Texas Revocable or Irrevocable Proxy

Description

How to fill out Revocable Or Irrevocable Proxy?

You might spend countless hours online attempting to locate the legal document template that fulfills the state and federal regulations you require.

US Legal Forms provides thousands of legal forms that have been evaluated by experts.

You can obtain or create the Texas Revocable or Irrevocable Proxy using their service.

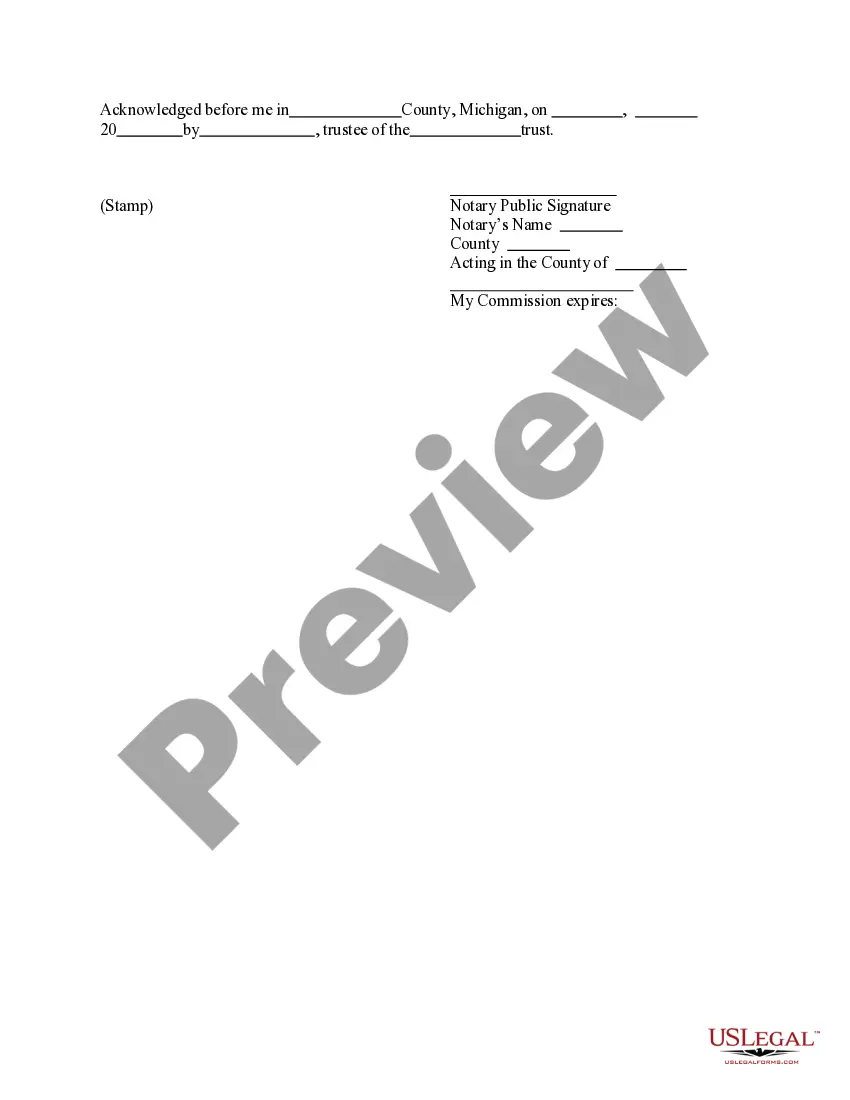

If available, utilize the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Acquire button.

- Following that, you can complete, edit, print, or sign the Texas Revocable or Irrevocable Proxy.

- Every legal document template you purchase belongs to you indefinitely.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your preferred state/city.

- Review the form description to confirm that you have chosen the right form.

Form popularity

FAQ

One major drawback of an irrevocable trust is that once established, it cannot be modified or revoked without the consent of all beneficiaries. This lack of flexibility can be challenging if your circumstances change, such as needing access to trust assets for unforeseen expenses. Additionally, transferring assets into an irrevocable trust generally means you will lose control over them, which makes careful planning essential. If you need assistance navigating these complexities, US Legal Forms offers valuable resources.

You should consider an irrevocable trust for protecting your assets from creditors, offering estate tax benefits, and ensuring that your assets are distributed according to your wishes after your passing. These trusts provide legal certainty where Texas Revocable or Irrevocable Proxy is concerned, granting peace of mind to you and your beneficiaries. By keeping control over your assets, you can create a solid financial strategy.

Creating an irrevocable trust in Texas involves several steps. First, you need to choose a trustee who will manage the trust. Next, you will draft a trust document outlining the terms and conditions of the trust, which should include all beneficiaries and the assets to be placed in the trust. Finally, you'll need to fund the trust with assets and ensure that all necessary legal filings are complete, which can be simplified using the US Legal Forms platform.

Yes, a proxy can indeed be irrevocable under certain conditions in Texas. An irrevocable proxy binds the proxy holder, meaning they cannot be changed or revoked by the original shareholder without mutual consent. This can be particularly useful when a shareholder wants to ensure their voting preferences are upheld, thereby reinforcing the importance of understanding the Texas Revocable or Irrevocable Proxy options. For comprehensive insights and forms to create a robust proxy arrangement, you can rely on the extensive resources provided by USLegalForms.

An irrevocable proxy is a legal document that allows someone to vote on your behalf, and it cannot be changed or revoked at will. This type of proxy often comes into play in corporate governance, where long-term commitments are common. If you find yourself needing help in creating or managing this type of agreement, platforms like uslegalforms offer solutions tailored to help you navigate Texas revocable or irrevocable proxies.

Not all proxies are revocable, but in general, a Texas revocable proxy can be revoked at any time before it is exercised. A revocable proxy lets you maintain control over who votes on your behalf, adapting as your situation changes. On the other hand, if you choose an irrevocable proxy, you give up that flexibility, which you should weigh carefully.

Generally, irrevocable proxies cannot be revoked easily once they are established. However, there may be specific circumstances that allow for revocation, such as changes in ownership or legal conditions. It’s important to consult with a legal expert familiar with Texas revocable or irrevocable proxies to explore your options.

Yes, a proxy can be viewed as a form of power of attorney, as it allows you to designate someone to act on your behalf. However, the primary function of a proxy is to allow someone to vote in your stead, particularly in corporate or shareholder settings. If you want to manage more legal or medical decisions, a more comprehensive power of attorney might be more appropriate than a simple Texas revocable or irrevocable proxy.

An irrevocable proxy is a type of proxy where you grant another person the authority to vote on your behalf, and this authority cannot be easily revoked. This means once you give someone this power, they hold onto it until a specific event occurs or until a court intervenes. Understanding the nuances of Texas revocable or irrevocable proxies can help you decide the best option for your situation.

An irrevocable proxy grants authority to another individual and cannot be undone without explicit consent. For instance, a shareholder may give an irrevocable proxy to another person to vote on their behalf during a meeting. Understanding the implications of a Texas Revocable or Irrevocable Proxy helps individuals make informed decisions about their rights and responsibilities in such arrangements.