Texas Acknowledgment by Debtor of Correctness of Account Stated

Description

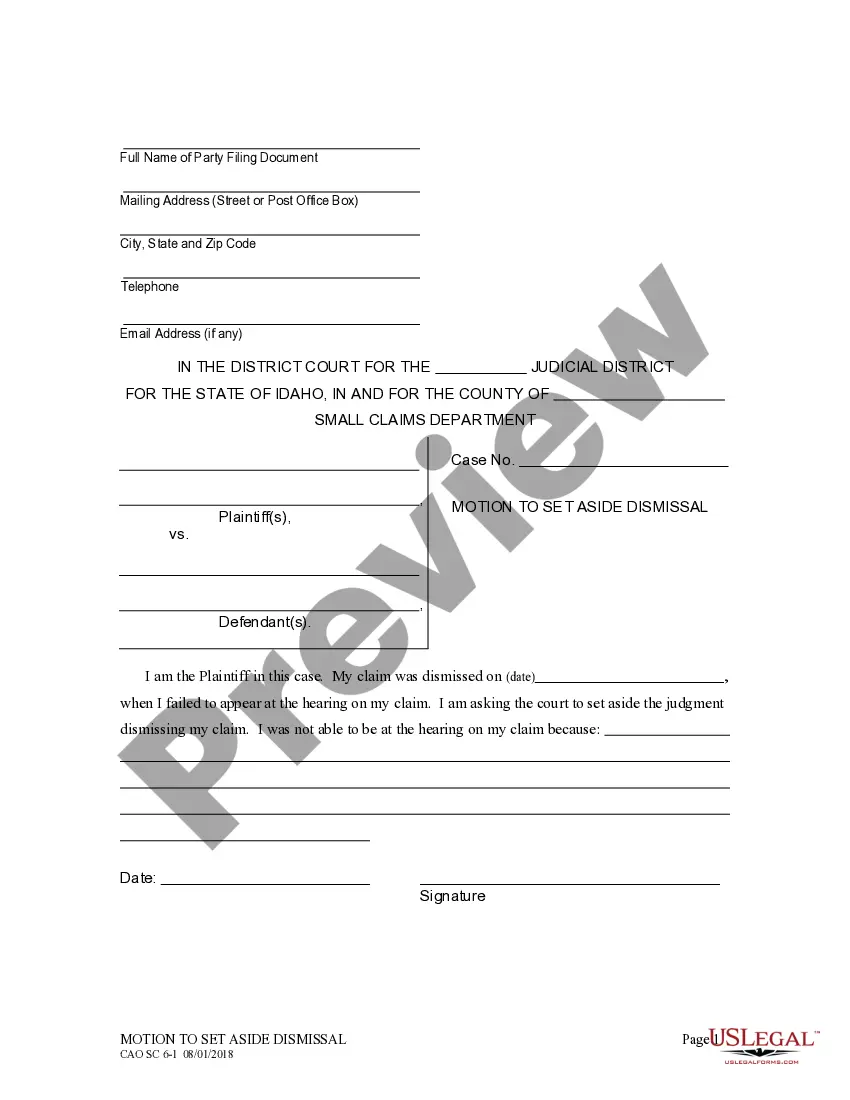

How to fill out Acknowledgment By Debtor Of Correctness Of Account Stated?

Are you presently inside a situation that you will need documents for sometimes business or personal purposes just about every day time? There are a variety of legal papers layouts available on the Internet, but discovering ones you can rely isn`t straightforward. US Legal Forms provides a large number of kind layouts, just like the Texas Acknowledgment by Debtor of Correctness of Account Stated, which are published to meet state and federal specifications.

When you are already acquainted with US Legal Forms internet site and get your account, merely log in. Afterward, you may acquire the Texas Acknowledgment by Debtor of Correctness of Account Stated template.

If you do not have an accounts and would like to begin using US Legal Forms, follow these steps:

- Get the kind you will need and ensure it is for the appropriate town/area.

- Make use of the Preview key to analyze the form.

- See the description to ensure that you have chosen the appropriate kind.

- If the kind isn`t what you are seeking, use the Look for discipline to discover the kind that fits your needs and specifications.

- Whenever you find the appropriate kind, just click Acquire now.

- Choose the prices strategy you would like, submit the desired information and facts to create your money, and pay money for your order utilizing your PayPal or charge card.

- Select a convenient file structure and acquire your version.

Discover each of the papers layouts you may have bought in the My Forms food list. You can aquire a additional version of Texas Acknowledgment by Debtor of Correctness of Account Stated anytime, if required. Just go through the needed kind to acquire or printing the papers template.

Use US Legal Forms, by far the most considerable variety of legal varieties, to save lots of efforts and stay away from blunders. The service provides expertly manufactured legal papers layouts which can be used for a variety of purposes. Produce your account on US Legal Forms and commence producing your daily life easier.

Form popularity

FAQ

In many lawsuits there are several causes of action stated separately, such as fraud, breach of contract, and debt, or negligence and intentional destruction of property.

An Account Stated establishes an implied contract, whereas a breach of contract traditionally refers to an expressly written contract. Account Stated is used when no contract exists or when the plaintiff cannot prove the existence of the contract.

Summary This Acknowledgement of Debt can be used where a debt is owed by two or more persons or legal entities, who are jointly liable for the same debt to the creditor. An Acknowledgement of Debt is a form of payment undertaking, used to acknowledge and confirm that a debt is due, and to specify the payment date.

Collections actions involving the sale of goods often include two varieties of ?account? claims in addition to traditional breach of contract theories: ?account stated? and ?open account.? Generally, an account stated claim alleges the failure to pay an agreed-upon balance, while an open account claim alleges an ...

Account stated refers to a document summarizing the amount a debtor owes a creditor. An account stated is also a cause of action in many states that allows a creditor to sue for payment.

What are the requirements of an AOD? In addition to a clear and undeniable admission of liability (?IOU?), the agreement should contain the payment terms, a breach clause, and the signatures of both the creditor and the debtor.

The elements of account stated are: (1) prior transactions between the parties which establish a debtor-creditor relationship; (2)an express or implied agreement between the parties as to the amount due; and (3) an express or implied promise from the debtor to pay the amount due.