This form is used when Assignor transfers, assigns and conveys to Assignee an overriding royalty interest in all of the oil, gas, and other minerals produced, saved, and marketed from all of the Lands and Leases equal to a determined amount (the Override ).

Texas Assignment of Overriding Royalty Interest by Multiple Assignors

Description

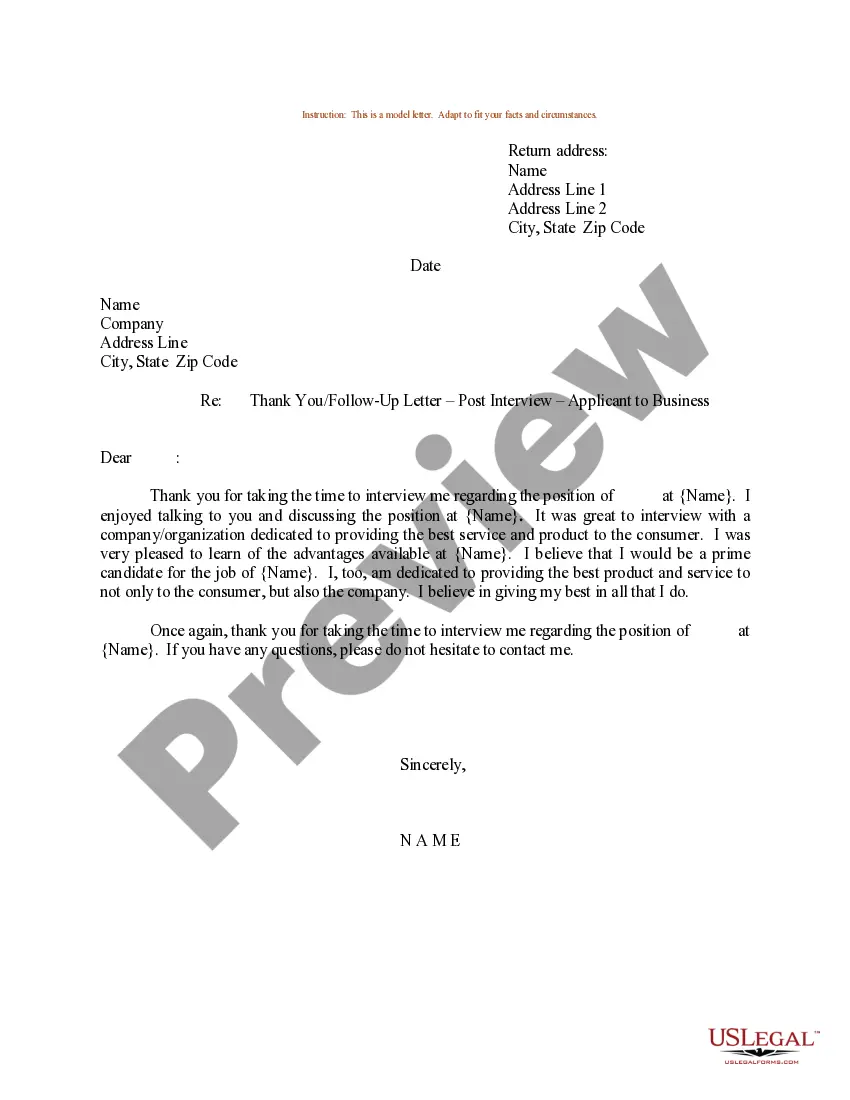

How to fill out Assignment Of Overriding Royalty Interest By Multiple Assignors?

US Legal Forms - among the greatest libraries of lawful types in the USA - provides a wide range of lawful record web templates you may obtain or print out. While using internet site, you can get thousands of types for enterprise and personal reasons, categorized by classes, states, or keywords and phrases.You will discover the most recent types of types like the Texas Assignment of Overriding Royalty Interest by Multiple Assignors in seconds.

If you already possess a monthly subscription, log in and obtain Texas Assignment of Overriding Royalty Interest by Multiple Assignors from the US Legal Forms catalogue. The Down load option will appear on each and every type you see. You gain access to all in the past delivered electronically types from the My Forms tab of your respective account.

In order to use US Legal Forms the very first time, listed here are easy recommendations to help you started out:

- Ensure you have picked the correct type for your personal area/state. Select the Preview option to analyze the form`s articles. See the type outline to ensure that you have chosen the appropriate type.

- If the type does not match your requirements, make use of the Research industry towards the top of the monitor to discover the the one that does.

- Should you be happy with the shape, verify your selection by clicking on the Buy now option. Then, choose the pricing program you favor and supply your qualifications to sign up for the account.

- Procedure the transaction. Utilize your charge card or PayPal account to complete the transaction.

- Pick the structure and obtain the shape in your gadget.

- Make alterations. Load, edit and print out and signal the delivered electronically Texas Assignment of Overriding Royalty Interest by Multiple Assignors.

Each template you added to your account lacks an expiration day and it is your own eternally. So, if you wish to obtain or print out yet another backup, just check out the My Forms area and click on on the type you want.

Obtain access to the Texas Assignment of Overriding Royalty Interest by Multiple Assignors with US Legal Forms, by far the most considerable catalogue of lawful record web templates. Use thousands of professional and express-specific web templates that satisfy your business or personal demands and requirements.

Form popularity

FAQ

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.