Texas Contract for Sale of Goods on Consignment

Description

How to fill out Contract For Sale Of Goods On Consignment?

Are you currently in a situation where you need documents for professional or personal purposes frequently.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of document templates, including the Texas Contract for Sale of Goods on Consignment, which are designed to comply with federal and state regulations.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete your order using PayPal or a Visa or Mastercard.

Select a suitable document format, and download your copy. Access all the document templates you have purchased in the My documents section. You can download an additional copy of the Texas Contract for Sale of Goods on Consignment anytime, if needed. Simply follow the required steps to obtain or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Texas Contract for Sale of Goods on Consignment template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you require and ensure it is for the correct jurisdiction/state.

- Use the Review feature to examine the document.

- Check the description to confirm you have picked the correct form.

- If the document is not what you are looking for, utilize the Search field to find the form that meets your requirements.

- Once you locate the appropriate form, click Get now.

Form popularity

FAQ

Yes, a Texas Realtors lease agreement can be utilized by any party engaging in rental transactions, provided it meets their specific needs. This document outlines terms for both the tenant and landlord, ensuring clarity in the rental process. Whether you're a landlord seeking tenants or a tenant searching for a lease, using a Texas Contract for Sale of Goods on Consignment can be beneficial for consigning personal property in rental situations. Always review the lease terms to ensure they align with your requirements.

To file a memorandum of contract in Texas, start by preparing the document, detailing parties involved and the terms of the Texas Contract for Sale of Goods on Consignment. Once the memorandum is signed, it needs to be filed with the appropriate county clerk’s office. This step provides public notice of the contract, protecting both parties' interests. For assistance, consider using US Legal Forms for templates and guidance.

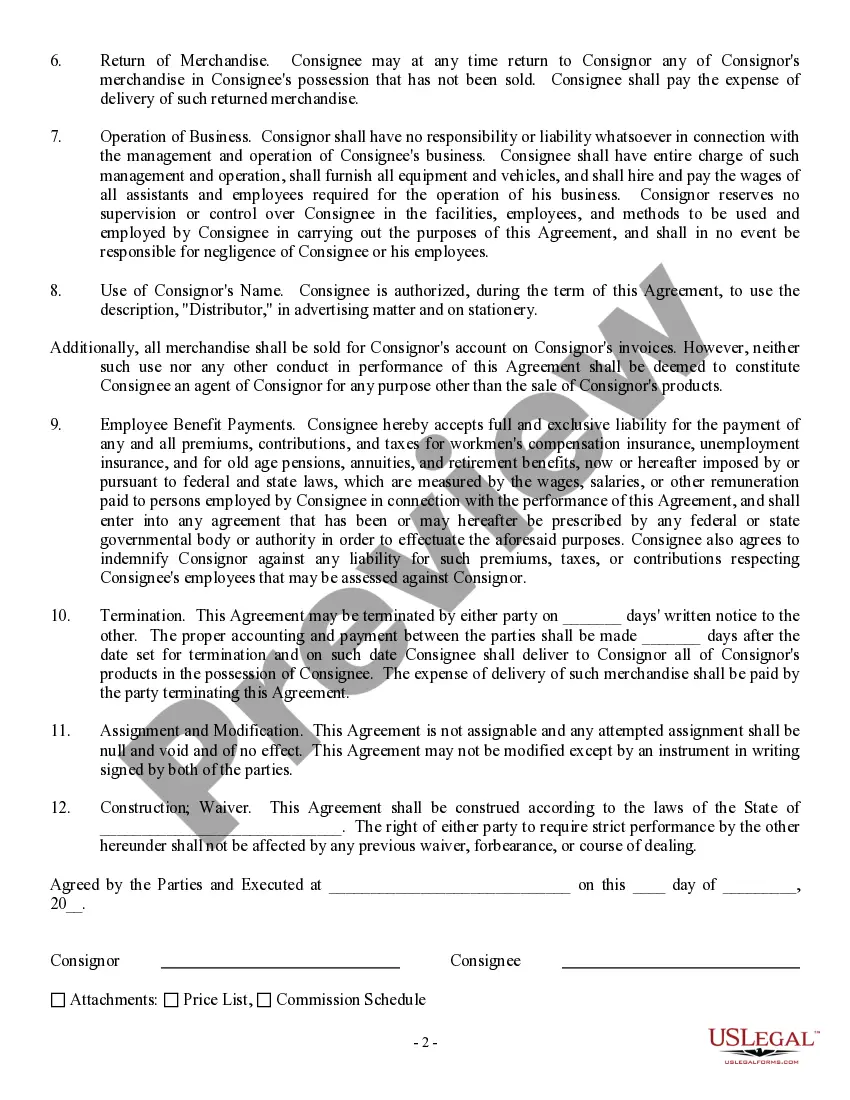

To terminate a consignment agreement, refer to the terms outlined in your Texas Contract for Sale of Goods on Consignment. Most agreements specify conditions for termination, such as providing written notice within a set timeframe. It is crucial to ensure that all remaining inventory is accounted for and returned to the seller. Clear communication with your consignee will facilitate a smooth conclusion to the partnership.

Yes, consignment sales are subject to IRS reporting. Both the seller and the consignee need to declare their earnings from the Texas Contract for Sale of Goods on Consignment. It's essential to keep accurate records of sales and commissions, as these figures will be necessary for tax filings. Consulting a tax professional can provide clarity on compliance and reporting requirements.

A Texas Contract for Sale of Goods on Consignment typically involves a seller providing goods to a consignee, who then sells the goods on behalf of the seller. The seller retains ownership until the goods are sold, minimizing risk for both parties. Once sold, the consignee deducts their commission and remits the remaining funds to the seller. This arrangement allows sellers to reach a wider market without upfront costs.

Yes, consignment sales must be reported to the IRS, as you are generating income from these sales. It's essential to keep detailed records of your transactions. Consult the Texas Contract for Sale of Goods on Consignment to ensure compliance with tax regulations and avoid potential issues.

Goods sold on consignment refers to items that are provided to a seller who sells them on behalf of the owner. The seller only pays for the goods after they have been sold, offering a safer method for both parties. Understanding this concept is crucial for leveraging the Texas Contract for Sale of Goods on Consignment effectively.

There are risks associated with selling on consignment, such as potential costs related to unsold inventory. Additionally, if you do not have a solid understanding of your Texas Contract for Sale of Goods on Consignment, it may lead to misunderstandings. However, with the right planning and guidance, these challenges can be managed.

Yes, goods sold on consignment can often be returned, depending on the terms outlined in the agreement. This flexibility can make consignment appealing, as it reduces risk for sellers. Always refer to your Texas Contract for Sale of Goods on Consignment to confirm the return policies.

Writing a consignment agreement involves outlining the terms and conditions clearly. Include details such as payment terms, duration of the agreement, and responsibilities of both parties. Using a Texas Contract for Sale of Goods on Consignment template can streamline this process, ensuring you cover all critical elements.