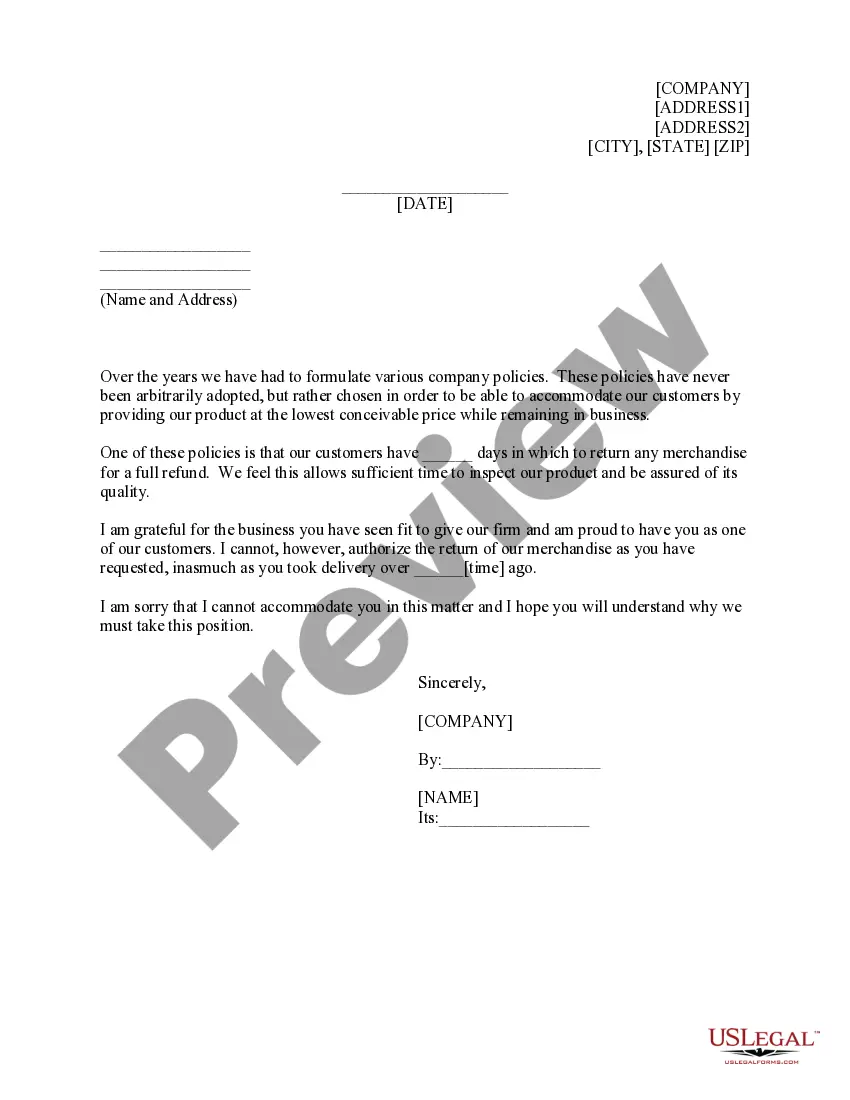

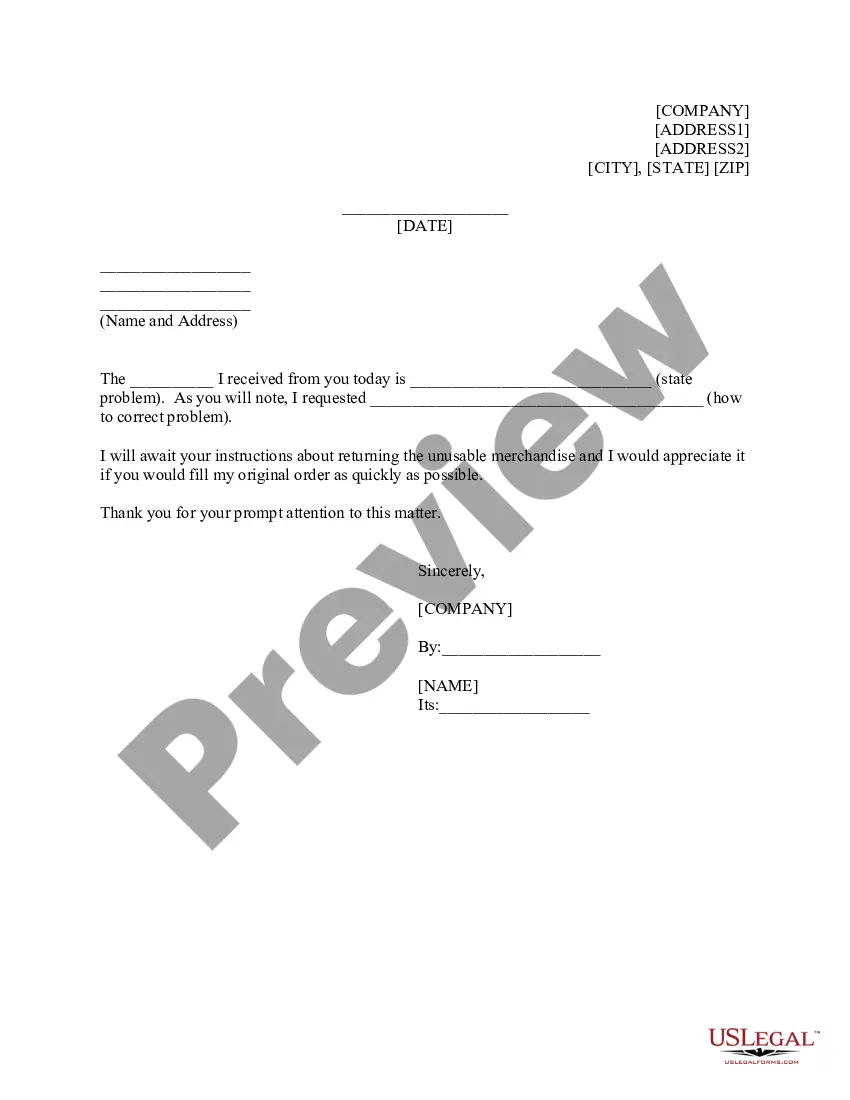

This is a form for return of merchandise by a customer.

Texas Merchandise Return

Description

How to fill out Merchandise Return?

If you desire to finalize, download, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms readily available online.

Take advantage of the site's straightforward and user-friendly search to find the documents you require.

Various templates for corporate and personal purposes are organized by categories and regions, or keywords.

Step 4. Once you have found the form you need, click the Acquire now button. Select the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to acquire the Texas Merchandise Return in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Texas Merchandise Return.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, please follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's details. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

The 10-day rule in Texas refers to the requirement for car dealerships to provide you with a temporary tag for your new vehicle. This rule allows you to legally drive your car while waiting for your permanent registration. It’s crucial to understand that this temporary tag is part of the Texas Merchandise Return process and ensures your vehicle is compliant for the specified period. Make sure to keep all documents handy during this time.

In Texas, you typically have 72 hours to change your mind after purchasing a car, thanks to the Texas Merchandise Return policy. This window allows you to reconsider your decision without penalty. During this period, keep in mind that you should return the vehicle in the same condition in which you bought it. For specific details or exceptions, it's wise to consult the dealership or check resources on our platform.

Yes, if you operate a business in Texas, you usually need to file business taxes. Even if your business does not generate a profit, you still have obligations to report income and expenses. Filing accurately can help you avoid penalties and maintain a good standing with the state. To prepare for these requirements, US Legal Forms offers tools specifically designed to help you with your Texas Merchandise Return.

Typically, a small business must file a tax return if it earns $1,000 or more in net income. However, depending on the structure of your business, different rules may apply. It's beneficial to keep accurate records of your income and expenses to determine your filing requirements. To assist you in this process, resources from US Legal Forms can guide you through your Texas Merchandise Return filings.

In Texas, the state sales tax rate is currently set at 6.25% on most merchandise purchases. Local governments may impose additional sales taxes, which can increase the total rate. Understanding these rates is essential for accurate business planning. For details and simplicity, consider accessing resources from US Legal Forms to calculate your Texas Merchandise Return tax responsibilities effectively.

Yes, LLCs must file tax returns in Texas, but their tax obligations depend on how they are classified for federal tax purposes. An LLC can choose to be taxed as a sole proprietorship, partnership, or corporation. Regardless of classification, accurate reporting is still essential. You can find valuable resources and forms for your Texas Merchandise Return on US Legal Forms to ensure compliance.

Yes, business entities operating in Texas, including corporations and partnerships, must file a business tax return. This return helps report income and calculates your franchise tax, if applicable. Even if your business doesn't owe any taxes, you still need to file. Utilizing US Legal Forms can simplify the completion of your Texas Merchandise Return and ensure you meet all filing deadlines.

You need to file a business tax return if your business generates income that exceeds the threshold set by Texas state law. It's crucial to assess your earnings and the type of business entity you operate. Depending on your revenue and structure, such as whether you operate as an LLC or a corporation, your filing requirements will vary. Platforms like US Legal Forms can help clarify these requirements to ensure you comply with your Texas Merchandise Return obligations.

Yes, if you have income sourced in Texas, you are generally required to file a Texas state return. This is essential for compliance with state tax laws and to avoid potential penalties. Filing ensures that you meet your obligations and accurately report your earnings. The process can be simplified with tools like US Legal Forms, which guide you through the requirements for a Texas Merchandise Return.

To fill out a Texas resale certificate, include your name, address, and the type of products you intend to resell. You'll also need to provide your seller's permit number, if applicable. This certificate allows you to make tax-exempt purchases when acquiring goods for resale. Familiarizing yourself with the resale certificate process can significantly ease any complexities you might face concerning Texas Merchandise Return transactions.