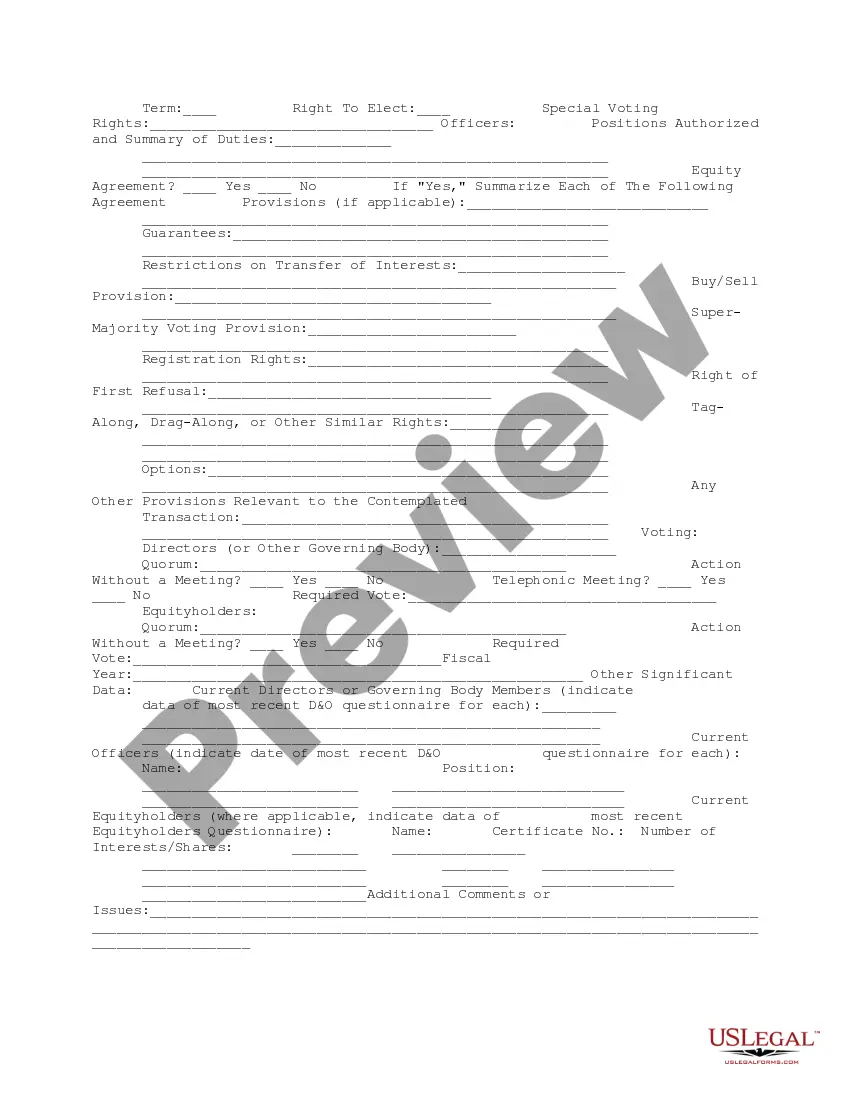

This form is a due diligence data summary to be prepared for the company and each of its Subsidiaries in business transactions.

Texas Company Data Summary

Description

How to fill out Company Data Summary?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a range of legal document templates that you can purchase or print.

By using the website, you will access thousands of templates for commercial and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Texas Company Data Summary in just moments.

If you hold an account, Log In to download the Texas Company Data Summary from the US Legal Forms library. The Download button appears on every template you view. You can access all previously downloaded forms in the My documents tab of your profile.

Choose the format and download the form to your device.

Edit. Fill out, modify, print, and sign the downloaded Texas Company Data Summary.

Each template stored in your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, just visit the My documents section and click on the form you desire.

Access the Texas Company Data Summary with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Ensure you have selected the correct template for your area/county. Click on the Preview button to check the content of the form.

- Review the form summary to make sure you have chosen the accurate document.

- If the form does not meet your needs, utilize the Search field located at the top of the screen to find one that suits you.

- When you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, select your preferred pricing plan and provide your details to create an account.

- Process the payment. Use your credit card or PayPal account to complete the payment.

Form popularity

FAQ

To perform a business lookup in Texas, start with the Texas Secretary of State's website. You can enter the business name or the registered agent's name to access the Texas Company Data Summary. This summary includes key details like the company's formation date and status. If you're looking for additional insights, the US Legal Forms platform can simplify your search and provide comprehensive reports.

Yes, the owner of an LLC is a matter of public record in Texas. When you view the Texas Company Data Summary, you will find information about the registered agent and the owners or members of the business. This transparency helps ensure accountability and builds trust within the community. If you need assistance accessing this information, consider using the US Legal Forms platform for a streamlined experience.

EDC stands for Economic Development Corporation in Texas, which focuses on enhancing local economies and fostering business growth. These organizations provide resources, incentives, and support for businesses looking to expand or establish themselves in Texas. Understanding EDC's role can be beneficial for companies analyzing their market potential within the Texas Company Data Summary.

Yes, Texas requires LLCs to file an annual report to maintain good standing. This report ensures that the information on file with the state is current and accessible. The annual report also serves as a reminder for business owners to review their compliance with state regulations. Keep your records orderly by consulting the Texas Company Data Summary.

A public information report for an LLC in Texas is a formal document required by the state. It shows information like the LLC's structure, contact details, and the names of its members or managers. This report helps maintain accurate state records and supports the integrity of business information. Refer to the Texas Company Data Summary for guidance on completing this report.

The public information report for an LLC in Texas is a document that summarizes key details about the business. This report includes information such as ownership, business address, and the identity of the registered agent. It's important for transparency and is utilized by governmental agencies for regulatory purposes. Ensure your LLC's data is accurate in the Texas Company Data Summary.

Yes, a Texas LLC is required to file an annual report, which is part of maintaining its good standing with the state. This report contains essential information about the LLC's business activities and registered agent details. Failure to file this report can lead to penalties or even the dissolution of the LLC. For a comprehensive overview, consult the Texas Company Data Summary.

The richest company in Texas is often cited as ExxonMobil, a global leader in the oil and gas industry. It generates significant revenue and has a considerable economic impact both locally and internationally. Companies like this can be included in your Texas Company Data Summary for analytical purposes. Understanding such entities can help you navigate the business landscape in Texas.

Generally, any entity that operates in Texas, including corporations, partnerships, and LLCs, must file a Texas public information report. This report provides critical data regarding the business's structure, officers, and registered agent. Filing helps maintain transparency and compliance within the state's records. You can refer to the Texas Company Data Summary for more details on your filing obligations.

If an LLC fails to file its annual report, it may face penalties, including fines and potential dissolution by the state. Additionally, not filing can result in the company being marked as inactive. This can hinder the LLC's ability to conduct business legally in Texas. To avoid these consequences, understanding the Texas Company Data Summary becomes essential.