Texas Full Release of Payment For Electrical and Communication Easement and Damages

Description

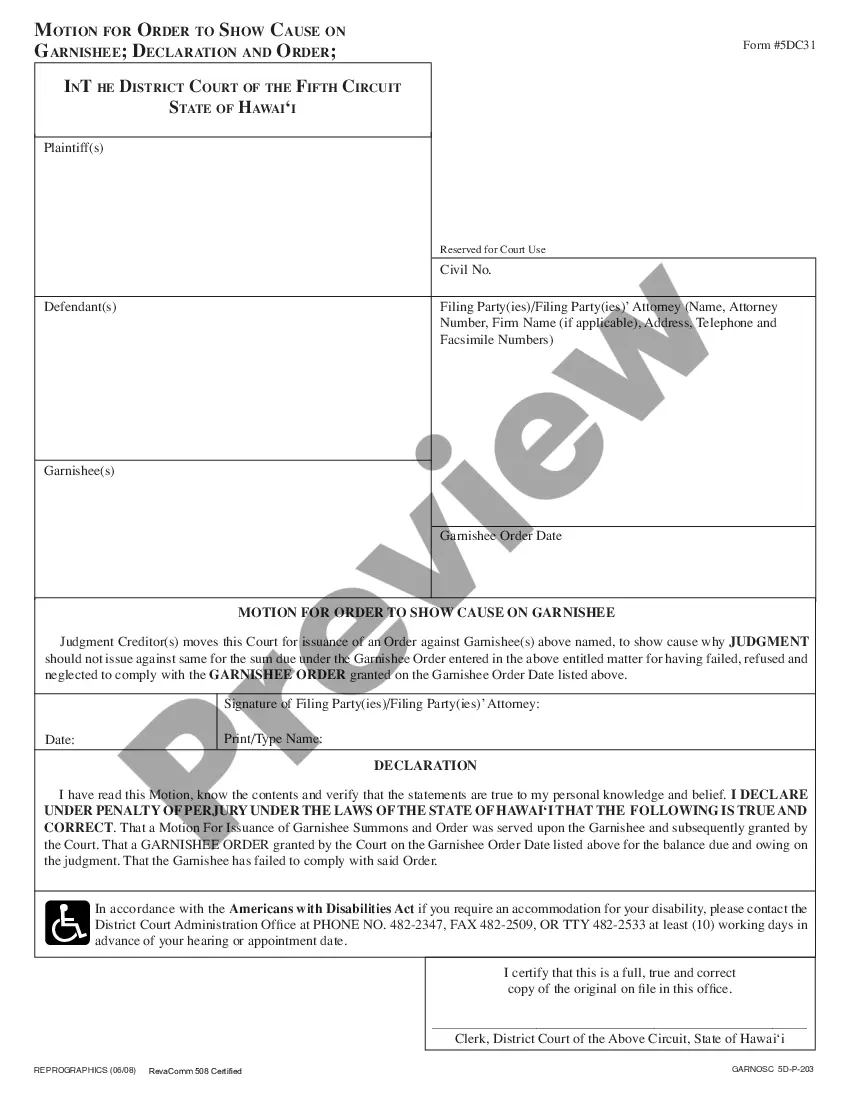

How to fill out Full Release Of Payment For Electrical And Communication Easement And Damages?

If you want to comprehensive, download, or printing lawful papers templates, use US Legal Forms, the greatest collection of lawful forms, which can be found online. Use the site`s simple and practical search to discover the files you will need. Various templates for company and specific functions are categorized by classes and suggests, or search phrases. Use US Legal Forms to discover the Texas Full Release of Payment For Electrical and Communication Easement and Damages with a handful of click throughs.

Should you be already a US Legal Forms customer, log in for your profile and click the Obtain key to find the Texas Full Release of Payment For Electrical and Communication Easement and Damages. You can also gain access to forms you earlier saved inside the My Forms tab of your own profile.

If you work with US Legal Forms the first time, follow the instructions under:

- Step 1. Make sure you have selected the shape to the correct metropolis/nation.

- Step 2. Take advantage of the Preview choice to examine the form`s articles. Do not forget about to read through the information.

- Step 3. Should you be not satisfied with all the form, make use of the Look for field near the top of the screen to discover other types of your lawful form web template.

- Step 4. Once you have located the shape you will need, click the Get now key. Choose the prices plan you prefer and add your qualifications to register to have an profile.

- Step 5. Method the financial transaction. You can utilize your credit card or PayPal profile to finish the financial transaction.

- Step 6. Pick the file format of your lawful form and download it on your product.

- Step 7. Complete, change and printing or indicator the Texas Full Release of Payment For Electrical and Communication Easement and Damages.

Each lawful papers web template you get is your own property eternally. You may have acces to each form you saved inside your acccount. Click the My Forms section and choose a form to printing or download yet again.

Compete and download, and printing the Texas Full Release of Payment For Electrical and Communication Easement and Damages with US Legal Forms. There are millions of skilled and condition-certain forms you can utilize for your company or specific needs.

Form popularity

FAQ

Therefore, unless there is an agreement with the easement holder (dominant estate) stating otherwise, the obligation to pay property taxes-including for the easement portion of the property-will continue to lie with the landowner even after the grant and recording of the easement.

An easement agreement costs between $100 and $5,000, varying based on the type of easement granted and associated legal and executive fees. This is the primary charge for the preparation, negotiation, and enactment of an easement agreement to ensure regulatory compliance.

An easement gives people or organizations the right to access and use your property in specific situations for a limited purpose. A right of way is a type of easement that establishes the freedom to use a pathway or road on another's property without conferring ownership. A right of way easement is very common.

Competing Easement Rights Sometimes homeowners want to understand if they can remove an easement from their property or can a property owner block an easement. If the intent is to prevent or obstruct the use of the easement, the answer is probably no.

There are eight ways to terminate an easement: abandonment, merger, end of necessity, demolition, recording act, condemnation, adverse possession, and release.

Easements may be extinguished by abandonment. Abandonment takes place whenever cessation of use occurs accompanied by a clear intent never to use the easement again. Mere nonuse does not constitute aban- donment. However, the intent may be inferred from the circumstances if such evidence is clear and definite.

Grants or sales of limited easements are usually not treated as taxable sales of property. Instead, amounts received from such transfers are subtracted from the basis of the property. Any amounts received in excess of basis are treated as taxable gain.