Texas Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment

Description

How to fill out Proposal To Amend The Articles Of Incorporation To Increase Authorized Common Stock And Eliminate Par Value With Amendment?

Choosing the best legal papers format could be a have a problem. Naturally, there are a variety of web templates available on the net, but how can you discover the legal kind you need? Use the US Legal Forms website. The support provides a huge number of web templates, such as the Texas Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment, that can be used for business and personal demands. All of the kinds are checked by pros and satisfy federal and state requirements.

In case you are presently listed, log in to your profile and click on the Down load button to find the Texas Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment. Utilize your profile to search from the legal kinds you have bought formerly. Check out the My Forms tab of your own profile and have another backup of your papers you need.

In case you are a whole new consumer of US Legal Forms, here are simple instructions that you should follow:

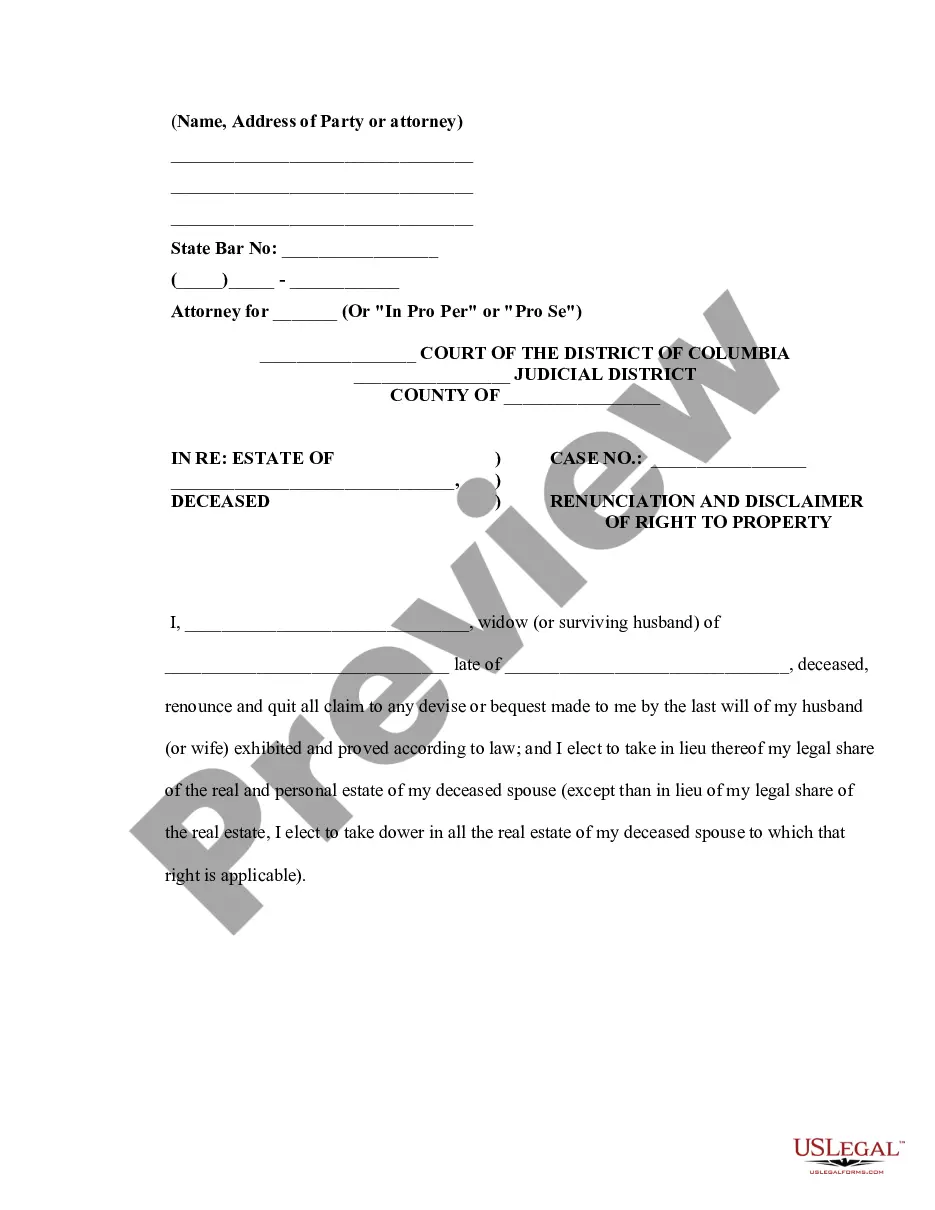

- Initial, ensure you have selected the correct kind for the city/area. It is possible to look through the shape utilizing the Review button and read the shape information to ensure this is basically the best for you.

- In case the kind will not satisfy your preferences, use the Seach field to discover the right kind.

- When you are positive that the shape is proper, click the Buy now button to find the kind.

- Pick the prices strategy you desire and enter in the required info. Create your profile and purchase the order with your PayPal profile or charge card.

- Choose the data file file format and down load the legal papers format to your device.

- Full, edit and print out and signal the obtained Texas Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment.

US Legal Forms may be the biggest collection of legal kinds in which you can discover a variety of papers web templates. Use the company to down load appropriately-produced paperwork that follow state requirements.

Form popularity

FAQ

Texas has one form for all domestic for-profit businesses. Fill out and file in duplicate Form 424, Certificate of Amendment. You can file it in person, by mail or online at Texas SOSDirect for $1 log in fee. You also can fax your amendment with form 807 with your credit card information.

Yes, a company can change the number of authorized shares it is allowed to issue. Public companies must often notify existing shareholders and call for a shareholder vote. The measure is then often reviewed at the following shareholder meeting.

Simply put, each share of common stock represents a share of ownership in a company. If a company does well, or the value of its assets increases, common stock can go up in value. An asset is any resource that holds value. On the other hand, if a company is doing poorly, common stock can decrease in value.

How to Amend Articles of Incorporation Review the bylaws of the corporation. ... A board of directors meeting must be scheduled. ... Write the proposed changes. ... Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

The number of authorized shares can be increased by the shareholders of the company at annual shareholder meetings, provided a majority of the current shareholders vote for the change.

These purposes may include: conversion of debt to equity, raising capital, providing equity incentives to employees, officers or directors, establishing strategic relationships with other companies, and expanding the Company's business or product lines through the acquisition of other businesses or products.

Either the directors or shareholders of a company may increase or decrease the number of authorised shares for a particular share class by amending the Memorandum of Incorporation (?MOI?) and filing a COR15.