Texas Assignment of Interest in Trust

Description

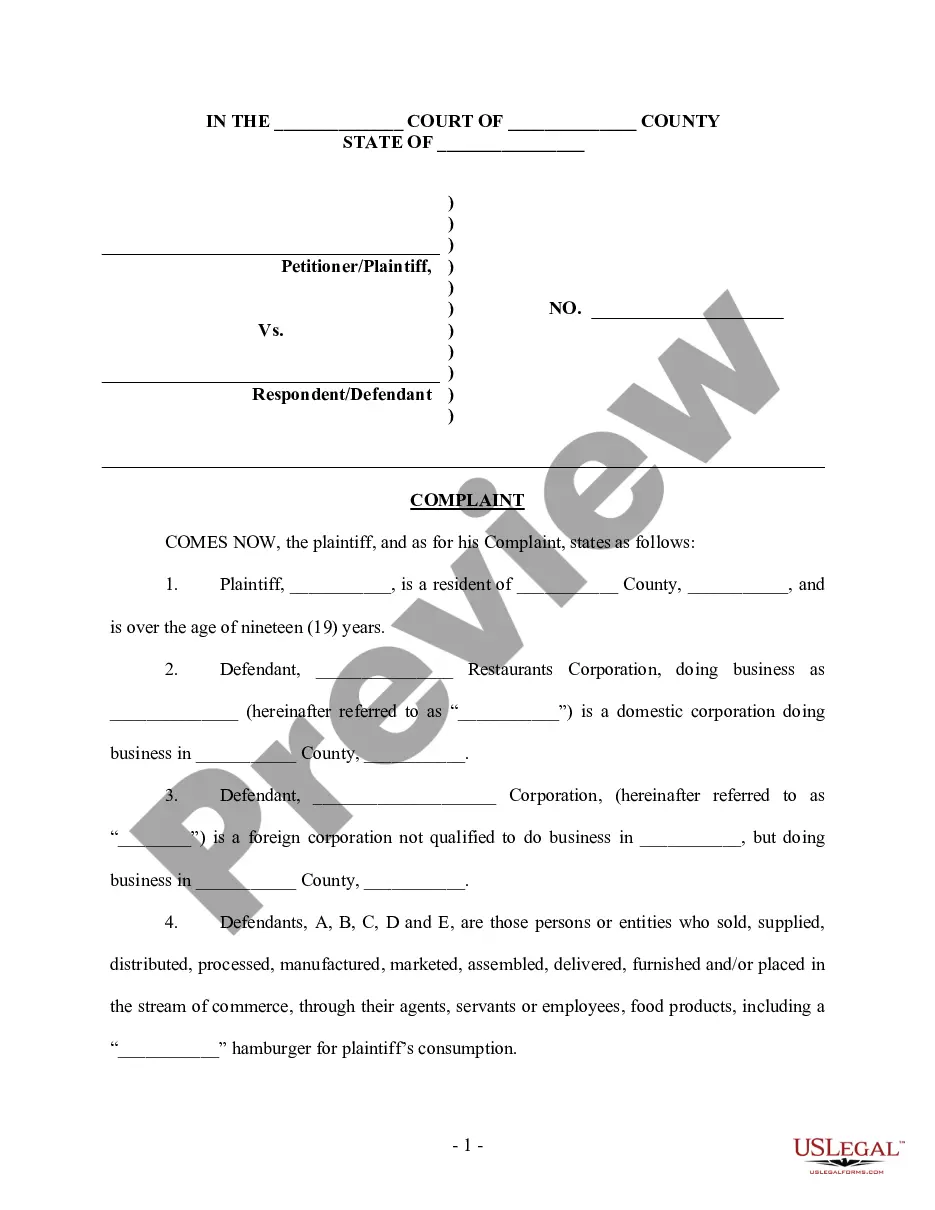

How to fill out Assignment Of Interest In Trust?

You can spend countless hours online looking for the legal document template that meets the federal and state requirements you desire.

US Legal Forms offers a plethora of legal documents that have been assessed by professionals.

It is easy to obtain or create the Texas Assignment of Interest in Trust through my services.

You can search for another version of the document by utilizing the Lookup field to find the template that meets your needs and criteria.

- If you possess a US Legal Forms account, you can Log In and select the Obtain option.

- Then, you can complete, modify, print, or sign the Texas Assignment of Interest in Trust.

- Each legal document template you buy becomes your property indefinitely.

- To retrieve an additional copy of a purchased form, navigate to the My documents section and select the relevant option.

- If this is your first time using the US Legal Forms site, follow the straightforward steps outlined below.

- First, ensure that you have chosen the correct document template for the state/city of your choice.

- Review the form description to confirm you have selected the right template.

Form popularity

FAQ

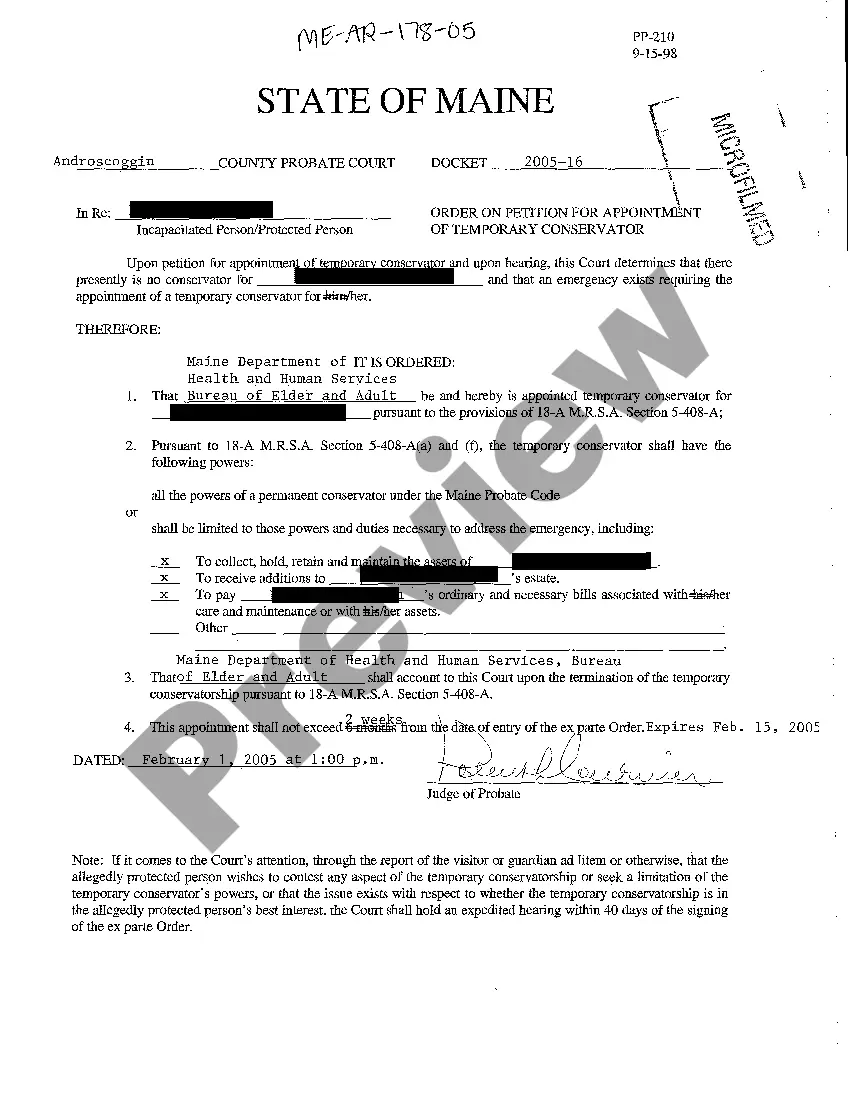

A beneficiary typically has a future interest in the trust's assets meaning they might access funds at a determined time, such as when the recipient reaches a certain age.

General powers of appointment, however, allow the power holder to transfer his inheritance rights to anyone, including his estate and his creditors. Without a power of appointment it is often impossible for the beneficiary to assign his/her inheritance because a trust will typically contain an anti-alienation clause.

Trustees are trusted to make decisions in the beneficiary's best interests and often have a fiduciary responsibility, meaning they act in the best interests of the trust beneficiaries to manage their assets.

If you want to make sure your children use the money wisely, consider putting it in trust with a few strings attached. Many estate planning attorneys recommend distributing the assets in chunks (typically one-third at age 25, one-third at age 30 and one-third at age 35).

Once the assets of the estate have been distributed, the personal representative must issue a final accounting with the court, which must also be sent to each beneficiary.

Usually, a trust prohibits beneficiaries from assigning their interest in the trust before distribution. The anti-assignment provision protects undistributed trust assets from claims by a beneficiary's creditors. Next, disclaimers are used when a beneficiary, or heir, refuses to accept a gift or inheritance.

A trust is not a legal entity in Texas. It is a relationship whereby a trustee acts as the agent for two classes of beneficiaries, income beneficiaries and remainder beneficiaries.

Inheritance advance paperwork may include: The death certificate for the person whose will you are named in. A copy of the legal will, if such a document is available. A document from the estate executor or administrator explaining who they are and their relation to the estate.

Assigning inheritance is the process of transferring your inheritance to someone else. For instance, if you receive an inheritance advance, you will assign a portion of your inheritance to the funding company providing the cash advance in return for immediate funds.

An assignment may not transfer a duty, burden or detriment without the express agreement of the assignee. The right or benefit being assigned may be a gift (such as a waiver) or it may be paid for with a contractual consideration such as money.