Texas Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement

Description

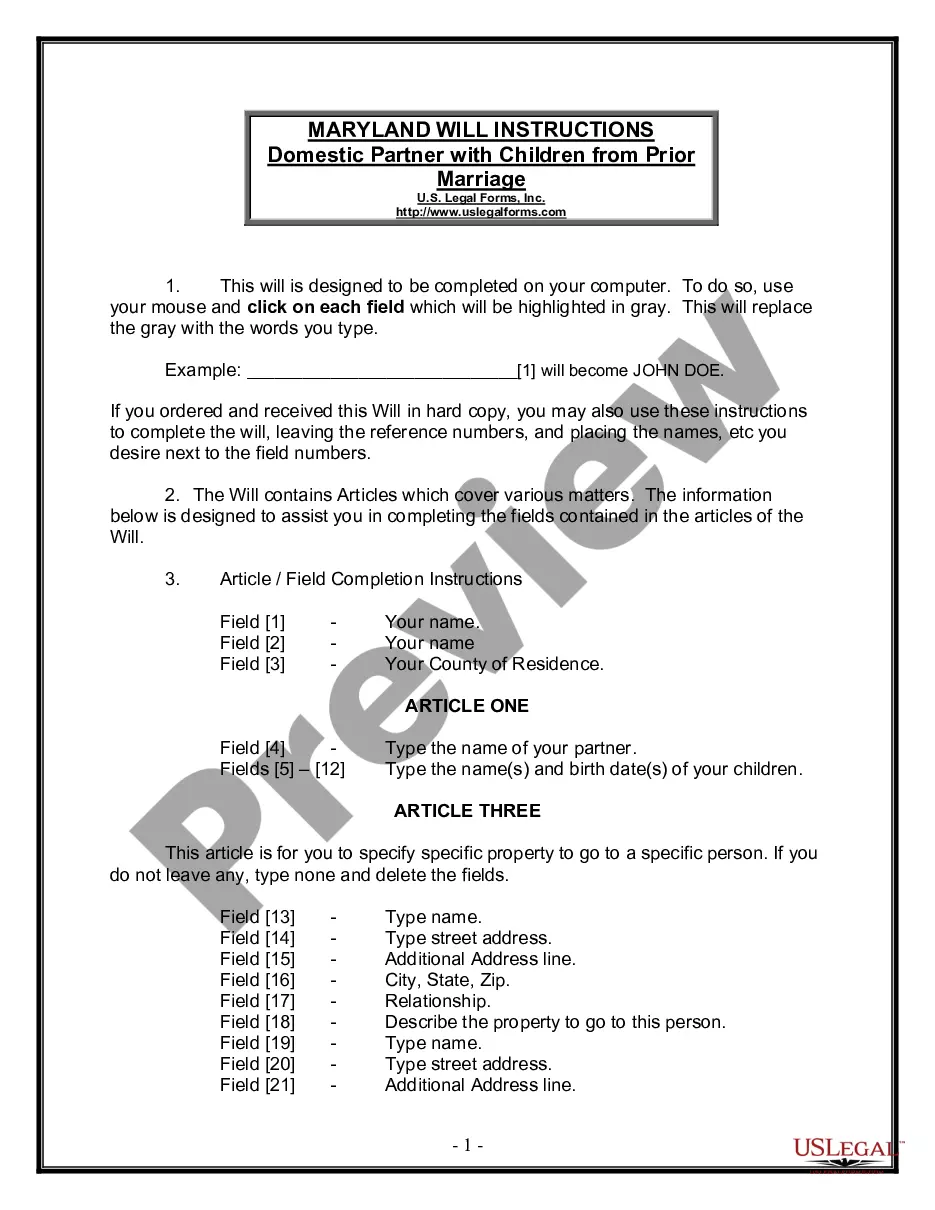

How to fill out Approval Of Transfer Of Outstanding Stock With Copy Of Liquidating Trust Agreement?

US Legal Forms - one of several biggest libraries of authorized kinds in the United States - delivers a wide range of authorized file themes it is possible to download or produce. Utilizing the site, you can find a large number of kinds for business and person functions, categorized by groups, claims, or keywords and phrases.You will find the latest types of kinds such as the Texas Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement in seconds.

If you already have a membership, log in and download Texas Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement from the US Legal Forms catalogue. The Down load key will show up on each and every kind you perspective. You get access to all in the past acquired kinds within the My Forms tab of your own profile.

If you wish to use US Legal Forms the very first time, allow me to share straightforward directions to get you began:

- Make sure you have picked out the proper kind to your metropolis/region. Go through the Preview key to check the form`s information. Read the kind outline to ensure that you have selected the correct kind.

- If the kind does not match your demands, take advantage of the Look for field near the top of the display to get the one that does.

- If you are pleased with the shape, verify your selection by clicking on the Purchase now key. Then, opt for the costs strategy you prefer and provide your credentials to sign up to have an profile.

- Approach the transaction. Utilize your credit card or PayPal profile to complete the transaction.

- Select the file format and download the shape on your product.

- Make modifications. Complete, change and produce and sign the acquired Texas Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement.

Each format you added to your account does not have an expiration date and is the one you have eternally. So, in order to download or produce one more backup, just proceed to the My Forms area and then click on the kind you require.

Get access to the Texas Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement with US Legal Forms, one of the most extensive catalogue of authorized file themes. Use a large number of expert and state-distinct themes that meet your organization or person requirements and demands.

Form popularity

FAQ

In 2005, the Texas Legislature enacted Texas Property Code Section 113.060 that imposed on trustees a duty to keep beneficiaries reasonably informed concerning the trust's administration and ?the material facts necessary for the beneficiaries to protect [their] interests.?

Texas Property Code Section 115.001 provides:[A] district court has original and exclusive jurisdiction over all proceedings by or against a trustee and all proceedings concerning trusts, including proceedings to: (1) construe a trust instrument; (2) determine the law applicable to a trust instrument; (3) appoint or ...

Section 113.151 - Demand for Accounting (a) A beneficiary by written demand may request the trustee to deliver to each beneficiary of the trust a written statement of accounts covering all transactions since the last accounting or since the creation of the trust, whichever is later.

113.001. LIMITATION OF POWERS. A power given to a trustee by this subchapter does not apply to a trust to the extent that the instrument creating the trust, a subsequent court order, or another provision of this subtitle conflicts with or limits the power. Amended by Acts 1983, 68th Leg., p.

ESTATES CODE CHAPTER 113. MULTIPLE-PARTY ACCOUNTS. (C) another similar arrangement. (2) "Beneficiary" means a person or trustee of an express trust evidenced by a writing who is named in a trust account as a person for whom a party to the account is named as trustee.

113.001. TAX LIABILITY SECURED BY LIEN. (a) All taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien on all of the person's property that is subject to execution. (b) The lien for taxes attaches to all of the property of a person liable for the taxes.

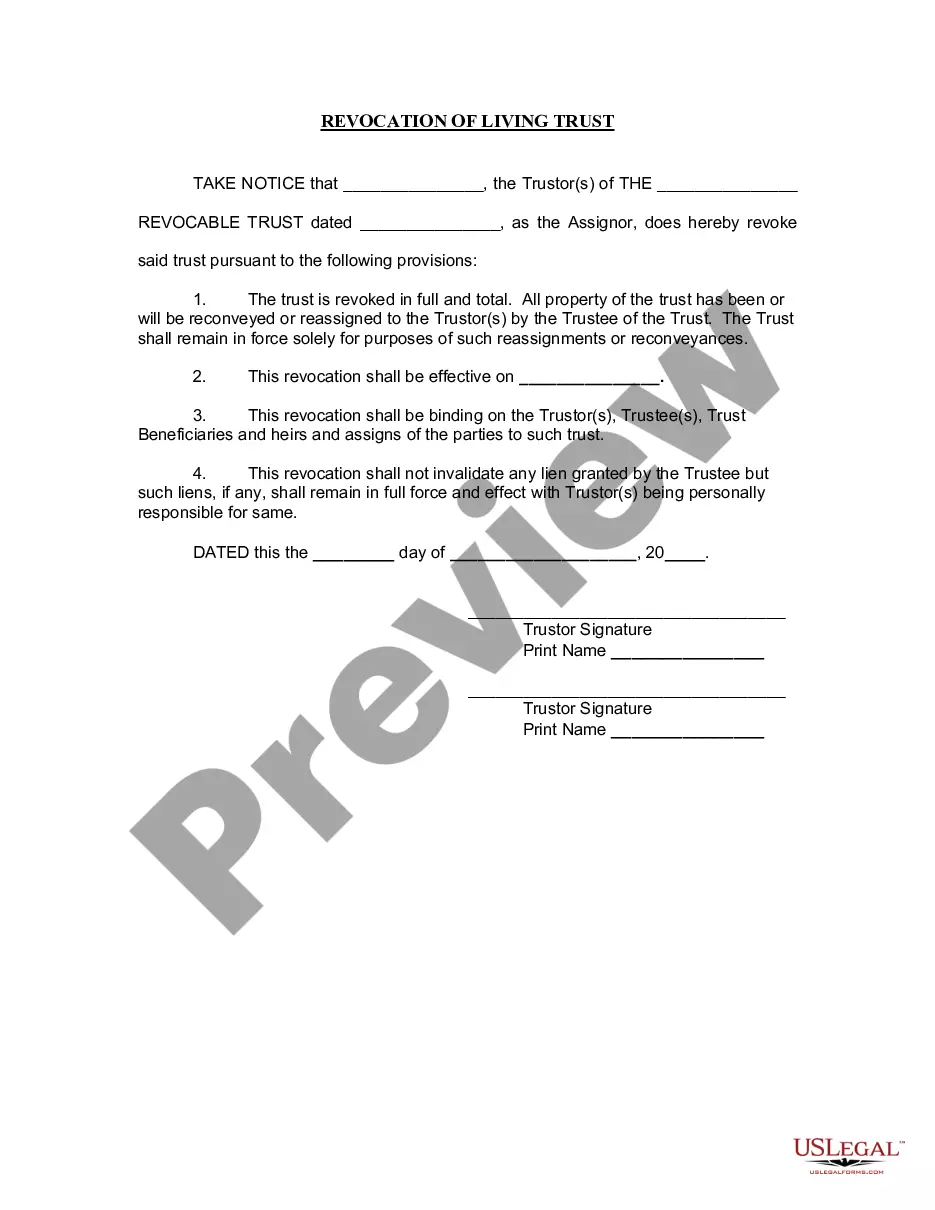

An organization will be considered a liquidating trust if it is organized for the primary purpose of liquidating and distributing the assets transferred to it, and if its activities are all reasonably necessary to, and consistent with, the accomplishment of that purpose.

However, if a liquidating trust is established for a corporation that is in bankruptcy, an EIN for that trust is required.