A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer.

Texas Checklist - Items to Consider for Drafting a Promissory Note

Description

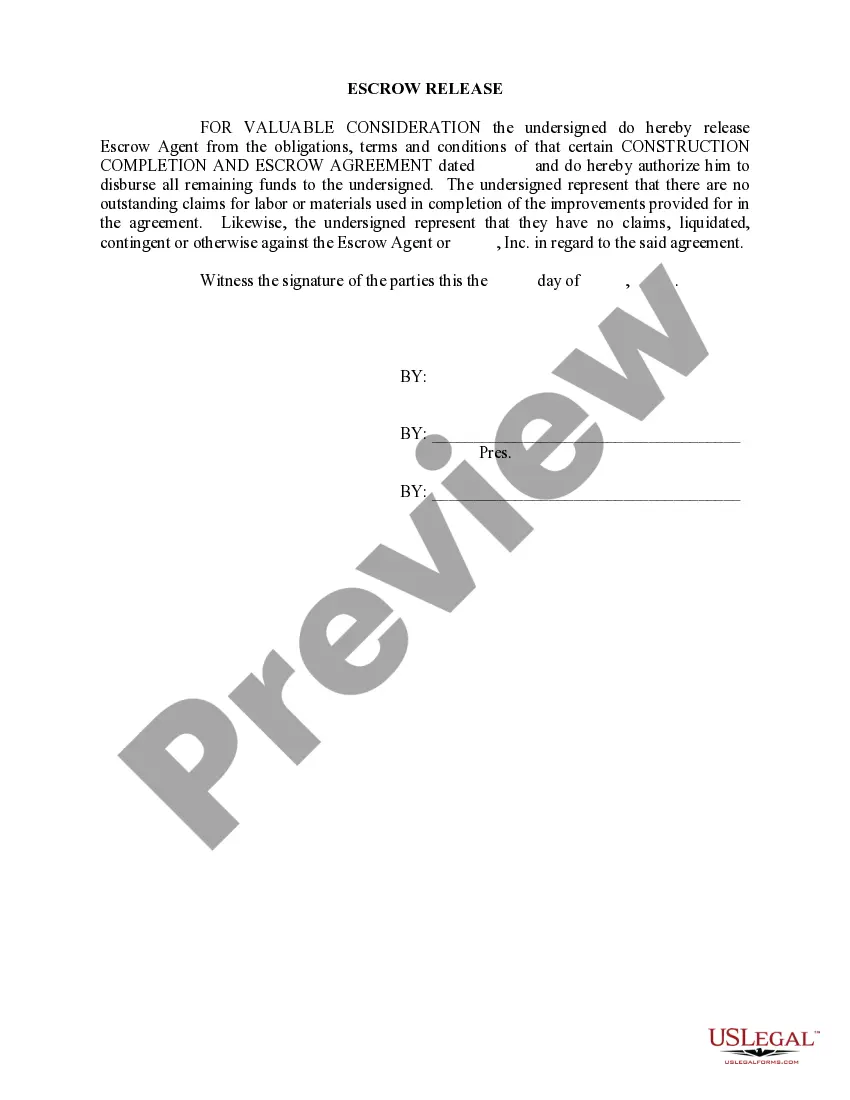

How to fill out Checklist - Items To Consider For Drafting A Promissory Note?

You might invest time online trying to locate the appropriate legal document template that satisfies the federal and state requirements you will need.

US Legal Forms provides thousands of legal documents that can be reviewed by professionals.

You can obtain or create the Texas Checklist - Considerations for Drafting a Promissory Note from your resources.

- If you have a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, create, or sign the Texas Checklist - Considerations for Drafting a Promissory Note.

- Each legal document template you buy is yours permanently.

- To get another copy of any purchased document, visit the My documents section and click the respective button.

- If you are using the US Legal Forms website for the first time, follow these simple instructions.

- First, ensure you have selected the correct document template for the state/city of your choice. Check the document description to confirm you have chosen the right document.

- If available, you can use the Preview button to review the document template as well.

- If you want to find another version of the document, utilize the Search field to locate the template that fits your wants and needs.

- Once you have discovered the template you want, click on Purchase now to proceed.

- Choose the pricing plan you want, enter your details, and register for an account on US Legal Forms.

Form popularity

FAQ

A promissory note can become void due to various factors, including fraud, duress, or mutual mistake of the parties involved. If the terms of the note are unconscionable or if one party lacked the capacity to consent, these can also be grounds for voiding the note. To safeguard your interests, following the Texas Checklist - Items to Consider for Drafting a Promissory Note is highly recommended.

Yes, promissory notes are legally binding in Texas, provided they meet certain criteria. The note must include clear terms regarding the amount owed, repayment schedule, and any applicable interest rates. Adhering to the Texas Checklist - Items to Consider for Drafting a Promissory Note can ensure your note holds up in a court of law.

A promissory note may be deemed invalid for several reasons, such as lack of essential elements like signatures, terms, or consideration. If the parties did not have the legal capacity to enter into the agreement or if the purpose of the note was illegal, the note could also be invalid. To avoid such issues, it's advisable to follow the Texas Checklist - Items to Consider for Drafting a Promissory Note carefully.

A promissory note can become invalid in Texas for various reasons, such as lack of consideration, missing essential terms, or signatures. In addition, if the note contains ambiguous language or violates any Texas laws, it could be deemed unenforceable. To avoid pitfalls, using the Texas Checklist - Items to Consider for Drafting a Promissory Note is recommended to validate your document and protect your interests.

To be valid, a promissory note in Texas must contain clear terms, including the amount borrowed, repayment schedule, interest rate, and signatures. It should also be written in a manner that reflects mutual agreement between both parties. Following the Texas Checklist - Items to Consider for Drafting a Promissory Note ensures that all these aspects are thoroughly addressed, promoting legal enforceability.

A valid promissory note in Texas must include a few key elements, such as the principal amount, interest rate, payment terms, and the signatures of both parties. These components are crucial for ensuring that the note is clear and enforceable. By following the Texas Checklist - Items to Consider for Drafting a Promissory Note, you can confirm that all necessary details are included to avoid potential issues.

In Texas, promissory notes do not require notarization to be legally binding. However, having a notary public witness the signing of the document can enhance its legal standing. A notarized promissory note might be useful in case of a dispute, as it typically carries added credibility. To ensure you meet all legal standards, refer to the Texas Checklist - Items to Consider for Drafting a Promissory Note.

The essential elements of promissory notes revolve around clarity and legal enforceability, as highlighted in the Texas Checklist - Items to Consider for Drafting a Promissory Note. Each note should have a clear amount, an agreed-upon payment timeline, and signatures from both the payer and the payee. These components create a solid foundation for any financial transaction represented by the note.

Examples of promissory notes include personal loans between friends or family members, business loans, or real estate transactions. Each type can have variations in terms and structure, aligned with the specifics of the agreement. To enhance your understanding, refer to the Texas Checklist - Items to Consider for Drafting a Promissory Note, which can provide tailored examples suitable for your needs.

In Texas, a promissory note must include specific elements to be legally enforceable. It should clearly state the amount borrowed, the repayment terms, and identify the borrower and lender. Additionally, for convenience and clarity, it’s beneficial to comply with the Texas Checklist - Items to Consider for Drafting a Promissory Note to avoid any potential disputes.