If you need to complete, download, or produce legal record templates, use US Legal Forms, the largest assortment of legal forms, that can be found on-line. Make use of the site`s basic and hassle-free research to obtain the paperwork you require. A variety of templates for business and person functions are categorized by classes and says, or keywords and phrases. Use US Legal Forms to obtain the Texas HAMP Loan Modification Package in just a couple of mouse clicks.

Should you be currently a US Legal Forms customer, log in for your bank account and click the Acquire button to find the Texas HAMP Loan Modification Package. You can even access forms you formerly delivered electronically inside the My Forms tab of your bank account.

If you use US Legal Forms the very first time, follow the instructions beneath:

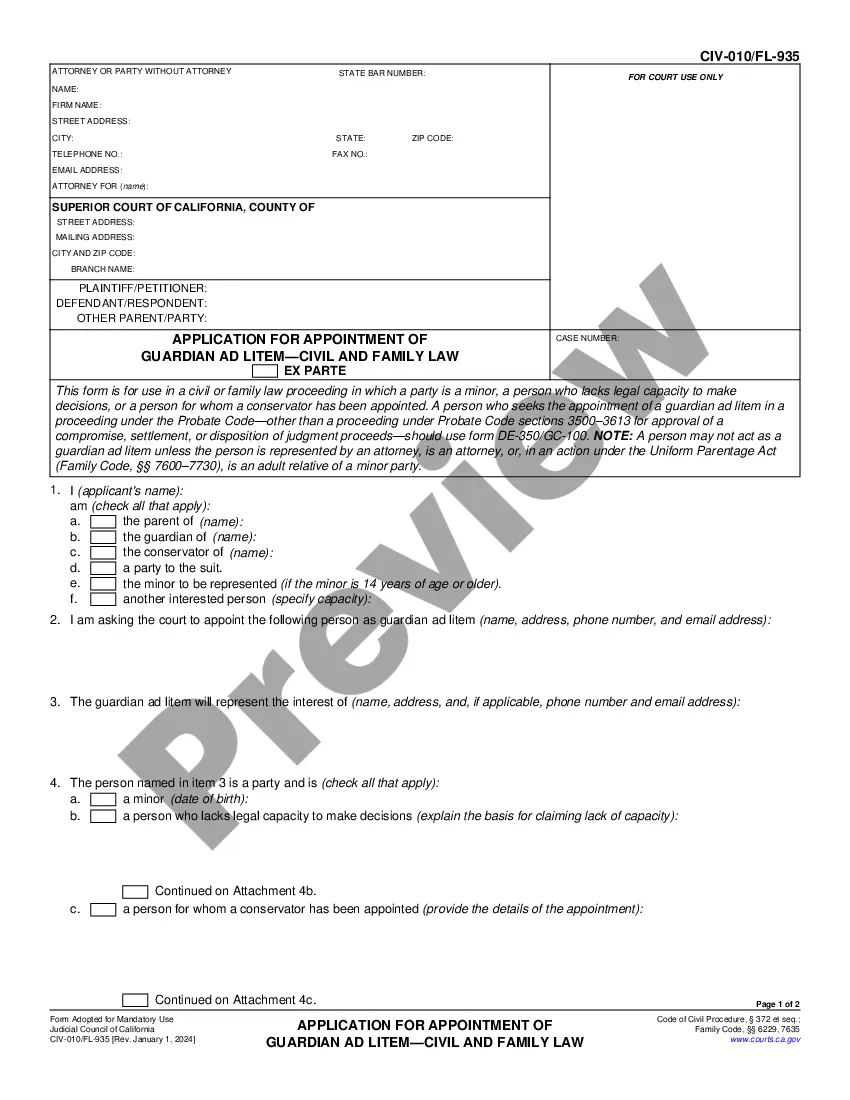

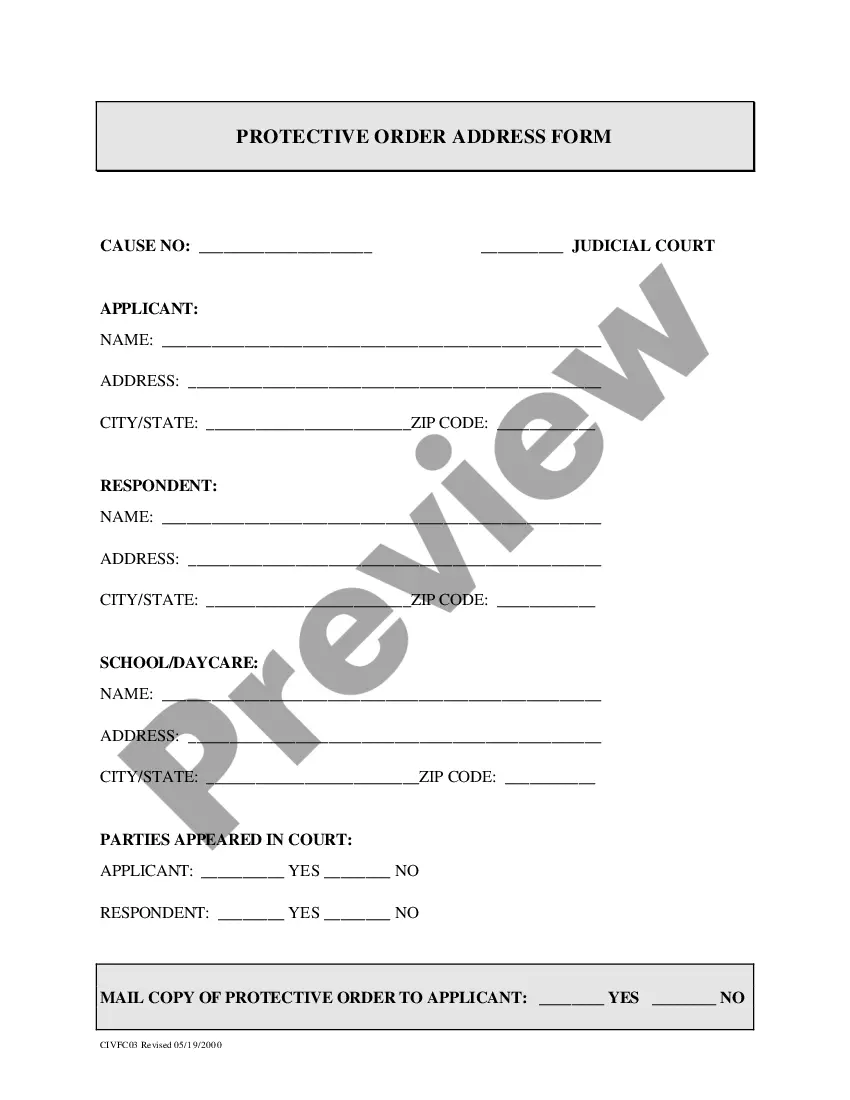

- Step 1. Ensure you have selected the shape for your correct town/country.

- Step 2. Take advantage of the Preview option to look through the form`s content. Never neglect to see the information.

- Step 3. Should you be not happy together with the develop, utilize the Lookup area near the top of the monitor to get other models from the legal develop web template.

- Step 4. Upon having located the shape you require, select the Get now button. Choose the costs program you choose and add your accreditations to sign up for the bank account.

- Step 5. Approach the purchase. You may use your Мisa or Ьastercard or PayPal bank account to complete the purchase.

- Step 6. Choose the formatting from the legal develop and download it on your own device.

- Step 7. Complete, revise and produce or sign the Texas HAMP Loan Modification Package.

Each and every legal record web template you get is your own property permanently. You might have acces to each and every develop you delivered electronically with your acccount. Select the My Forms area and pick a develop to produce or download again.

Contend and download, and produce the Texas HAMP Loan Modification Package with US Legal Forms. There are millions of specialist and express-specific forms you can use for your personal business or person requirements.