Trust Agreement - Revocable - Multiple Trustees and Beneficiaries

Definition and meaning

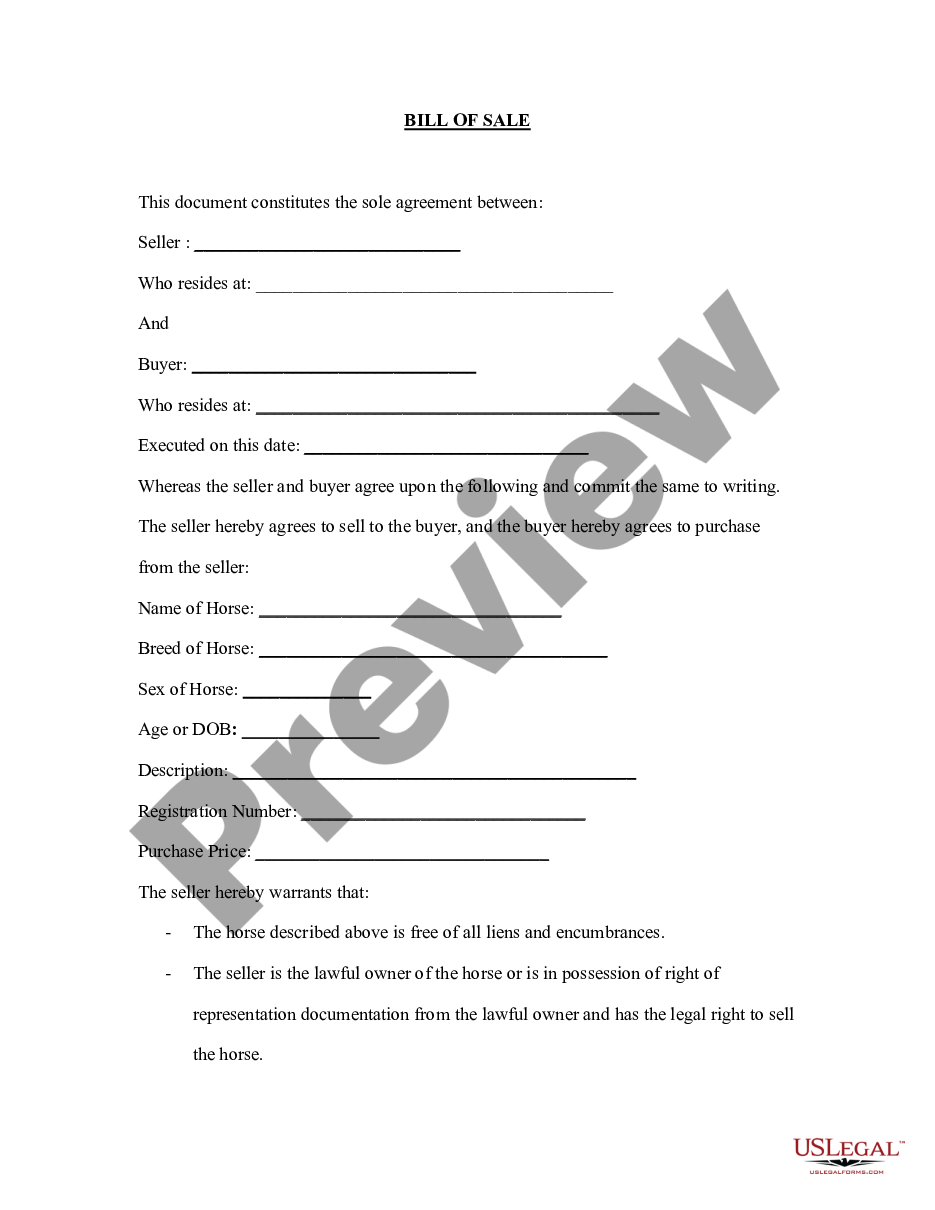

A Trust Agreement - Revocable - Multiple Trustees and Beneficiaries is a legal document that establishes a trust, allowing multiple trustees to manage the assets for the benefit of designated beneficiaries. This agreement outlines how assets are to be held, managed, and distributed during the grantor's lifetime and after their passing. The revocable nature of the trust allows the grantor to modify or terminate the trust at any time, providing flexibility in estate planning.

Key components of the form

This form includes essential sections that define the trust's purpose, the roles of the trustees, and the rights of beneficiaries. Key components typically include:

- Grantor's information: The individual setting up the trust.

- Trustees: The individuals responsible for managing the trust assets.

- Beneficiaries: The people who will benefit from the trust.

- Assets included in the trust: A detailed list of property or investments placed into the trust.

- Distribution guidelines: Instructions on how income and principal should be distributed to beneficiaries.

- Revocation and amendment instructions: Procedures for changing or dissolving the trust.

How to complete a form

Completing a Trust Agreement - Revocable - Multiple Trustees and Beneficiaries involves several steps:

- Gather required information: Collect details about the grantor, trustees, beneficiaries, and specific assets to be included in the trust.

- Fill out the form: Clearly state the names, addresses, and roles of the grantor, trustees, and beneficiaries. Provide detailed descriptions of the assets.

- Review the terms: Ensure that the distribution guidelines reflect your wishes for how and when beneficiaries will receive their shares.

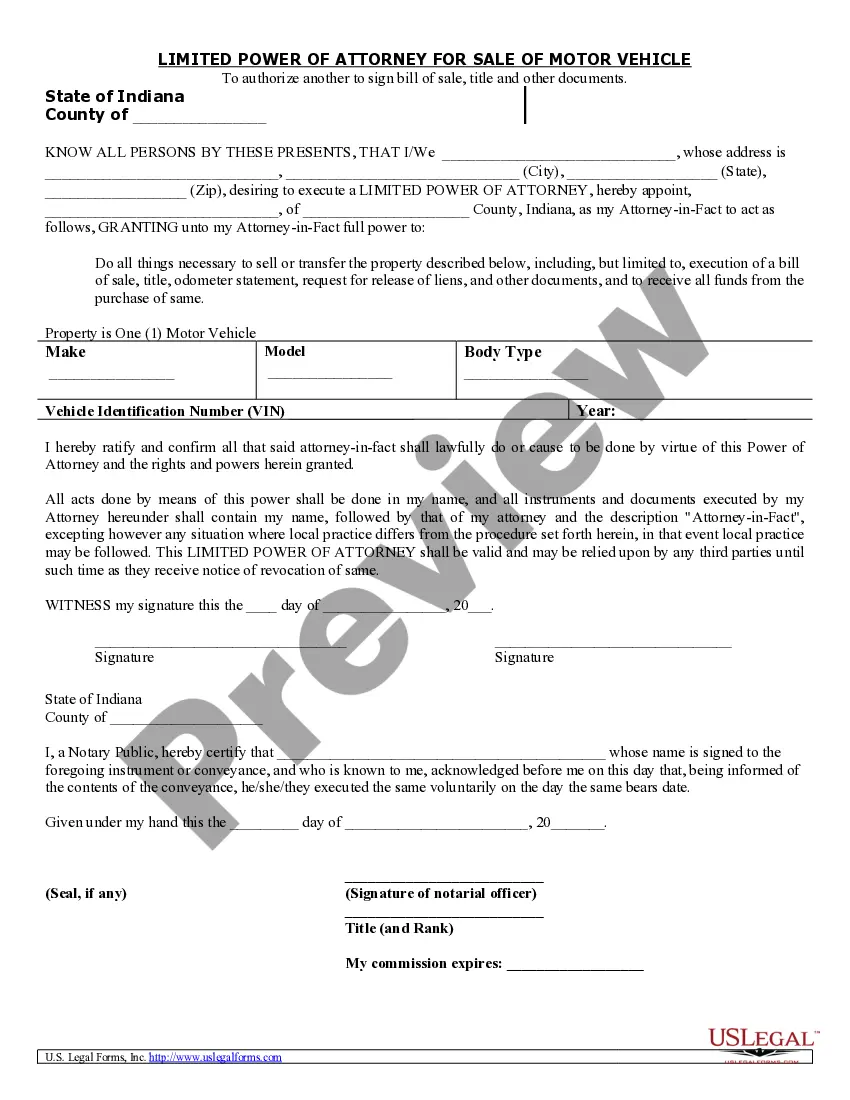

- Sign and date the document: The grantor and all trustees must sign the agreement in the presence of a notary public or witnesses, as required by state law.

Who should use this form

This trust agreement is suitable for individuals aiming to provide for their loved ones through structured management of assets. It is particularly beneficial for those who:

- Wish to maintain control over their assets while alive and provide for beneficiaries after passing.

- Desire flexibility in their estate planning, with the option to revoke or modify the trust.

- Have multiple beneficiaries that may require tailored instructions for distribution of assets.

Common mistakes to avoid when using this form

When completing a Trust Agreement - Revocable - Multiple Trustees and Beneficiaries, avoid these common pitfalls:

- Incomplete information: Ensure all sections are properly filled out, including names, addresses, and details of assets.

- Missing signatures: All necessary parties must sign the document; failure to do so could render the trust invalid.

- Neglecting state-specific requirements: Review local laws, as different states may have unique requirements for trust documents.

- Ignoring the need for notary or witnesses: Verify whether notarization or witnesses are required and follow through accordingly.

Form popularity

FAQ

Maximum. Whilst there is no general restriction on the maximum number of trustees that can be appointed of a trust of personality, the number of trustees of a settlement holding land is limited to four.

The person or people benefiting from the trust are the beneficiaries. Because a revocable trust lists one or more beneficiaries, the trust avoids probate, which is the legal process of distributing assets of a will.

When a grantor establishes a trust, a single trustee manages the trust's assets on behalf of the named beneficiaries. However, there is no requirement for a trust to have only one trustee. When a grantor names multiple trustees, or co-trustees, they are responsible for co-managing the trust's assets.

The simple answer is yes, a Trustee can also be a Trust beneficiary. In fact, a majority of Trusts have a Trustee who is also a Trust beneficiary. Being a Trustee and beneficiary can be problematic, however, because the Trustee must still comply with the duties and responsibilities of a Trustee.

While there's no limit to how many trustees one trust can have, it might be beneficial to keep the number low. Here are a few reasons why: Potential disagreements among trustees. The more trustees you name, the greater the chance they'll have different ideas about how your trust should be managed.

And there is no limit to the number of trustees to hold the position in one trust. Generally there are more than one trustee , the trustees, with respect to each other, are referred to as co-trustees, and when acting jointly as a collective body are referred to as the Board of Trustees .

A trust is a legal document that governs how the grantor's assets pass to the named beneficiaries upon the grantor's death.However, there is no requirement for a trust to have only one trustee. When a grantor names multiple trustees, or co-trustees, they are responsible for co-managing the trust's assets.

A single Trustee can be appointed but it is usually recommended that you appoint at least two. Not only does this avoid problems when a single Trustee is unable to conduct their duties, if the trust property includes any land, at least two Trustees will be needed for legal reasons.