Texas Cleaning Services Contract - Self-Employed

Description

How to fill out Cleaning Services Contract - Self-Employed?

Are you presently in the location where you require documents for potential organizational or personal purposes virtually every day.

There is a wide range of legal document templates accessible online, but discovering ones you can trust is not simple.

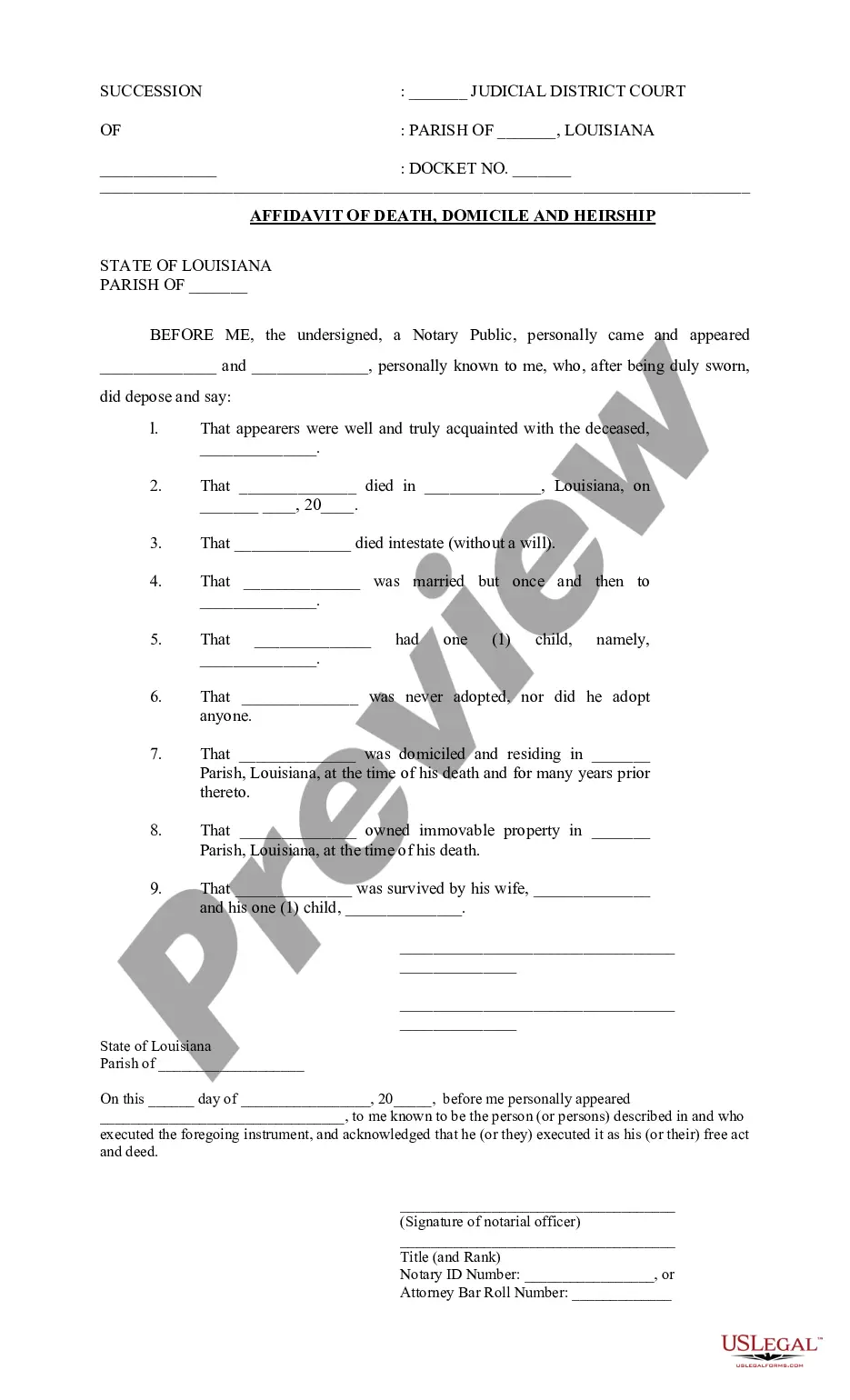

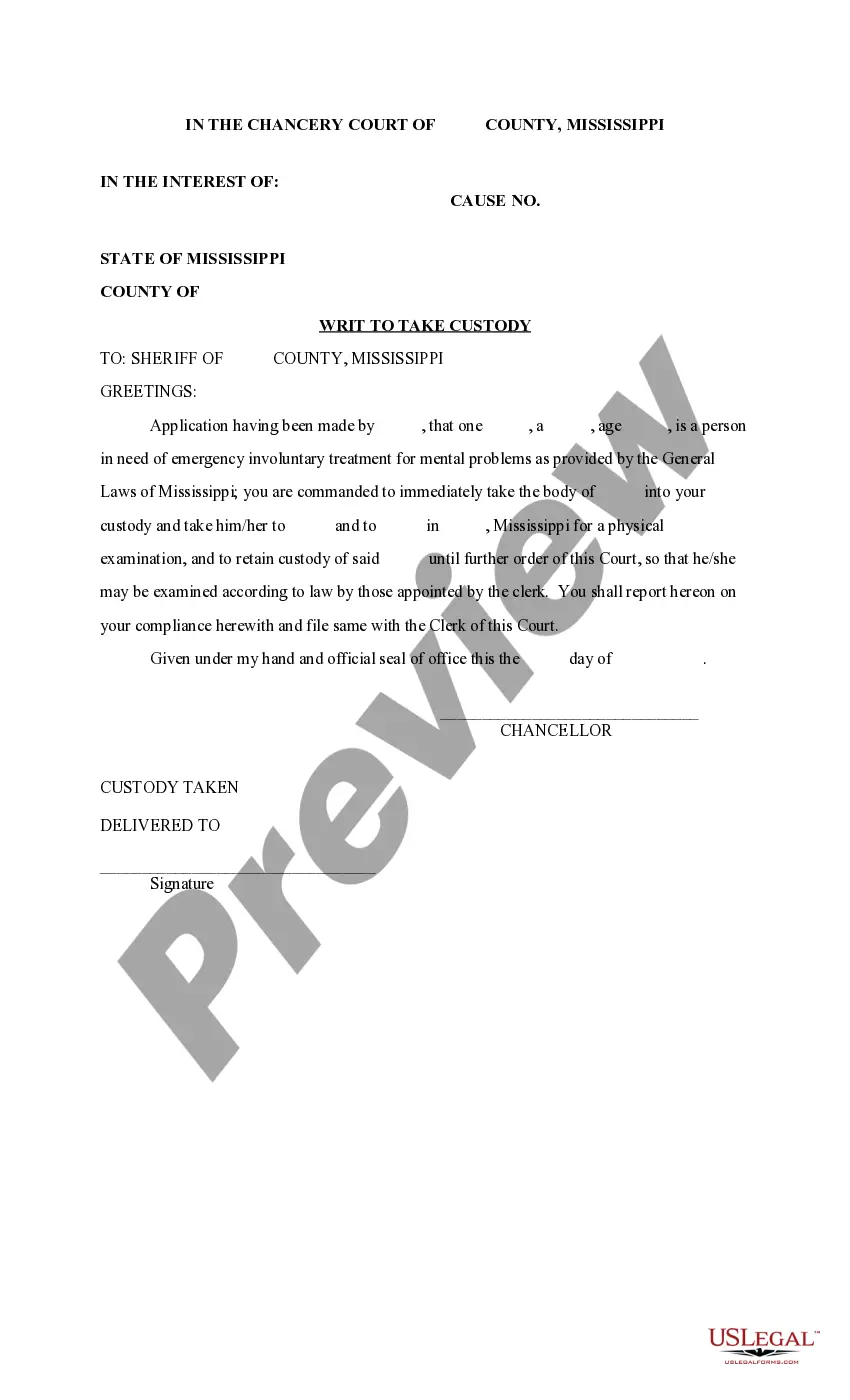

US Legal Forms provides thousands of form templates, such as the Texas Cleaning Services Contract - Self-Employed, which can be designed to meet federal and state requirements.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Texas Cleaning Services Contract - Self-Employed at any time, if necessary. Just select the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can obtain the Texas Cleaning Services Contract - Self-Employed template.

- If you do not possess an account and wish to start utilizing US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/region.

- Use the Preview feature to examine the document.

- Check the description to ensure you have chosen the correct form.

- If the form is not what you're seeking, use the Lookup field to find the form that meets your requirements and needs.

- Once you locate the appropriate form, click Purchase now.

- Select the pricing plan you want, input the necessary information to create your account, and complete the transaction with your PayPal or credit card.

Form popularity

FAQ

You can find commercial cleaning contracts through various sources, including local businesses, online job boards, and networking with other industry professionals. Additionally, consider platforms like USLegalForms, which can provide templates for a Texas Cleaning Services Contract - Self-Employed. These templates not only streamline the contracting process but also ensure that you include all necessary terms to protect your business interests. Expanding your network and utilizing available resources can significantly enhance your chances of securing lucrative contracts.

An independent cleaning contractor is an individual who operates a cleaning business without being employed by a specific company. They decide their own working hours, manage their client relationships, and can choose the types of services they offer. In the context of a Texas Cleaning Services Contract - Self-Employed, this means they can tailor agreements to fit their business needs and clientele, creating a unique service experience. This flexibility allows them to grow their business while meeting the demands of various clients.

Setting up a cleaning contract involves several key steps. Begin by detailing the scope of work, including specific tasks, timelines, and payment terms. It's essential to ensure that both parties understand their responsibilities. By using a Texas Cleaning Services Contract - Self-Employed from a reliable platform like uslegalforms, you can simplify this process and have a legally binding agreement that protects your interests.

To become a subcontractor for cleaning services, start by researching local cleaning companies that offer subcontracting opportunities. Once you find potential partners, reach out to them to express your interest. You should also prepare your business credentials and any necessary documentation to establish your professionalism. Utilizing a Texas Cleaning Services Contract - Self-Employed can formalize your agreements and create trust.

Writing a contract agreement for cleaning services involves several key elements, including the scope of work, payment terms, and termination conditions. Start by clearly defining the services you intend to provide, ensuring that both parties understand their responsibilities. Utilizing a Texas Cleaning Services Contract - Self-Employed from our platform can simplify this process, offering a clear template that covers all necessary components to protect your interests.

In Texas, a specific license is not required to operate cleaning services. However, depending on your business structure, you may need to register your business and obtain a sales tax permit. It is important to ensure compliance with local regulations and business laws. For more detailed guidance, consider using a Texas Cleaning Services Contract - Self-Employed through our platform, which can help you navigate these requirements.

Texas businesses are exempt from paying state sales and use tax on labor for constructing new facilities. Texas companies are exempt from paying state and local sales and use tax on electricity and natural gas used in manufacturing, processing, or fabricating tangible personal property.

To make your contract as effective as possible, be sure to include these eight key elements:Your contact information and license number.A contract or billing number.A detailed list of the services you'll provide and on what schedule.Your prices per service.

There is no tax on the charges of a self-employed person who provides traditional household services such as housekeeping, babysitting, or cooking. For the charges to be exempt from tax, the person must be an employee of the household and not act as a subcontractor for a third party, such as a maid service.

Under California sales tax rules, cleaning or janitorial services are exempt from having to charge sales tax even when certain products (cleaning products and supplies) are used incidentally in connection with the services.