Texas Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

Are you currently in a circumstance where you need documents for either business or personal reasons regularly.

There are many legitimate document templates available online, but finding ones you can trust is not simple.

US Legal Forms offers a vast array of form templates, including the Texas Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, which are designed to comply with federal and state regulations.

Select a convenient file format and download your copy.

Find all the form templates you have purchased in the My documents list. You can obtain another version of Texas Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption at any time, if needed. Simply access the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid errors. The service provides appropriately crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms site and possess an account, simply sign in.

- Then, you can download the Texas Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct region/county.

- Utilize the Preview option to review the document.

- Check the description to ensure that you have selected the accurate form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs and specifications.

- Once you find the right form, click Get now.

- Choose the pricing plan you prefer, complete the necessary information to create your account, and place the order using your PayPal or credit card.

Form popularity

FAQ

Receiving a 1099-S when selling your house is not guaranteed; it depends on the nature of the sale and whether it meets IRS reporting requirements. If your situation is exempt under the Texas Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, a 1099-S may not be necessary. Understanding these criteria helps clarify your position.

If you do not receive a 1099-S after your home sale, it may indicate that your transaction does not require reporting or that the responsible party failed to file. However, it's crucial to maintain your own records and consult with a tax professional to ensure compliance and proper tax exemptions under the Texas Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

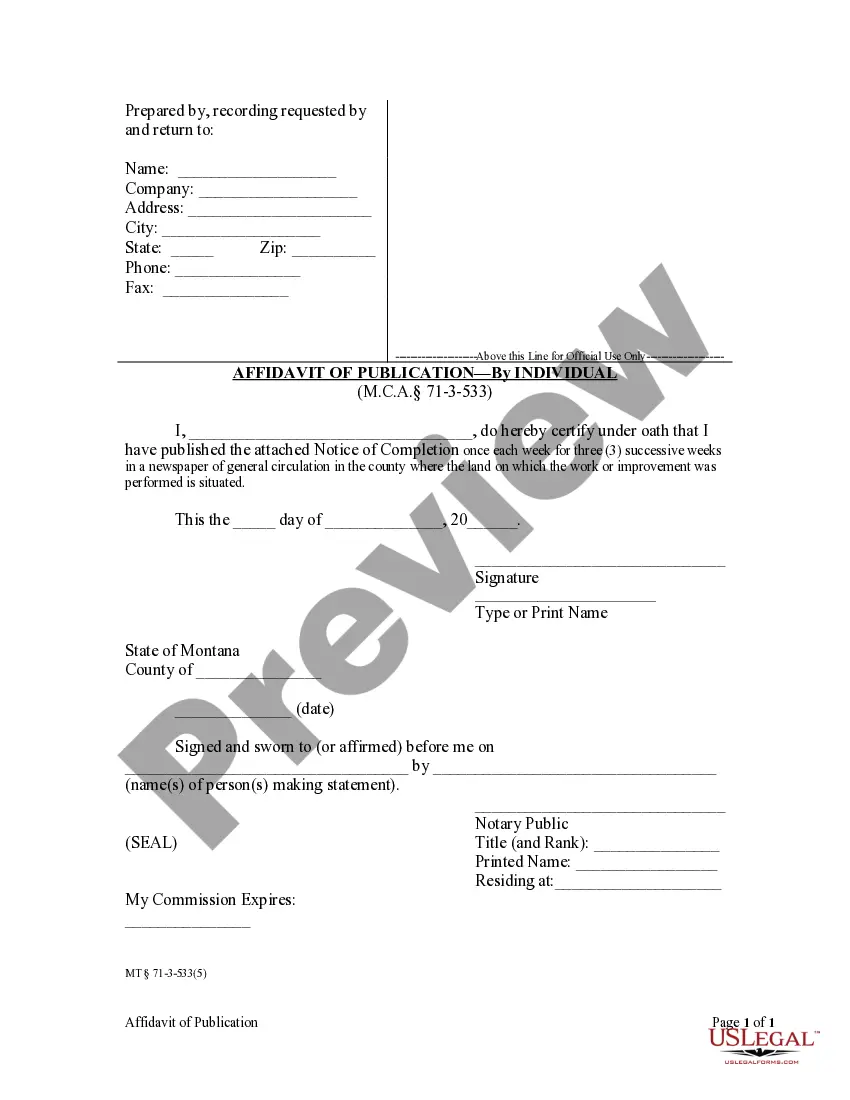

CERTIFICATION FOR NO INFORMATION REPORTING. ON THE SALE OR EXCHANGE OF A PRINCIPAL RESIDENCE. This form may be completed by the seller of a principal residence.

The form you are referring to Certification for No Information Reporting on the Sale or Exchange of a Principal Residence is a form which is to be completed by the seller of a principal residence in order to determine whether the sale or exchange needs to be reported to the IRS on Form 1099-S, Proceeds

Form 1099-S - Proceeds From Real Estate Transactions (Estates and Trusts) IRS Form 1099-S Proceeds From Real Estate Transactions is used to report proceeds from real estate transactions. Where this information is reported depends on the use of the property (personal use, investment use, or business or rental use).

An exemption certificate must be in substantially the form of a Texas Sales and Use Tax Exemption Certification, Form 01-339 (Back). Copies of the form may be obtained from the Comptroller of Public Accounts, Tax Policy Division or by calling 1-800-252-5555.

What is Substitute Form 1099-S for? This form is designed for reporting a transaction that may consist of the complete or partial sale or money exchange, property, indebtedness, services of the future or present interest of the ownership.

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

Businesses are required to issue a 1099 form to a taxpayer (other than a corporation) who has received at least $600 or more in non-employment income during the tax year. For example, a taxpayer might receive a 1099 form if they received dividends, which are cash payments paid to investors for owning a company's stock.

Do I need to submit a resale certificate each time I make a purchase? Yes, except that if a customer purchases exclusively for resale, a seller can accept a blanket resale certificate. The certificate should state that all purchases will be resold in the regular course of business.