Texas Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association

Description

How to fill out Notice Of Meeting To Pass On Resolution To Incorporate Non-Profit Association?

Selecting the appropriate legal document template might present a challenge. Certainly, there is a multitude of designs accessible online, but how will you find the legal form you need.

Utilize the US Legal Forms website. The platform offers an extensive collection of templates, such as the Texas Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association, suitable for both professional and personal use. All forms are vetted by experts and comply with federal and state regulations.

If you are currently registered, Log In to your account and click on the Download button to obtain the Texas Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association. Use your account to review the legal forms you have purchased previously. Navigate to the My documents section of your account and download another copy of the document you need.

Choose the format and download the legal document template to your device. Finally, edit, print, and sign the obtained Texas Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association. US Legal Forms is the largest repository of legal documents with numerous file templates available. Utilize the service to acquire professionally crafted documents that adhere to state requirements.

- Firstly, confirm you have chosen the correct form for your city/state.

- You may examine the form using the Review button and read the form description to ensure it meets your requirements.

- If the form does not fulfill your needs, utilize the Search field to find the right form.

- Once you are certain that the form is suitable, click the Acquire now button to obtain the form.

- Select the pricing plan you prefer and input the necessary information.

- Create your account and complete the order using your PayPal account or credit card.

Form popularity

FAQ

Section 6.201 B of the Texas Business Organizations Code specifies the requirements for organizing a nonprofit association in Texas. This section highlights the procedural aspects, including the necessity of holding meetings and incorporating resolutions like the Texas Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association. Understanding this section will ensure you comply with state laws while forming your organization. Always consult legal resources or platforms like uslegalforms for guidance on these requirements.

To file a complaint against a non-profit organization in Texas, you should contact the Texas Attorney General's office. Prepare a written complaint detailing your concerns, and submit it through their website or by mail. They will review the complaint and determine if further investigation is warranted. Staying informed about regulations, like the Texas Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association, can help when approaching these matters.

In Texas, non-profit organizations are regulated by the Secretary of State and the Attorney General's office. The Secretary of State handles the formation and compliance aspects, while the Attorney General oversees legally mandated activities and enforces charity laws. Adhering to requirements such as the Texas Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association helps ensure you meet regulatory standards.

To establish a non-profit corporation in Texas, you need to file a Certificate of Formation with the Secretary of State. You'll also require a board of directors and a set of bylaws that outline your organization's governance. It is important to collect and document your meeting resolutions. This process incorporates the Texas Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association for fulfilling all regulatory obligations.

Non-profit organizations in the US are primarily regulated at both the state and federal levels. The Internal Revenue Service (IRS) oversees tax-exempt status and compliance. Additionally, states have various agencies that govern non-profit activities, which often include departments of state. For organizations in Texas, adhering to the Texas Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association ensures regulatory compliance.

Starting a Nonprofit in California- FAQs If you file online for your Articles of Incorporation and Initial Report, the process takes 1-3 days. Your tax-exempt status with the IRS will take the longest to arrive. You can expect a determination letter anywhere from one to six months after filing.

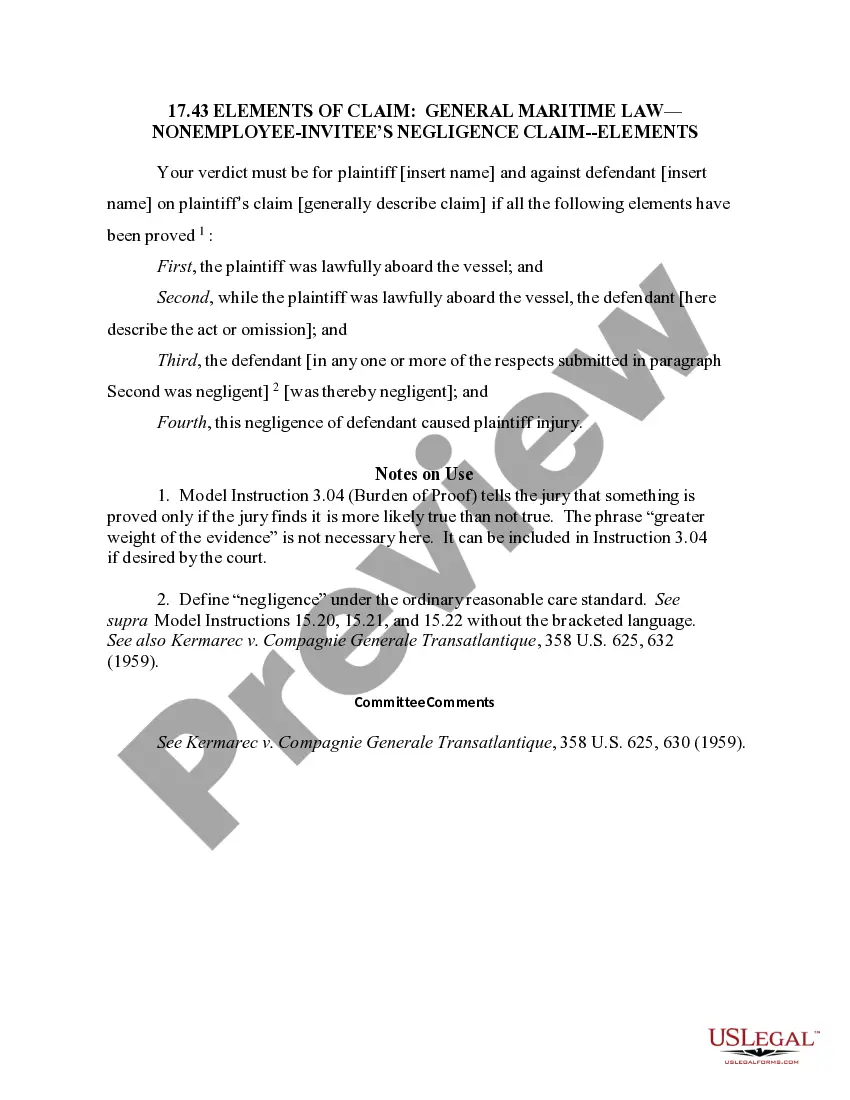

A board resolution template is a manner of documenting decisions made by the company's Shareholders or Board of Directors. The decision can cover anything relevant to the affairs of the organization like a decision extending loans to other companies or when voting for a new member to join the board.

Some basic information a resolution should include is the name of the corporation; the date of the board meeting when the resolution was approved; and the names of the board members who attended the meeting, or a statement that all board members or a quorum were present.

How long does it take to start a Texas nonprofit? Texas Articles of Incorporation Turnaround 3-5 business days. You can pay an additional $25 expedite fee to get your mailed filing in 2 business days.

Labeling a vote a resolution means that the board believed the issue was important enough to separate it from standard voting issues. A resolution is considered an official board action and it requires a quorum. Board directors must document all official board actions, including resolutions, in their meeting minutes.