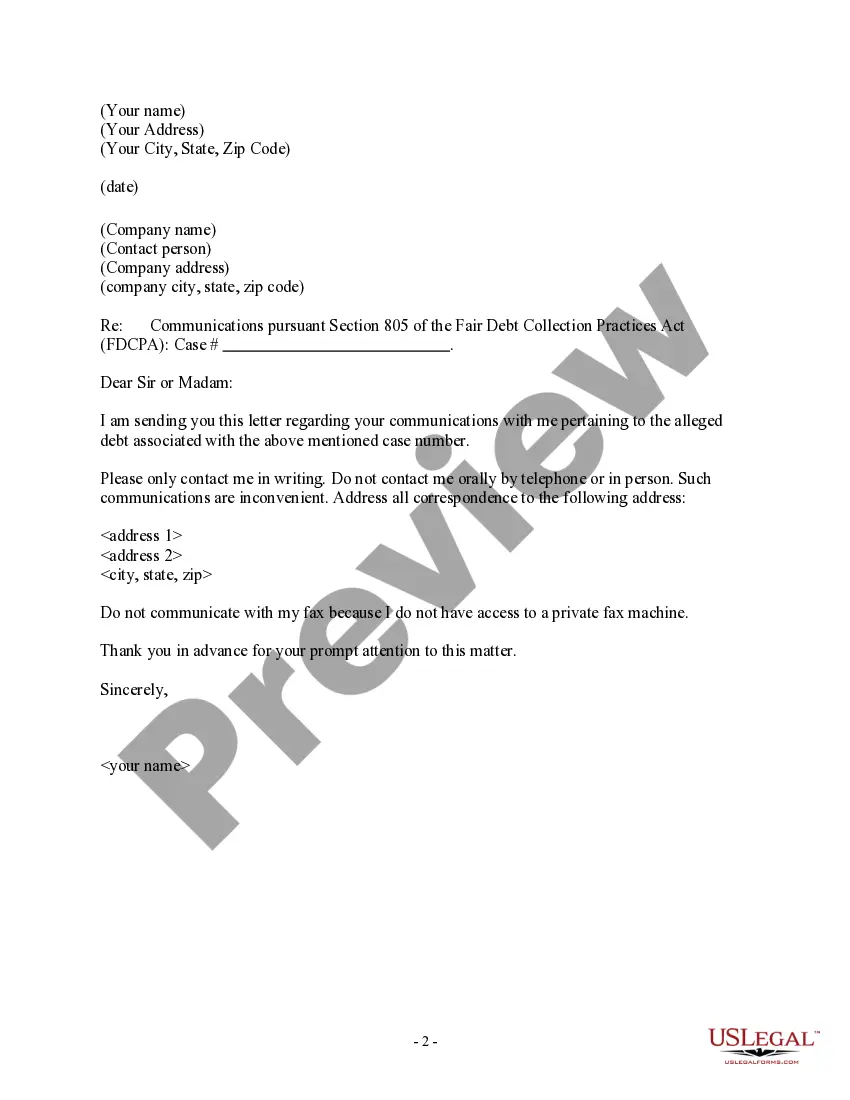

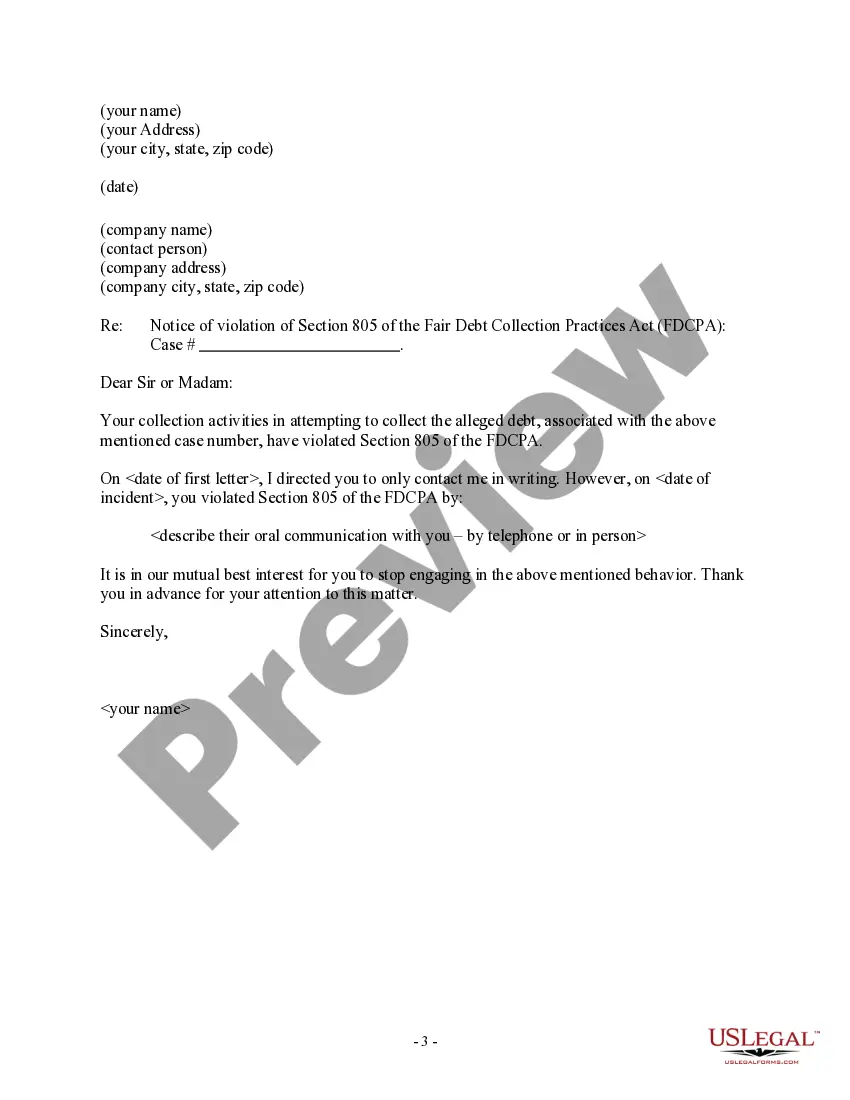

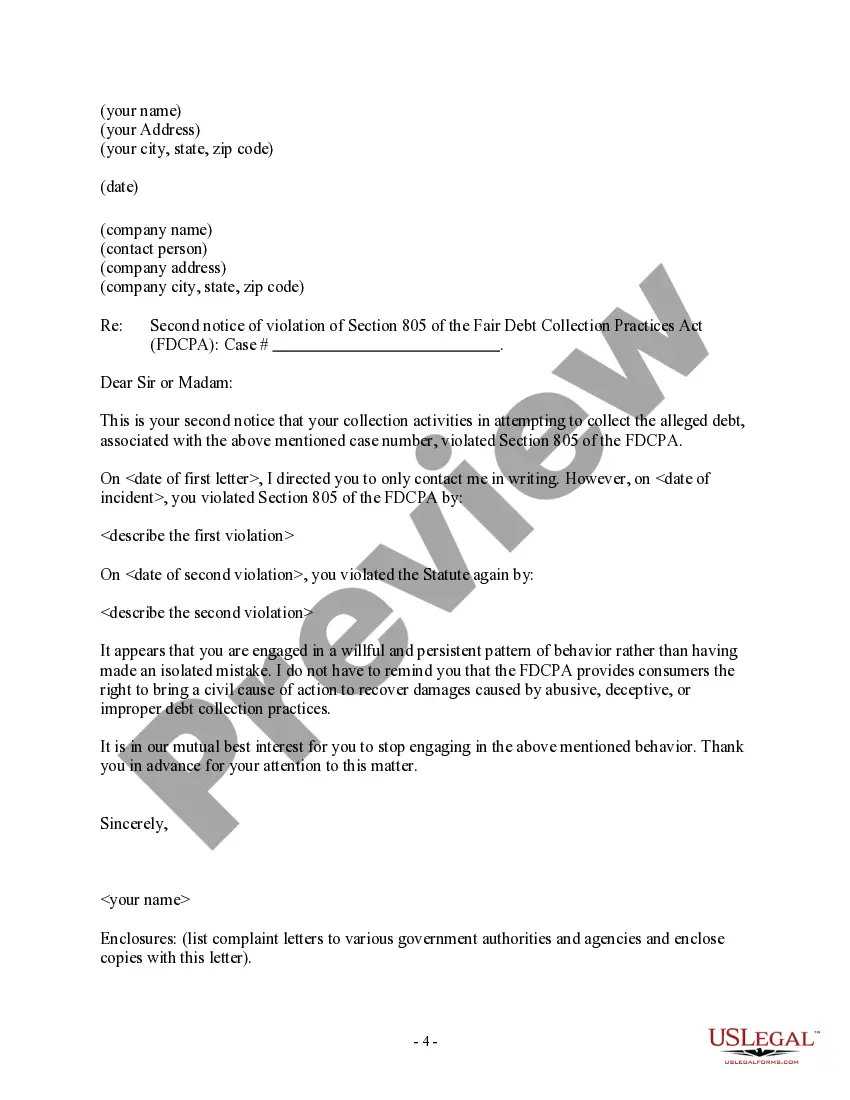

Texas Letter to Debt Collector - Only Contact Me In Writing

Description

How to fill out Letter To Debt Collector - Only Contact Me In Writing?

Finding the right legal papers template might be a battle. Of course, there are plenty of layouts available on the net, but how do you discover the legal develop you require? Take advantage of the US Legal Forms website. The service gives 1000s of layouts, including the Texas Letter to Debt Collector - Only Contact Me In Writing, which can be used for organization and private requirements. Each of the types are inspected by professionals and satisfy state and federal needs.

Should you be currently registered, log in for your profile and click the Acquire button to obtain the Texas Letter to Debt Collector - Only Contact Me In Writing. Make use of your profile to check through the legal types you might have ordered earlier. Go to the My Forms tab of the profile and have another backup of the papers you require.

Should you be a brand new user of US Legal Forms, here are easy recommendations that you should adhere to:

- Initially, be sure you have selected the right develop to your city/area. You may look over the form while using Preview button and browse the form explanation to ensure this is basically the right one for you.

- In case the develop fails to satisfy your requirements, make use of the Seach field to find the right develop.

- Once you are certain that the form is proper, go through the Purchase now button to obtain the develop.

- Opt for the pricing strategy you desire and enter in the needed details. Design your profile and buy the transaction using your PayPal profile or bank card.

- Pick the submit structure and acquire the legal papers template for your device.

- Full, change and print out and signal the acquired Texas Letter to Debt Collector - Only Contact Me In Writing.

US Legal Forms is definitely the greatest local library of legal types in which you can discover different papers layouts. Take advantage of the service to acquire expertly-created files that adhere to condition needs.

Form popularity

FAQ

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

It should be short, concise, to the point and very clear as to what you want. It's imperative that you say as much as you can with as little text as possible. Remember to include the exact amount owed, the invoice number and the due date.

Can a Debt Collector Send a Text or Social Media Message? Under new Consumer Financial Protection Bureau rules, debt collectors can now contact people via email, text, and social media. These rules went into effect on November 30, 2021.

A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L. Kraninger, took effect Tuesday, Nov. 30.

What Does a Debt Verification Notice Include? A debt collector has to send you a written statement outlining the specifics of your debt that is in collection. Within five days of contacting you, a debt collector must send you this written notice with the amount of money you owe and the name of the original creditor.

Legally Speaking, Emails are Considered Writings If sent to a consumer by a third-party debt collector, emails must comply with the Fair Debt Collection Practices Act (or FDCPA). If the email communication pertains to healthcare debt, the Health Insurance Portability and Accountability Act (HIPAA) applies.

A debt collector has to send you a written statement outlining the specifics of your debt that is in collection. Within five days of contacting you, a debt collector must send you this written notice with the amount of money you owe and the name of the original creditor.

Legally Speaking, Emails are Considered Writings If sent to a consumer by a third-party debt collector, emails must comply with the Fair Debt Collection Practices Act (or FDCPA).

For some folks, that means dealing with calls from debt collectors. Starting late next year, collectors will also be allowed to contact consumers by email, text message, and even through social media, according to the Consumer Financial Protection Bureau.

As of Nov. 30, 2021, debt collectors have new options for how they may communicate with you about debts they're trying to collect. Now they can text you. Text messages, along with emailing and direct messages on social media, are allowed as part of an update to the Fair Debt Collection Practices Act (FDCPA).