Texas Cease and Desist for Debt Collectors

Description

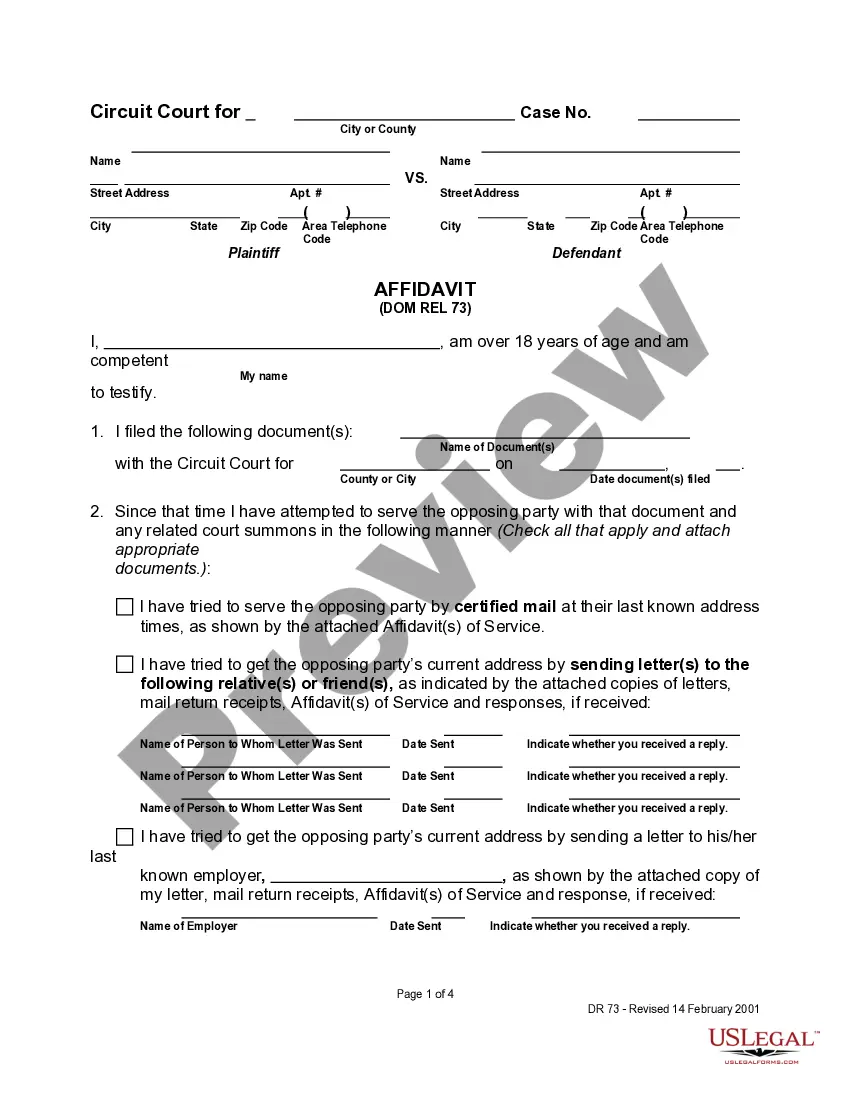

How to fill out Cease And Desist For Debt Collectors?

If you need to compile, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site’s straightforward and user-friendly search to find the documents you need. Many templates for business and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to obtain the Texas Cease and Desist for Debt Collectors with just a few clicks.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Choose the format of your legal form and download it to your device. Step 7. Complete, edit, and print or sign the Texas Cease and Desist for Debt Collectors. Every legal document template you acquire is yours permanently. You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again. Compete and obtain, and print the Texas Cease and Desist for Debt Collectors with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to retrieve the Texas Cease and Desist for Debt Collectors.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you have chosen the form for your appropriate area/state.

- Step 2. Utilize the Review feature to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find alternative versions of your legal form template.

- Step 4. Once you have located the form you need, select the Buy now button. Choose the payment plan you prefer and enter your details to create an account.

Form popularity

FAQ

Absolutely, you can instruct a debt collector to cease and desist from contacting you. This request can be made verbally or through a written letter, which is more effective. Using a Texas Cease and Desist for Debt Collectors template helps ensure that your request is clear and enforceable.

In Texas, debt collectors are bound by both state and federal laws that protect consumers from unfair practices. The Texas Debt Collection Act outlines what debt collectors can and cannot do. Understanding these laws can empower you to take action, including sending a Texas Cease and Desist for Debt Collectors to halt unwanted communications.

A cease and desist letter is not a legally binding document, but it carries significant weight. It informs the debt collector of your wishes, and if they continue to contact you after receiving it, you may have grounds for legal action. Utilizing a Texas Cease and Desist for Debt Collectors can help you assert your rights effectively.

A 609 letter is a specific request for verification of a debt, referring to Section 609 of the Fair Credit Reporting Act. It requires the debt collector to provide evidence that they have the right to collect the debt. This letter can be a useful tool in conjunction with a Texas Cease and Desist for Debt Collectors, as it helps clarify your situation.

Yes, you can write a cease and desist letter to a debt collector. This letter serves as a formal notification that you want them to stop contacting you. Using a well-crafted Texas Cease and Desist for Debt Collectors template can simplify the process and ensure your letter meets legal standards.

To effectively issue a cease and desist, you should gather documentation that supports your claim. This could include records of communication with the debt collector, evidence of harassment, or any relevant contracts. Presenting clear proof strengthens your position and enhances the effectiveness of a Texas Cease and Desist for Debt Collectors.

You can indeed tell a debt collector to cease and desist their communication. This is a formal way of requesting that they stop contacting you regarding a debt. Sending a Texas cease and desist for debt collectors can be an effective strategy to protect your peace of mind. Utilizing services like USLegalForms can help you ensure that your request is clear and legally binding.

Yes, you can send a cease and desist letter to a debt collector to stop them from contacting you. This letter informs the collector that you do not wish to receive further communication regarding the debt. By sending a Texas cease and desist for debt collectors, you assert your rights and take control of the situation. Platforms like USLegalForms can assist you in drafting a legally sound cease and desist letter tailored to your needs.

The 777 rule for debt collectors refers to a guideline that protects consumers against aggressive debt collection practices in Texas. Under this rule, debt collectors must adhere to specific regulations regarding communication and collection methods. If they violate these rules, consumers can take action, including sending a Texas cease and desist for debt collectors to halt their attempts. Understanding this rule empowers you to manage your interactions with debt collectors more effectively.

Yes, cease and desist letters can be effective tools against debt collectors. When you send a letter under the Texas Cease and Desist for Debt Collectors, you formally notify them to stop contacting you. Many collectors will comply with your request to avoid legal repercussions. However, if they continue to contact you, it may be necessary to seek legal advice to enforce your rights.