Texas Involuntary Petition Against a Non-Individual

Description

How to fill out Involuntary Petition Against A Non-Individual?

Are you presently within a place that you will need documents for sometimes enterprise or specific purposes virtually every working day? There are plenty of authorized file themes available online, but locating types you can trust isn`t effortless. US Legal Forms offers thousands of type themes, just like the Texas Notice to Creditors and Other Parties in Interest - B 205, that are published to satisfy federal and state needs.

When you are currently acquainted with US Legal Forms web site and also have an account, simply log in. After that, you are able to obtain the Texas Notice to Creditors and Other Parties in Interest - B 205 template.

Unless you come with an bank account and need to begin to use US Legal Forms, abide by these steps:

- Discover the type you need and ensure it is for that proper town/county.

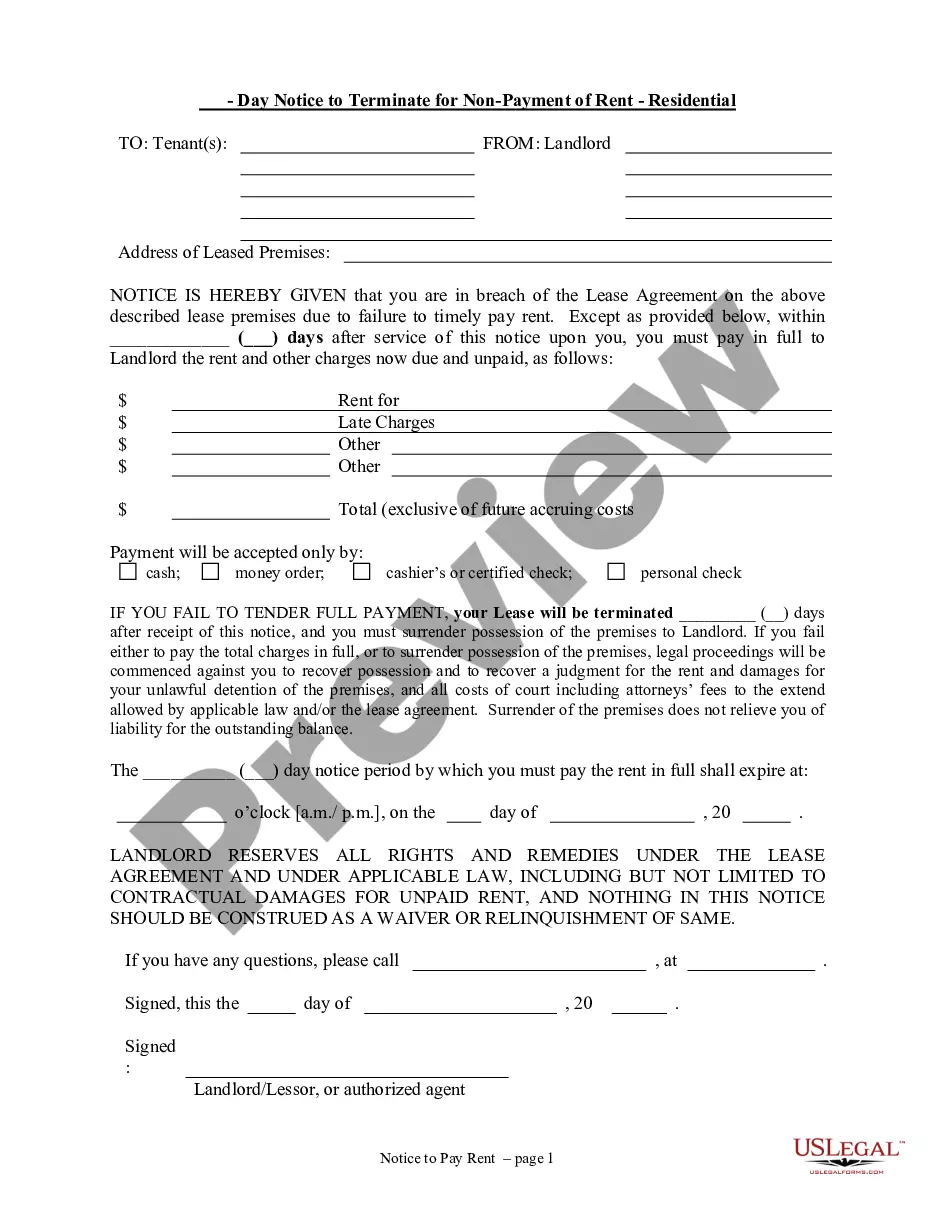

- Make use of the Preview option to analyze the form.

- Read the explanation to actually have chosen the proper type.

- In the event the type isn`t what you are searching for, make use of the Lookup field to discover the type that meets your requirements and needs.

- Whenever you discover the proper type, click Acquire now.

- Select the costs strategy you would like, fill out the required details to produce your account, and pay for your order using your PayPal or bank card.

- Select a convenient data file file format and obtain your backup.

Get each of the file themes you possess purchased in the My Forms food list. You can obtain a extra backup of Texas Notice to Creditors and Other Parties in Interest - B 205 at any time, if possible. Just click the required type to obtain or print out the file template.

Use US Legal Forms, by far the most comprehensive assortment of authorized varieties, to conserve time and avoid errors. The service offers expertly created authorized file themes which you can use for an array of purposes. Create an account on US Legal Forms and commence creating your life a little easier.

Form popularity

FAQ

Letters Testamentary: You may order your letters testamentary after you have taken and filed the oath and have had your bond approved, if a bond is required. These letters will serve as the evidence of your appointment when dealing with third persons concerning the affairs of the estate.

Texas maintains a four-year statute of limitations on general debts from their original due date. However, all such limitations are suspended for twelve months following the estate owner's death.

A creditor then has a time limit within which they may file a claim against the estate. They must do so within the later of: Six months from when the probate process officially begins (i.e., the date letters testamentary or of administration are granted), or. Four months after the date the mandatory notice is received.

The executor generally has three years after their appointment to distribute the remaining assets (after debts and disputes are resolved). The Texas probate process can be fairly simple in most cases.

A legally competent person who is interested in a hearing in a probate proceeding may waive notice of the hearing in writing either in person or through an attorney.

Creditors then have 60 days from the date on the form to file their claim, or four months from the date the estate was opened. Once the claim is received by the representative or the executor, they can pay it or, if it doesn't seem legitimate, they can dispute it.

The form must include: The witnesses' names and addresses. Relationships to the decedent. Decedent's date of death. Decedent's marital history. Decedent's family history (children, grandchildren, parents, siblings, nieces/nephews)

Notice to Creditors of the Estate: Within two months after your qualification, you must mail a registered or certified letter, return receipt requested, to each secured creditor of the estate. A secured creditor is one who holds a claim secured by a deed of trust, a mortgage, or some other lien upon property.