Texas Architect Agreement - Self-Employed Independent Contractor

Description

How to fill out Architect Agreement - Self-Employed Independent Contractor?

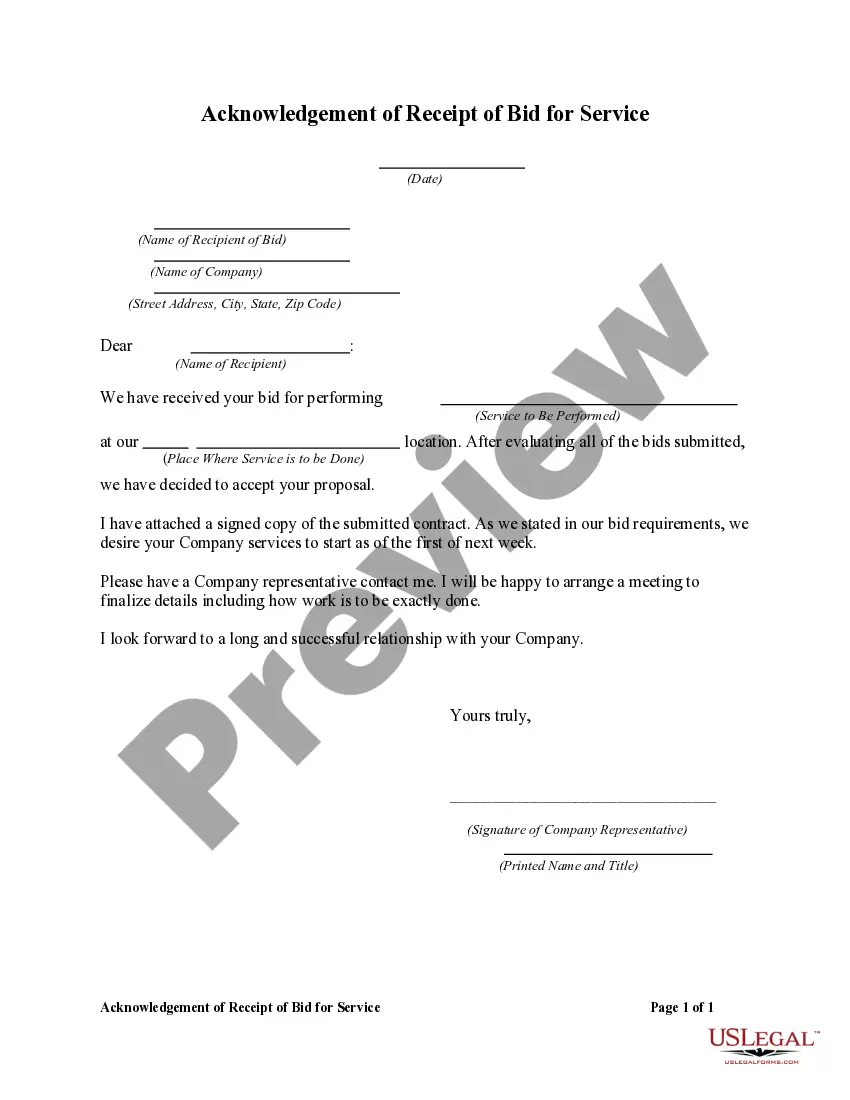

Finding the right lawful record design could be a battle. Of course, there are a lot of templates accessible on the Internet, but how would you get the lawful type you require? Make use of the US Legal Forms website. The services offers 1000s of templates, including the Texas Architect Agreement - Self-Employed Independent Contractor, that you can use for enterprise and personal requires. Every one of the varieties are checked by professionals and meet federal and state requirements.

Should you be already registered, log in in your profile and then click the Download switch to find the Texas Architect Agreement - Self-Employed Independent Contractor. Make use of your profile to appear with the lawful varieties you have acquired earlier. Check out the My Forms tab of the profile and acquire an additional copy from the record you require.

Should you be a fresh user of US Legal Forms, here are basic directions that you can stick to:

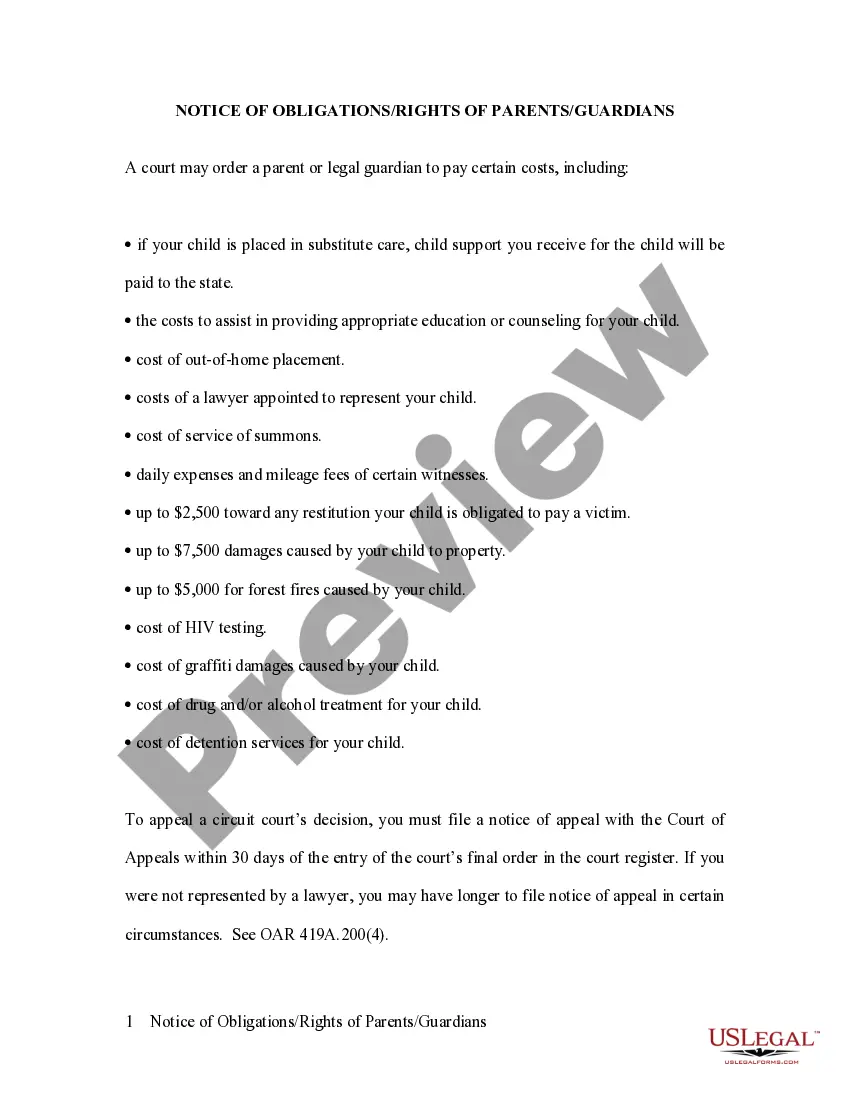

- Very first, make sure you have chosen the right type for your personal area/state. It is possible to check out the form making use of the Review switch and look at the form explanation to guarantee it will be the best for you.

- In case the type will not meet your preferences, utilize the Seach discipline to find the appropriate type.

- When you are certain the form is proper, click on the Buy now switch to find the type.

- Select the costs plan you need and type in the required information and facts. Build your profile and purchase the transaction making use of your PayPal profile or credit card.

- Opt for the submit format and acquire the lawful record design in your system.

- Comprehensive, change and printing and signal the attained Texas Architect Agreement - Self-Employed Independent Contractor.

US Legal Forms may be the most significant local library of lawful varieties where you can see various record templates. Make use of the company to acquire professionally-produced files that stick to condition requirements.

Form popularity

FAQ

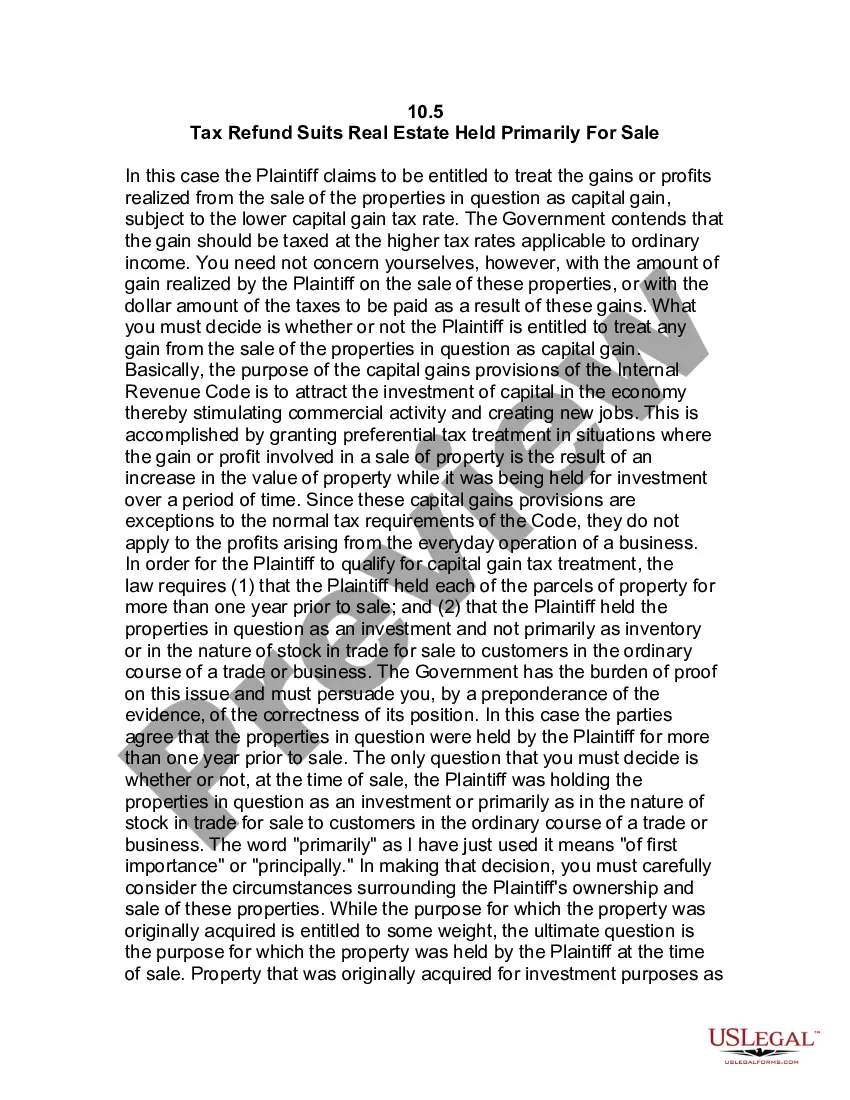

All work required of the contract is performed by the independent contractor and employees. Independent contractors are not typically considered employees of the principal. A "general contractor" is an entity with whom the principal/owner directly contracts to perform certain jobs.

If Architect is retained for construction administration, Architect will review lien waivers of contractor, subcontractors and suppliers with each pay application. Architect's contract is entered into based upon a standard of mutual trust, good faith and fair dealing.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

The independent contractor can be anyone: An architect who is preparing architectural plans for a new restaurant or building for your company. A software engineer hired to create software for your company or to do programming for maintenance of your company's existing software.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

The most common business organizations for Independent Contractors include C-corporation, S-Corporation, Partnership, Limited Partnership (LP), Limited Liability Partnership (LLP), Limited Liability Company (LLC), and Sole Proprietorship.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.