Texas Sample Term Sheet with Explanatory Annotations

Description

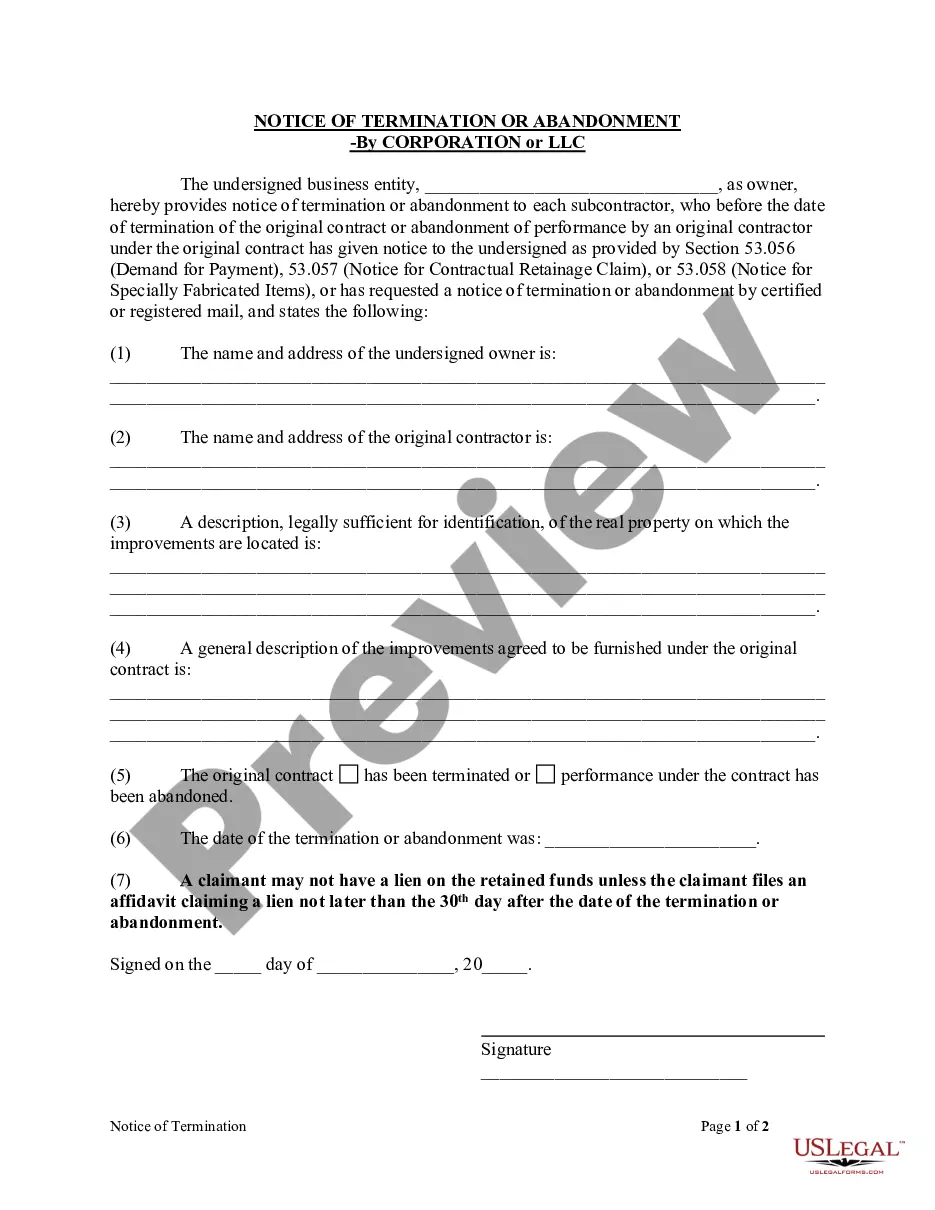

Term sheets are very similar to "letters of intent" (LOI) in that they are both preliminary, mostly non-binding documents meant to record two or more parties' intentions to enter into a future agreement based on specified (but incomplete or preliminary) terms. The difference between the two is slight and mostly a matter of style: an LOI is typically written in letter form and focuses on the parties' intentions; a term sheet skips most of the formalities and lists deal terms in bullet-point or similar format. There is an implication that an LOI only refers to the final form. A term sheet may be a proposal, not an agreed-to document.

How to fill out Sample Term Sheet With Explanatory Annotations?

If you need to obtain comprehensive, download, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site's simple and user-friendly search function to locate the documents you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you locate the form you desire, click the Buy now button. Choose the pricing plan you prefer and enter your information to create an account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the Texas Sample Term Sheet with Explanatory Annotations in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Texas Sample Term Sheet with Explanatory Annotations.

- You can also access forms you have previously downloaded within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Use the Review option to examine the form's content. Don't forget to read the details.

- Step 3. If you are dissatisfied with the form, utilize the Search area at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

To analyze a term sheet, first review each section to understand the implications of the investment terms and conditions. Consider the negotiation leverage you have and what potential risks are associated with each clause. Resources like the Texas Sample Term Sheet with Explanatory Annotations can clarify specific terms and enhance your understanding. Rely on these tools to ensure you are making informed decisions on essential business agreements.

The term sheet format typically includes sections such as introducing the parties, describing the investment, outlining key terms, and detailing any special rights or obligations. It's important that the format is clear and easy to follow to avoid confusion later on. The Texas Sample Term Sheet with Explanatory Annotations establishes a consistent format that can guide you through the process. A well-organized term sheet enhances negotiation and communication between parties.

To analyze a term sheet effectively, focus on the most important terms and provisions that impact the agreement's outcome. Assess the valuation, investment terms, and what rights you may or may not hold as an investor or business owner. The Texas Sample Term Sheet with Explanatory Annotations can aid in this analysis by providing context and detailed explanations for each clause. Engage a legal expert if necessary to ensure you fully understand the implications.

A term sheet is a document that outlines the main terms and conditions of an agreement between parties. It serves as a blueprint for drafting final legal documents and helps clarify the intentions of all stakeholders. The Texas Sample Term Sheet with Explanatory Annotations simplifies this process by providing both structure and detailed explanations of each term involved. This summary helps parties understand the broader context of their agreement.

To fill out a term sheet, start by clearly stating the names of the parties involved and the terms of the agreement. Next, outline the investment amount and any preferences or rights associated with the securities. Make sure to reference a well-crafted guide, such as the Texas Sample Term Sheet with Explanatory Annotations, which can provide clarity on each section. Finally, review the document to ensure accuracy and completeness before signing.

Five key points to consider in a term sheet include the investment amount, preferred stock terms, liquidation preferences, board composition, and voting rights. Each of these factors plays a pivotal role in shaping the relationship between investors and the business. Utilizing a resource like the Texas Sample Term Sheet with Explanatory Annotations can help ensure you grasp these concepts thoroughly. Understanding these points enhances negotiation and helps secure favorable terms.

But no matter who the investor is, a term sheet will always contain six key components, including:A valuation. An estimate of what a company is worth as an investment opportunity.Securities being issued.Board rights.Investor protections.Dealing with shares.Miscellaneous provisions.

How to Prepare a Term SheetIdentify the Purpose of the Term Sheet Agreements.Briefly Summarize the Terms and Conditions.List the Offering Terms.Include Dividends, Liquidation Preference, and Provisions.Identify the Participation Rights.Create a Board of Directors.End with the Voting Agreement and Other Matters.

The company valuation, investment amount, percentage stake, voting rights, liquidation preference, anti-dilutive provisions, and investor commitment are some items that should be spelled out in the term sheet.