Texas Sample Letter for Insufficient Amount to Reinstate Loan

Description

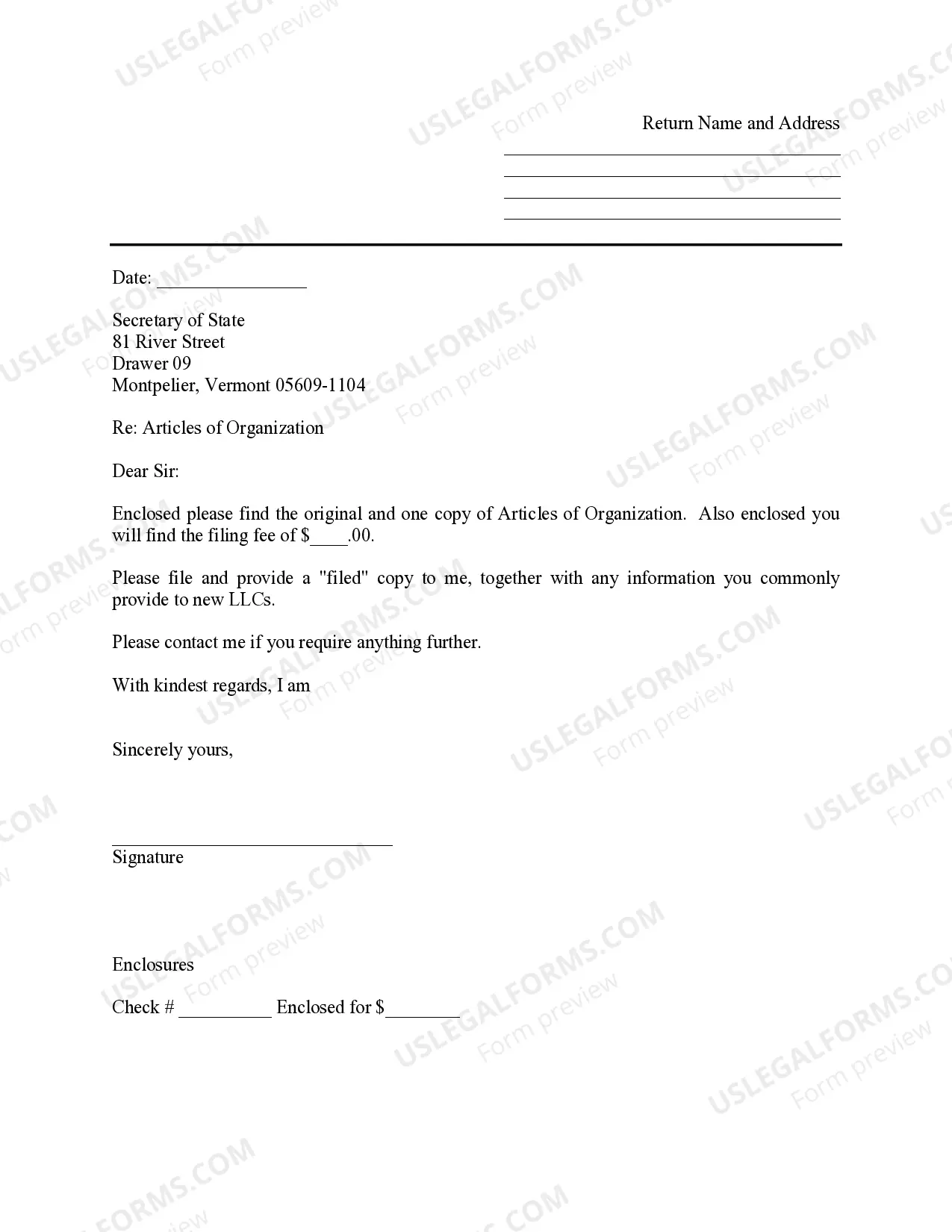

How to fill out Sample Letter For Insufficient Amount To Reinstate Loan?

If you want to be thorough, download or print legal document templates, utilize US Legal Forms, the primary repository of legal documents, accessible online.

Employ the site's straightforward and effective search feature to find the documents you require.

Various templates for business and personal purposes are organized by categories and titles, or keywords.

Step 5. Complete the transaction. You can use a credit card or PayPal account to finalize the payment.

Step 6. Choose the format of your legal document and download it to your device. Step 7. Fill out, modify, and print or sign the Texas Sample Letter for Insufficient Amount to Reinstate Loan. Every legal document template you purchase is yours indefinitely. You can access every form you downloaded in your account. Click on the My documents section and select a form to print or download again. Compete and download, and print the Texas Sample Letter for Insufficient Amount to Reinstate Loan with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to access the Texas Sample Letter for Insufficient Amount to Reinstate Loan with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Texas Sample Letter for Insufficient Amount to Reinstate Loan.

- You can also access documents you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the content of the form. Make sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find alternative templates.

- Step 4. Once you find the form you need, select the Acquire now button. Choose your preferred payment plan and provide your credentials to set up an account.

Form popularity

FAQ

To reinstate an entity in Texas, you typically need to address any outstanding taxes and file specific paperwork with the Texas Secretary of State. This process can be straightforward if you have the right forms and knowledge. Utilizing a Texas Sample Letter for Insufficient Amount to Reinstate Loan can be a helpful tool to communicate effectively with lenders or state authorities regarding your reinstatement process. For comprehensive assistance, consider exploring resources on the Uslegalforms platform.

Commonly, people use the term 'defaulting' to describe the situation of not paying debt. This term captures the idea of failing to fulfill financial obligations. If you find yourself in this situation, it’s essential to address it promptly, perhaps by considering a Texas Sample Letter for Insufficient Amount to Reinstate Loan. Open communication with your creditors can help you navigate these challenges.

Writing an official letter of explanation involves a clear structure and formal tone. Begin with your address, followed by the recipient's details, and a clear introduction. Next, state the purpose of your letter and provide relevant information that supports your case. Utilizing a Texas Sample Letter for Insufficient Amount to Reinstate Loan can guide you through this process, ensuring you cover all key points effectively.

To write a letter explaining your financial situation, start by clearly stating your current circumstances. Describe any changes that have affected your income, such as job loss or medical expenses. Next, explain how these changes impact your ability to make loan payments. You might find a Texas Sample Letter for Insufficient Amount to Reinstate Loan template helpful in organizing your thoughts and ensuring you include all necessary details.

In Texas, you typically have a limited timeframe to file a motion to reinstate. Generally, you must file within 30 days from the date the entity was administratively dissolved or the decision was made. If your situation involves financial issues, using a Texas Sample Letter for Insufficient Amount to Reinstate Loan may help you clearly outline your case and expedite your motion. Always check with the relevant authorities to confirm specific deadlines.

The new discovery rules in Texas focus on streamlining the discovery process, promoting efficiency and reducing disputes. These rules encourage transparency and timely exchanges of information, which can enhance collaboration between parties. When engaging with these rules, utilizing resources like a Texas Sample Letter for Insufficient Amount to Reinstate Loan may help ensure that all necessary documentation is prepared properly and exchanged according to the updated guidelines.

Common grounds for a motion to dismiss in Texas include lack of jurisdiction, failure to state a claim, and the expiration of the statute of limitations. Filing a motion to dismiss requires a clear articulation of legal failures inherent in the plaintiff's claims. For those involved in related issues, a Texas Sample Letter for Insufficient Amount to Reinstate Loan can act as a helpful tool to clarify your position before the court and potentially avoid the need for a motion to dismiss.

After a default judgment is issued in Texas, the winning party can seek enforcement of the judgment through various means, including garnishment or property seizure. The losing party may have limited options to contest the judgment, often requiring a separate motion to set aside the judgment. Understanding these implications can help individuals prepare a Texas Sample Letter for Insufficient Amount to Reinstate Loan, which may assist in negotiations or seek relief effectively.

Yes, you can appeal a foreclosure in Texas, though the process has specific guidelines that must be followed. After the foreclosure sale, you can challenge the legality of the proceedings in court, but you must act quickly to preserve your rights. When dealing with this situation, consider using a Texas Sample Letter for Insufficient Amount to Reinstate Loan to facilitate communication with your lender and possibly mitigate issues before they escalate to a foreclosure appeal.

Rule 306a in Texas addresses the timeline for filing post-judgment motions, specifically regarding when a party is deemed to have received notice of a final judgment. This rule plays a critical role in determining appeal deadlines and extending the time to file for those who have not received timely notice. Incorporating this understanding is beneficial while drafting a Texas Sample Letter for Insufficient Amount to Reinstate Loan, ensuring any appeals or motions are filed within the correct time frame.