This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Texas Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse

Description

How to fill out Notice Of Non-Responsibility For Debts Or Liabilities Contracted By Spouse?

Finding the correct authentic document template can be quite a challenge.

Indeed, there are numerous designs available online, but how can you locate the genuine form you require.

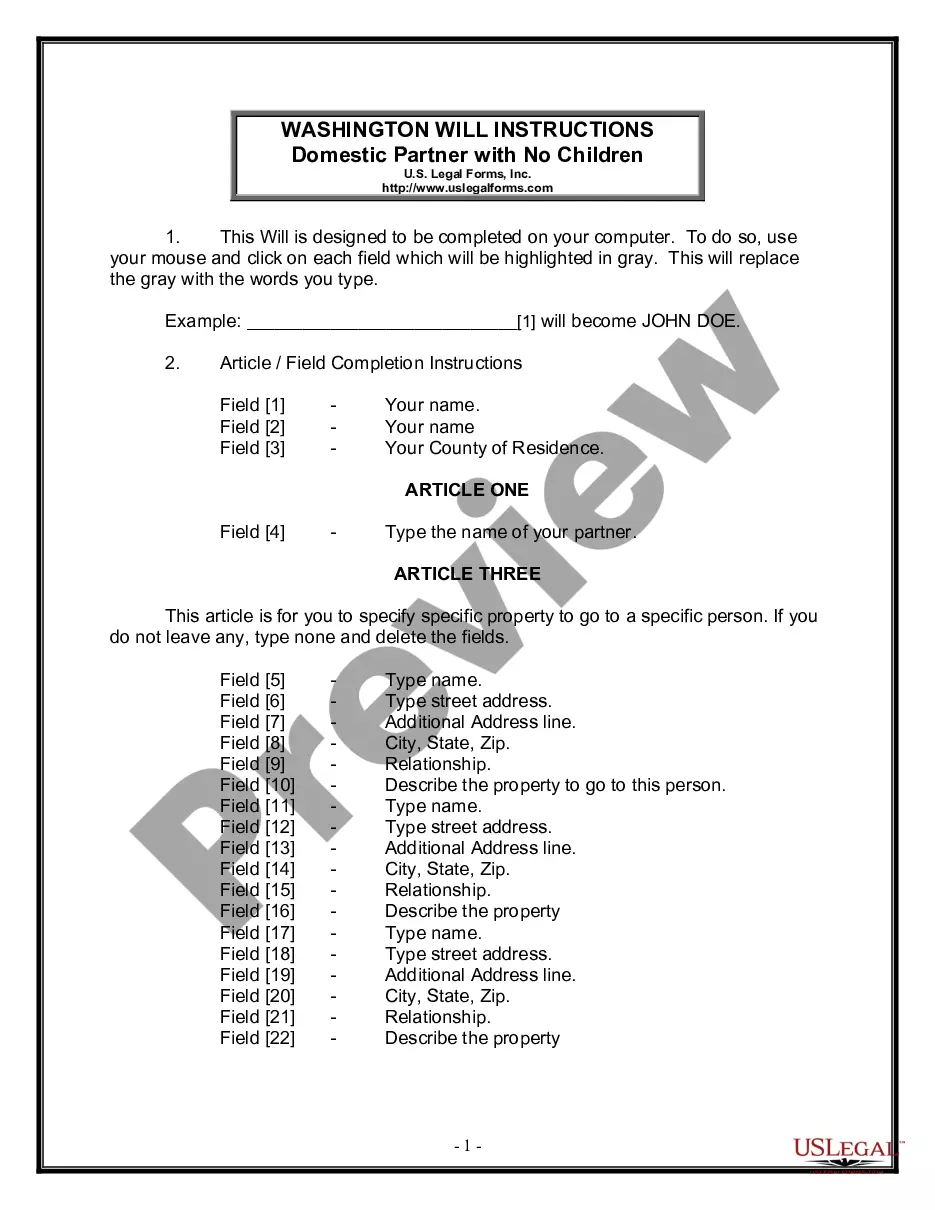

Utilize the US Legal Forms platform. This service offers thousands of templates, including the Texas Notice of Non-Responsibility for Debts or Liabilities Incurred by Spouse, which you can use for business and personal needs.

If the form does not satisfy your needs, use the Search field to find the correct form. Once you are confident that the form is appropriate, click the Buy now button to acquire the form. Select the pricing plan you prefer and enter the required information. Create your account and complete the transaction using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Texas Notice of Non-Responsibility for Debts or Liabilities Incurred by Spouse. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Use the service to download professionally crafted paperwork that comply with state requirements.

- All documents are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Obtain button to access the Texas Notice of Non-Responsibility for Debts or Liabilities Incurred by Spouse.

- Use your account to search through the legal forms you may have purchased previously.

- Visit the My documents section of your account and download a new copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure that you have selected the right form for your area. You may view the form using the Preview button and read the form description to confirm it is suitable for you.

Form popularity

FAQ

Generally, you are not liable for your spouse's medical debt in Texas, especially if the debt is in their name alone. However, if you've signed any agreements or contracts related to medical bills, your liability might differ. Utilizing the Texas Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse can help solidify your position on this issue. For further guidance, check out the resources available on USLegalForms.

In Texas, a spouse is not automatically responsible for the other spouse's debts. However, creditors may hold both spouses accountable for certain joint debts. To protect yourself from potential liability, consider using the Texas Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse. This legal notice can help clarify your financial responsibilities.

Texas is not considered a non-spousal state. Instead, it recognizes both spouses' contributions to the marriage, including those who don't work. This legal framework allows the courts to evaluate spousal properties and debts, ensuring fairness during divorce proceedings. Knowing about the Texas Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse can guide you in understanding your responsibilities and rights regarding marital debts.

athome wife may be entitled to spousal support and a share of the marital property upon divorce in Texas. Courts recognize the contributions made by spouses who prioritize homemaking over employment. Factors like the couple's standard of living and any gathered debts come into play, including the importance of the Texas Notice of NonResponsibility for Debts or Liabilities Contracted by Spouse. Understanding these rights can help you seek a fair settlement.

working spouse in Texas may be entitled to spousal support and a fair distribution of marital assets. The court typically looks at various factors, such as the earning capacity of both spouses and the duration of the marriage. The Texas Notice of NonResponsibility for Debts or Liabilities Contracted by Spouse can also help protect the nonworking spouse from unwanted financial obligations. It’s vital to explore your entitlements carefully.

When a wife has no income during a divorce, the court may consider her needs for spousal support. The judge assesses the financial capabilities of both spouses and the length of the marriage. Moreover, the Texas Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse can protect her from being liable for any debts incurred solely by her spouse. Understanding your rights is crucial in securing the support you need.

In Texas, if your name is not on a deed, you may still have rights concerning the property, especially if it was acquired during the marriage. The Texas Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse can help clarify your position. This notice indicates that you are not liable for debts incurred by your spouse regarding the property. Utilizing this notice may protect your interests and ensure that you are treated fairly in any financial dealings related to the property.

A wife typically cannot be held responsible for her husband's debt incurred before their marriage in Texas. The Texas Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse can serve as an important legal document to assert this position. Nevertheless, it is wise to consult with a legal expert to understand the nuances of liability in specific situations.

Section 4.102 of the Texas Family Code addresses the clarification of responsibilities regarding marital property and debts. This section helps outline the legal obligations of each spouse, particularly in regards to debts incurred before marriage. Utilizing the Texas Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse alongside this code can provide additional protection for your financial interests.

Generally, you are not responsible for your husband's debt in Texas, especially if it was incurred before your marriage. The Texas Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse provides a formal method to affirm that you do not assume those debts. However, ensure you understand the specific circumstances surrounding any debt to avoid unexpected liabilities.