Texas Proposal Approval of Nonqualified Stock Option Plan

Description

How to fill out Proposal Approval Of Nonqualified Stock Option Plan?

Have you been in a situation where you will need paperwork for both enterprise or individual functions nearly every day? There are plenty of lawful papers templates accessible on the Internet, but finding kinds you can trust isn`t easy. US Legal Forms delivers thousands of develop templates, much like the Texas Proposal Approval of Nonqualified Stock Option Plan, that happen to be composed to meet federal and state requirements.

Should you be presently acquainted with US Legal Forms internet site and have a merchant account, just log in. Next, it is possible to acquire the Texas Proposal Approval of Nonqualified Stock Option Plan template.

Should you not provide an profile and want to begin using US Legal Forms, abide by these steps:

- Get the develop you will need and make sure it is for the appropriate city/state.

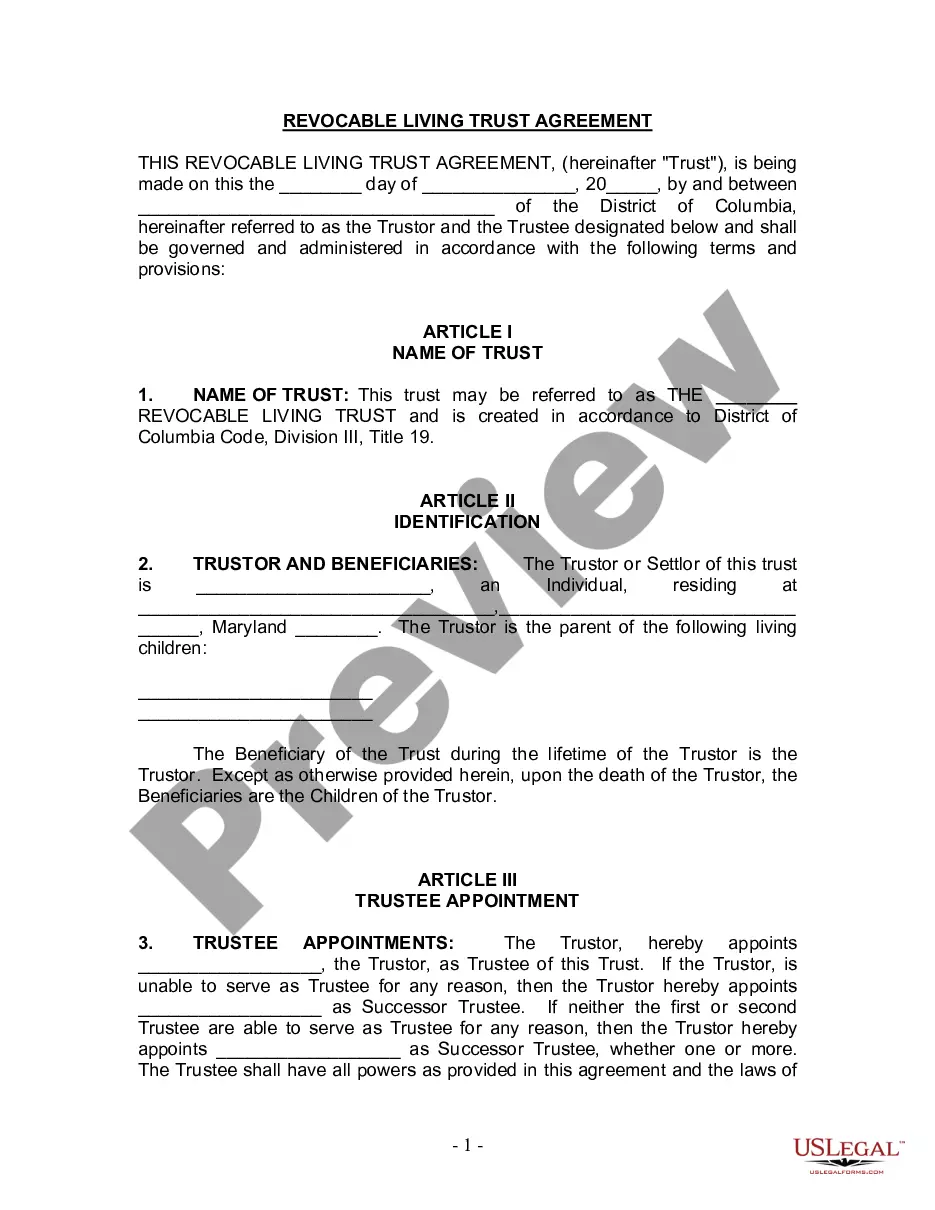

- Make use of the Preview key to examine the form.

- Look at the explanation to ensure that you have selected the proper develop.

- If the develop isn`t what you`re trying to find, take advantage of the Look for discipline to obtain the develop that meets your requirements and requirements.

- Once you get the appropriate develop, just click Acquire now.

- Select the rates program you desire, fill out the necessary info to create your money, and purchase the order using your PayPal or bank card.

- Decide on a handy file formatting and acquire your backup.

Find every one of the papers templates you possess purchased in the My Forms menus. You can obtain a more backup of Texas Proposal Approval of Nonqualified Stock Option Plan whenever, if required. Just click on the essential develop to acquire or produce the papers template.

Use US Legal Forms, one of the most considerable collection of lawful types, to conserve efforts and steer clear of errors. The service delivers expertly made lawful papers templates that can be used for a selection of functions. Produce a merchant account on US Legal Forms and begin creating your life a little easier.

Form popularity

FAQ

The income related to the option exercise should be included in the Form W-2 you receive from your employer or 1099-NEC from the company if you are a non-employee. Any capital gain or loss amount may also be reportable on your US Individual Income Tax Return (Form 1040), Schedule D and Form 8949 in the year of sale.

NSOs allow employees to assume some of the risks of a new business, but they can also earn higher rewards if the company succeeds. NSOs allow the holder to buy a company's stock at a preset price at some time in the future. IF the holder does not exercise them before the expiration date, they lose the option.

While Non-Qualified Stock Options are available to anyone, Qualified Stock Options issued by a company can only be given to employees of that company. QSOs must be nontransferable and must have an exercise price that is not lower than the fair market value of the stock at the time the option is granted.

The option plan must be approved by the stockholders within 12 months before or after the plan is adopted (see also Explanation: §423, Shareholder Approval Requirement) (IRC § 422(b)(1); Reg. §1.422-3).

Taxation on nonqualified stock options As mentioned above, NSOs are generally subject to higher taxes than ISOs because they are taxed on two separate occasions ? upon option exercise and when company shares are sold ? and also because income tax rates are generally higher than long-term capital gains tax rates.