Texas Leaseback Provision in Sales Agreement

Description

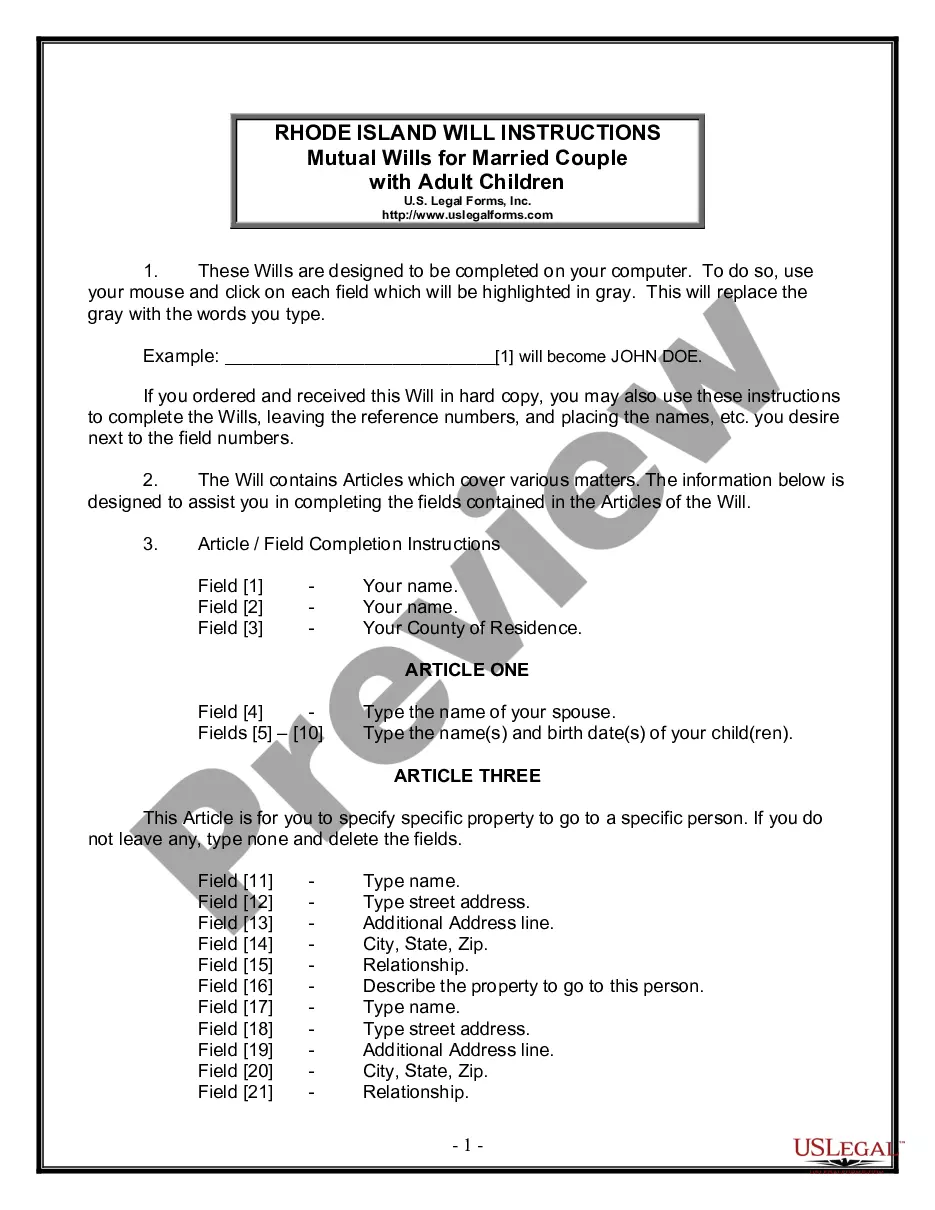

How to fill out Leaseback Provision In Sales Agreement?

It is feasible to invest time online striving to discover the sanctioned document template that meets the local and national requirements you desire.

US Legal Forms offers a vast collection of legal forms that have been assessed by professionals.

You can obtain or print the Texas Leaseback Provision in Sales Agreement from their services.

If you wish to locate another variation of the form, use the Search field to find the template that suits you and your needs.

- If you already possess a US Legal Forms account, you can sign in and then click the Download button.

- After that, you can complete, modify, print, or sign the Texas Leaseback Provision in Sales Agreement.

- Every legal document template you purchase is yours indefinitely.

- To acquire another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are accessing the US Legal Forms site for the first time, follow these straightforward instructions below.

- First, ensure you have selected the correct document template for the county/city of your preference.

- Review the form description to make sure you have chosen the right template.

Form popularity

FAQ

A sale and leaseback transaction occurs when a property owner sells an asset, such as commercial real estate, and simultaneously leases it back from the new owner. For instance, consider a company that owns its office building and sells it to an investor. After the sale, the company enters into a Texas Leaseback Provision in Sales Agreement, allowing it to continue operating in the same location while freeing up capital for other investments. This arrangement offers flexibility and liquidity, making it an attractive option for many business owners.

In Texas, while it is not mandatory to involve a lawyer for creating a leaseback provision in a sales agreement, it's strongly advised. Legal jargon can be complex, and having a professional ensures that the language aligns with your intentions and protects your interests. Using the Texas Leaseback Provision in your sales agreement can simplify the sale process while providing security to both parties, but it is wise to seek legal guidance for clarity and compliance. Platforms like US Legal Forms offer templates and resources to help you draft provisions accurately.

In Texas, a leaseback operates under the terms established in the Texas Leaseback Provision in Sales Agreement. After selling the property, the seller becomes a tenant and maintains usage rights while the buyer becomes the landlord. It's essential to ensure both parties are aligned on the terms to make this arrangement beneficial and straightforward.

A leaseback involves selling a property and then leasing it back from the buyer, facilitating immediate capital access. In the context of the Texas Leaseback Provision in Sales Agreement, this process allows sellers to retain occupancy of the property while relieving them of ownership responsibilities. This arrangement can benefit both parties, providing sellers with liquidity and buyers with a tenant.

In Texas, the duration of a leaseback can vary based on the terms outlined in the Texas Leaseback Provision in Sales Agreement. Typically, leasebacks last from a few months to several years, depending on the agreement between the buyer and seller. It's crucial to communicate and set clear expectations regarding the leaseback duration to ensure smooth transitions.

Leasebacks carry risks such as potential market fluctuations affecting lease costs and changes in the financial condition of either party. There is also the risk of the leaseback agreement not meeting business needs over time. By leveraging the Texas Leaseback Provision in Sales Agreement, businesses can mitigate some of these risks with careful planning.

Leasing often leads to continuous payments without ownership, which may not provide long-term financial benefits. Additionally, lease agreements might restrict how you can use the asset, limiting your operational flexibility. Understanding the Texas Leaseback Provision in Sales Agreement can illuminate ways to mitigate these drawbacks.

The leaseback condition is a stipulation within a sale and leaseback agreement that defines the terms under which the seller can lease the asset back after the sale. This condition outlines rental payments, duration, and maintenance responsibilities. Familiarity with the Texas Leaseback Provision in Sales Agreement will enable you to structure these terms to meet your business needs.

The leasehold system can limit your control over the property, as the lease terms dictate usage rights. Additionally, renewal negotiations may lead to unexpected costs or unfavorable terms. Recognizing the implications of the Texas Leaseback Provision in Sales Agreement can help you better navigate these challenges.

An SRA leaseback in Texas refers to a Sale and Return Agreement (SRA) where the seller leases the property back from the buyer after the sale. This arrangement allows businesses to access capital while retaining the use of their assets. Understanding the Texas Leaseback Provision in Sales Agreement can help parties navigate this type of transaction effectively.