Texas New!The Uncontested Docket: When the Decedent Dies With a Will(updated 02/27/2018)

Description

How to fill out Texas New!The Uncontested Docket: When The Decedent Dies With A Will(updated 02/27/2018)?

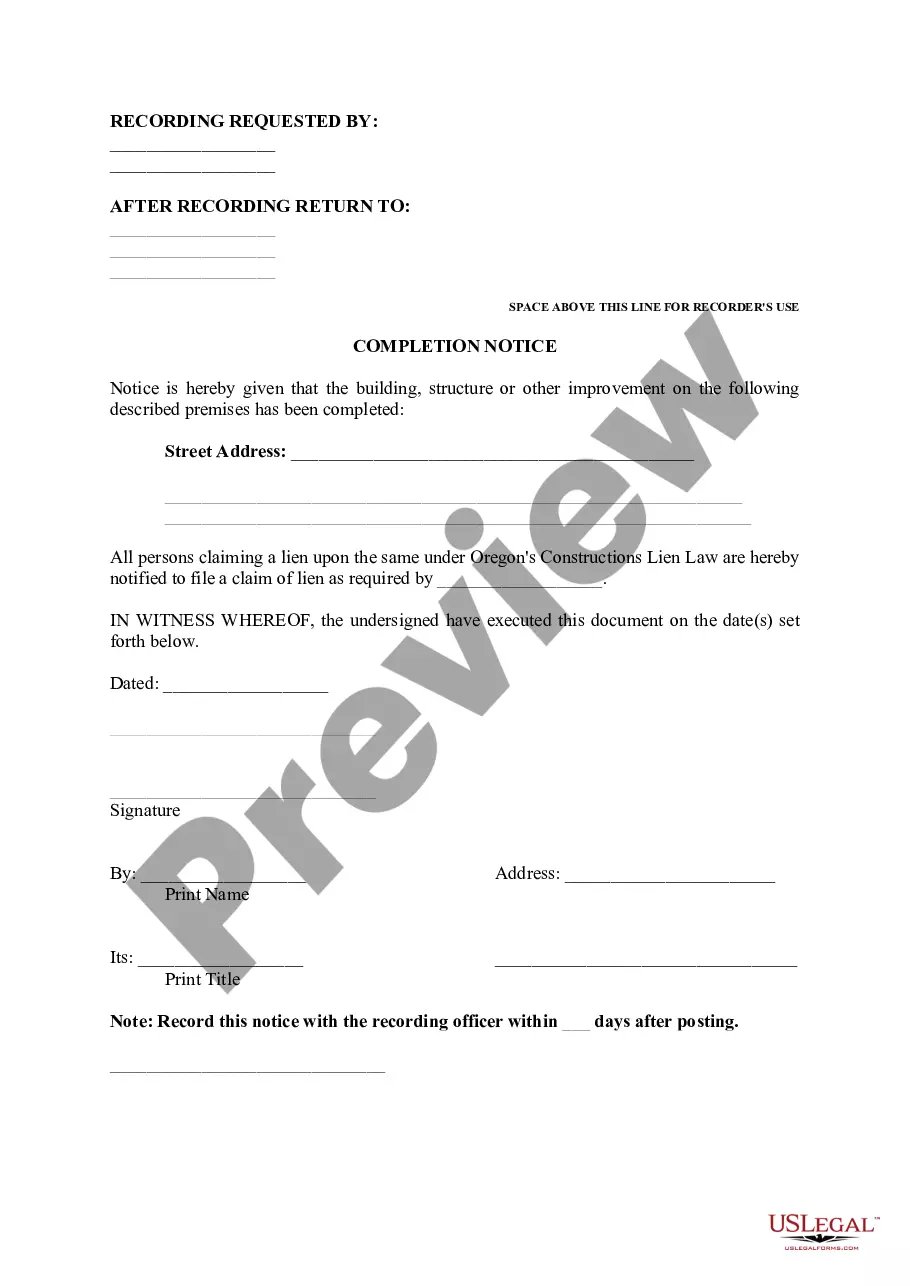

Preparing official paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them correspond with federal and state regulations and are verified by our specialists. So if you need to prepare Texas New!The Uncontested Docket: When the Decedent Dies With a Will(updated 02/27/2018), our service is the perfect place to download it.

Obtaining your Texas New!The Uncontested Docket: When the Decedent Dies With a Will(updated 02/27/2018) from our library is as easy as ABC. Previously registered users with a valid subscription need only sign in and click the Download button once they locate the correct template. Later, if they need to, users can take the same blank from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few minutes. Here’s a brief instruction for you:

- Document compliance check. You should attentively examine the content of the form you want and make sure whether it suits your needs and meets your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library using the Search tab above until you find an appropriate blank, and click Buy Now when you see the one you want.

- Account registration and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Texas New!The Uncontested Docket: When the Decedent Dies With a Will(updated 02/27/2018) and click Download to save it on your device. Print it to fill out your papers manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to get any formal document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

What Happens If You Don't Probate A Will In Texas? Heirs Do Not Realize They Need To Probate The Will.Possible Family Agreement On Disposition Of Assets.The Person Holding The Will Refuses To Produce The Will Or Take Any Action To Settle The Estate.An Affidavit Of Heirship & Family Settlement Agreement Will Not Work.

Texas law provides that, when this happens, the Will is treated as if it did not exist, and the estate passes by intestate (without a Will) succession. This means that children by a prior marriage take the deceased spouse's one-half of any community property.

There is no general requirement that all wills go through probate in Texas. However, if the decedent dies and leaves a will, you can only implement its provisions through probate.

Probate records of Texas have been kept by the probate clerk in each county courthouse. You can obtain copies of the records from the clerk's office. In most counties, all information pertaining to a probate case is recorded in the "probate minutes."

In Texas, the executor of the estate must file for probate within four years from the testator's death. Texas probate law is very strict about this statute of limitations. In certain circumstances, there may be alternatives for wills that have expired.

The executor generally has three years after their appointment to distribute the remaining assets (after debts and disputes are resolved). The Texas probate process can be fairly simple in most cases.

An estate may be exempt from the probate process in certain circumstances. Under Texas Estates Code, Title 2, Chapter 205, an estate need not pass through the probate process if there is no will and the total value of the estate (not counting any homestead real estate owned by the Decedent) is $75,000 or less.

Generally, yes, probate is public. The application and other documents are filed with the county clerk and open for inspection by the public. In fact, most counties provide free online access to the county clerk's records.