Texas Agreement to Manage Farm

Description

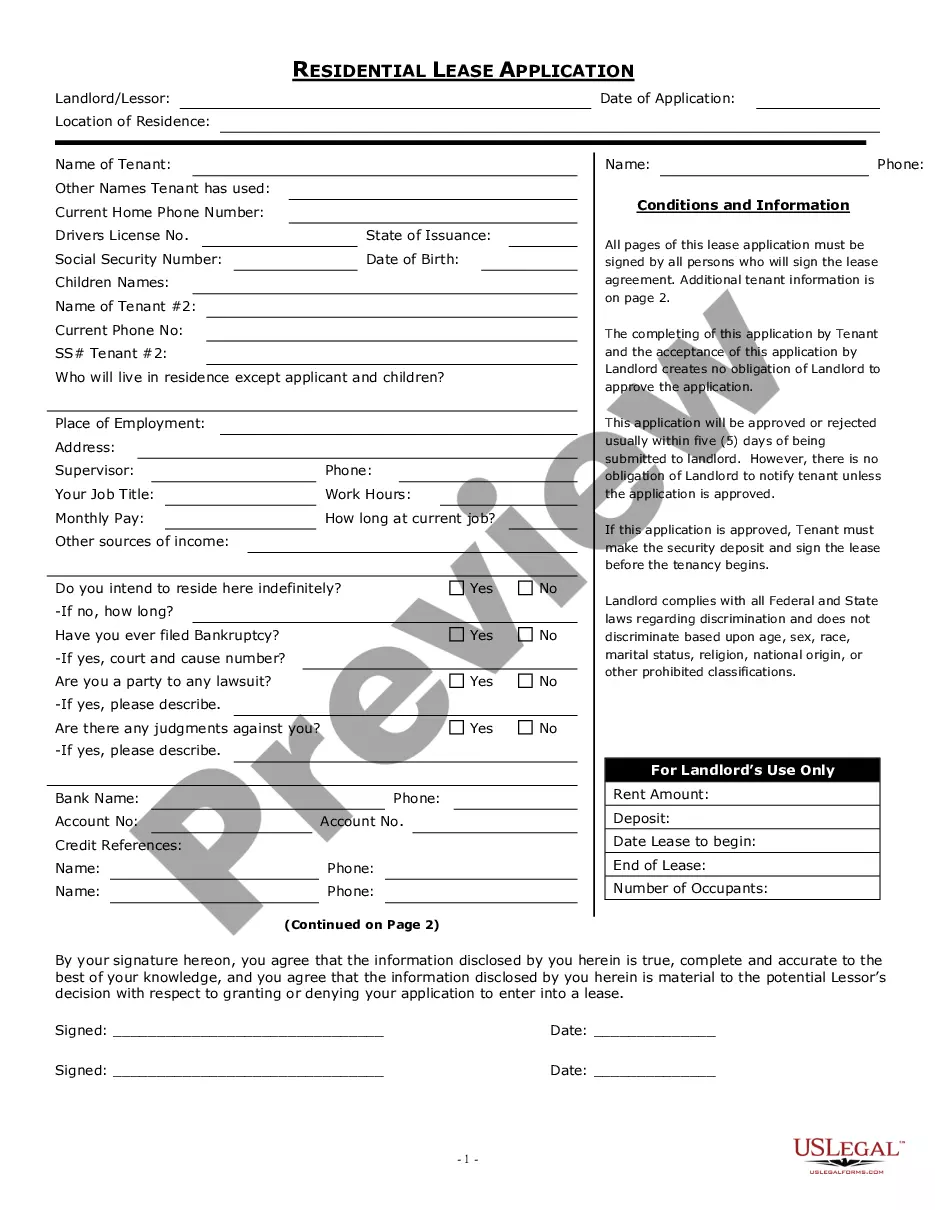

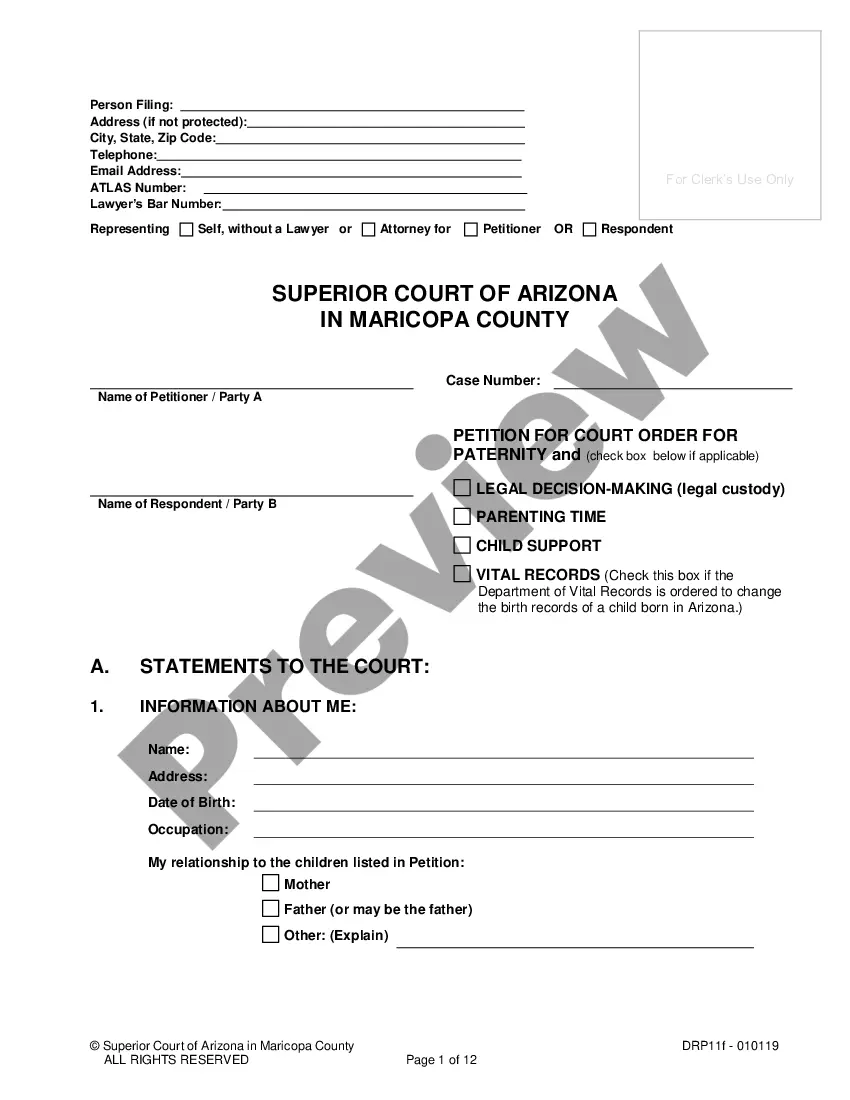

How to fill out Agreement To Manage Farm?

If you wish to total, obtain, or print out legal document templates, utilize US Legal Forms, the largest collection of legal forms, available on the internet.

Take advantage of the site's straightforward and convenient search to locate the documents you require.

Various templates for commercial and personal purposes are categorized by types and states, or keywords and phrases.

Step 4. Once you have found the form you need, select the Get now button. Choose the payment plan you prefer and enter your credentials to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to find the Texas Agreement to Manage Farm in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Texas Agreement to Manage Farm.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your appropriate location.

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

While you are not required to use a Texas Real Estate Commission (TREC) contract in Texas, it is highly recommended for standard real estate transactions due to its comprehensive framework and legally binding nature. TREC contracts are designed to protect the interests of all parties involved. For agricultural properties, leveraging something like the Texas Agreement to Manage Farm can provide additional clarity and specificity that aligns with your farming needs.

In Texas, the state does not specify a set number of acres to qualify as a farm for tax purposes. Instead, the focus is on the land's use for agriculture and whether it meets certain agricultural productivity criteria. If you aim to claim tax benefits, having the Texas Agreement to Manage Farm can clearly outline the agricultural use of your property and support your case with local tax authorities.

A farm and ranch contract should be used in Texas when you are buying or selling property that is primarily intended for agricultural or ranching activities. This type of contract is tailored to include specific terms that deal with the nuances of farming operations. By utilizing the Texas Agreement to Manage Farm within this context, you can ensure all parties have a clear understanding of their responsibilities related to the management of the property.

Yes, anyone can use a Texas Realtors lease agreement as long as it meets the requirements of the transaction. However, it is advisable for both landlords and tenants to ensure that it aligns with their specific needs and legal obligations. If you are leasing property for agricultural purposes, you might want to consider integrating terms from the Texas Agreement to Manage Farm to address unique farming issues.

The effective date of a real estate contract in Texas is usually the date when both parties have signed the agreement. This date is significant as it marks the beginning of the timeline for any contingencies or obligations outlined in the contract. Understanding this date can be vital, especially when using agreements like the Texas Agreement to Manage Farm, as it sets the stage for future actions regarding the property.

To obtain a farm exemption in Texas, you must meet certain agricultural use criteria, including proving that the land is actively used for farming or ranching. This typically involves submitting an application along with any necessary supporting documentation to your local appraisal district. Utilizing the Texas Agreement to Manage Farm can help you outline how you use the property for agricultural purposes, supporting your exemption application.

You should use an unimproved property contract in Texas when purchasing raw land without any existing structures or improvements. This type of contract addresses unique aspects related to undeveloped land, ensuring all parties are clear on expectations. When integrated with a Texas Agreement to Manage Farm, you can efficiently manage the nuances associated with such transactions.

Yes, it is advisable to have insurance on vacant land in Texas. While the land may not currently be developed, unexpected events can still occur, leading to financial liabilities. Choosing the right insurance coverage aligns with your objectives, whether utilizing a Texas Agreement to Manage Farm or for personal investment purposes.

To maintain an agricultural exemption in Texas, you need to actively use the land for farming or ranching purposes. This involves adhering to specific state requirements, such as producing income from agricultural activities. Utilizing a Texas Agreement to Manage Farm can help you document your activities and support your case for retaining the exemption.

You should use a farm and ranch contract in Texas when buying or selling agricultural property. This type of contract details specific terms related to the use of the land, ensuring that both parties understand their rights and responsibilities. Incorporating a Texas Agreement to Manage Farm enhances clarity, making it easier to navigate the complexities of farm transactions.