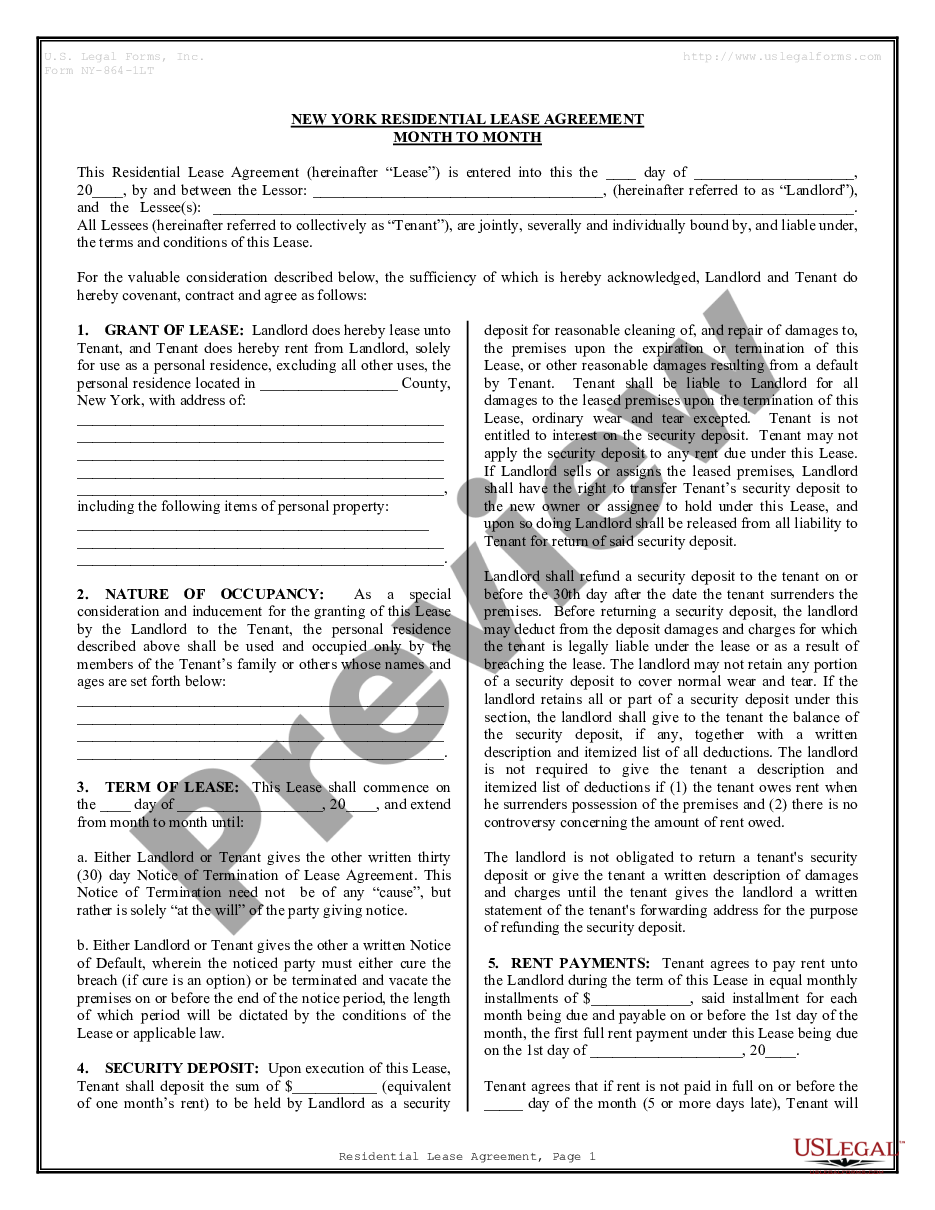

What to expect during notarization or witnessing

Notarization may be required for the Offer to Purchase Commercial Property to ensure the authenticity of signatures. During this process, you can expect the following:

- Identification: You will need to present valid identification to the notary.

- Signature Verification: The notary will confirm that you are signing the document voluntarily.

- Record Keeping: The notary may keep a record of the transaction for future reference.

This step adds an extra layer of legal protection to your offer, confirming that all parties have agreed to the terms outlined.

Form popularity

FAQ

Your legal name, the name of the seller and the address of the property. the amount you're offering to pay (the purchase price) and the amount of your deposit. any extra items you want included in the purchase (for example, window coverings) the date you want to take possession (closing day)

Know Your Needs. The first step in an effective negotiation is to have a firm grasp on what you need out of the lease or sale. Set Budget Beforehand. Now that you have a general idea of what you're looking for, it's time to set a budget. Due Diligence. Making an Offer. Treat All Parties With Respect.

Know Your Needs. The first step in an effective negotiation is to have a firm grasp on what you need out of the lease or sale. Set Budget Beforehand. Now that you have a general idea of what you're looking for, it's time to set a budget. Due Diligence. Making an Offer. Treat All Parties With Respect.

The Person Liable for the Lease. Your Business Structure. How Long You Have Been in Business. The Nature of Your Business. Contact Information. Your Proposed Terms (or, Counter Offer) The Length of the Lease. Condition of the Property.

LoopNet. LoopNet is one of the most recognized CRE search engines. For those more involved in multi family or residential real estate, LoopNet is often considered the Zillow of commercial real estate.

Yes, buying commercial property has proven to be a smart investment for those who know what to expect. The income potential alone is what draws so many real estate investors to this asset type. Commercial real estate is known to have a higher return on investment when compared to residential properties.

7 Key Steps for Buying a Commercial Real Estate Property Understand your motivations for investing in commercial real estate. Assess your investment options. Secure financing.Find the right property in your market.

Income potential.Commercial properties typically have an annual return off the purchase price between 6% and 12%, depending on the area, current economy, and external factors (such as a pandemic). That's a much higher range than ordinarily exists for single family home properties (1% to 4% at best).