Texas Irrevocable Trust Agreement Setting up Special Needs Trust for Benefit of Multiple Children

Description

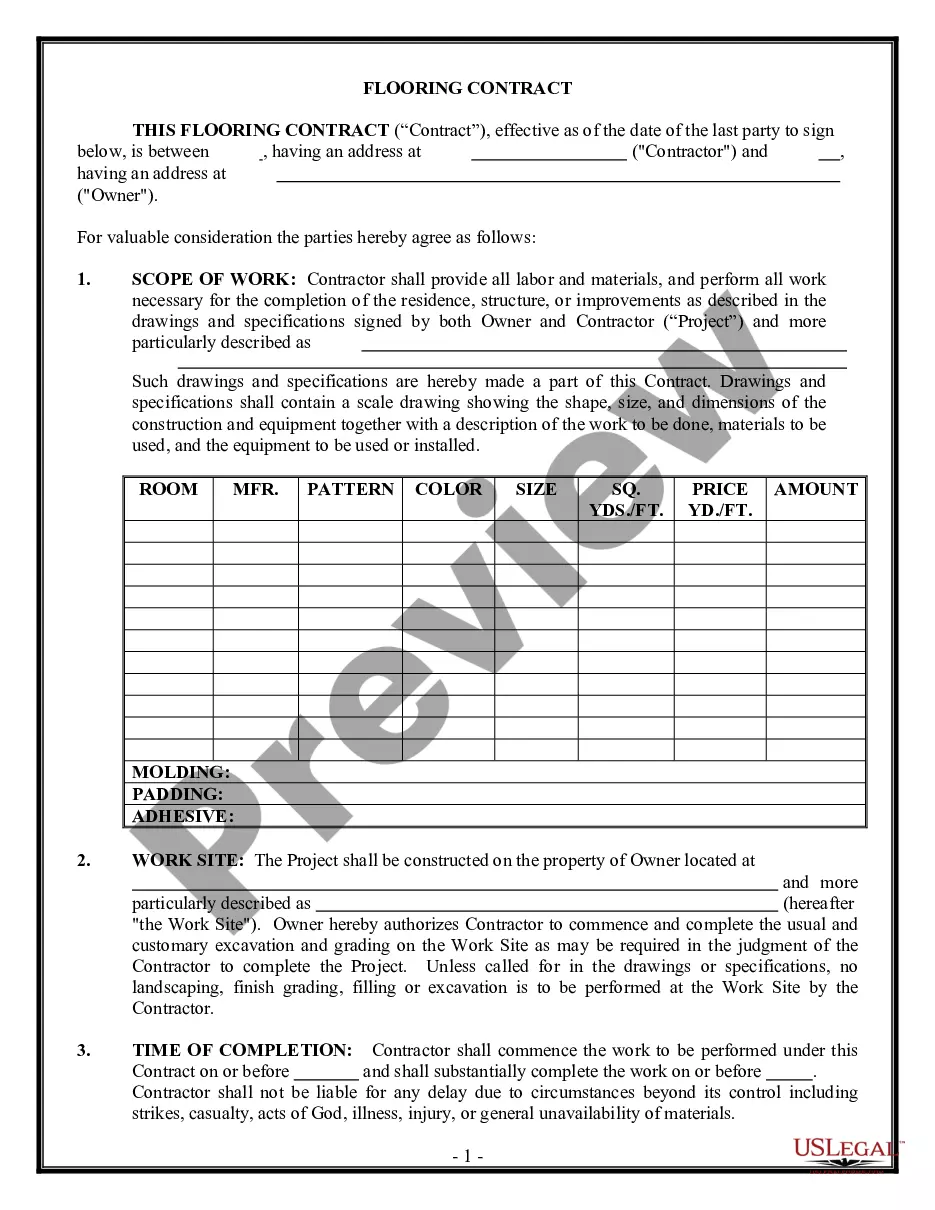

How to fill out Irrevocable Trust Agreement Setting Up Special Needs Trust For Benefit Of Multiple Children?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal template categories available for download or printing.

Through the website, you can access thousands of forms for both business and personal uses, organized by categories, states, or keywords.

You can find the latest versions of forms like the Texas Irrevocable Trust Agreement Creating Special Needs Trust for Benefit of Multiple Children in just a few minutes.

If the form does not meet your needs, use the Search area at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose your preferred pricing plan and provide your details to register for an account.

- If you have a subscription, Log In to download the Texas Irrevocable Trust Agreement Creating Special Needs Trust for Benefit of Multiple Children from the US Legal Forms library.

- The Download option will appear on every form you view.

- You can access all previously saved forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple steps to get you going.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form's content.

Form popularity

FAQ

While there's no limit to how many trustees one trust can have, it might be beneficial to keep the number low. Here are a few reasons why: Potential disagreements among trustees. The more trustees you name, the greater the chance they'll have different ideas about how your trust should be managed.

Primary Beneficiary vs.A living trust can have both primary beneficiaries and contingent beneficiaries. This is true both for a single-grantor trust and a joint living trust, a common option for spouses as it allows for multiple grantors.

Trusts can have more than one beneficiary and they commonly do. In cases of multiple beneficiaries, the beneficiaries may hold concurrent interests or successive interests.

All these elements are important to address and start preparing the trust.Estimate the Funds Required For Special Needs Care. One of the major considerations while setting up a trust us to identify the fund's trust will require.Preparing the Trust Deed.Registering the Trust Deed.

While there's no limit to how many trustees one trust can have, it might be beneficial to keep the number low. Here are a few reasons why: Potential disagreements among trustees. The more trustees you name, the greater the chance they'll have different ideas about how your trust should be managed.

Disadvantages to SNTCost. Annual fees and a high cost to set up a SNT can make it financially difficult to create a SNT The yearly costs to manage the trust can be high.Lack of independence.Medicaid payback.

Once you move your asset into an irrevocable trust, it's protected from creditors and court judgments. An irrevocable trust can also protect beneficiaries with special needs, making them eligible for government benefits, unlike if they inherited properties outright.

Most living trusts automatically become irrevocable upon the grantor's death, so if you were included as a beneficiary of a trust when the grantor died, you will remain a beneficiary of the trust. One of the main exceptions to this rule is where a trust is invalidated through a trust contest.

An irrevocable trust is a trust that can't be amended or modified. However, like any other trust an irrevocable trust can have multiple beneficiaries. The Internal Revenue Service allows irrevocable trusts to be created as grantor, simple or complex trusts.

Trusts can have more than one beneficiary and they commonly do. In cases of multiple beneficiaries, the beneficiaries may hold concurrent interests or successive interests.