Texas Agreement for Donation of Land to City

Description

How to fill out Agreement For Donation Of Land To City?

Selecting the appropriate valid document format can be a challenge.

Certainly, there are numerous templates accessible online, but how can you acquire the valid template you need.

Utilize the US Legal Forms platform. This service offers thousands of templates, such as the Texas Agreement for Donation of Land to City, that can be utilized for business and personal purposes.

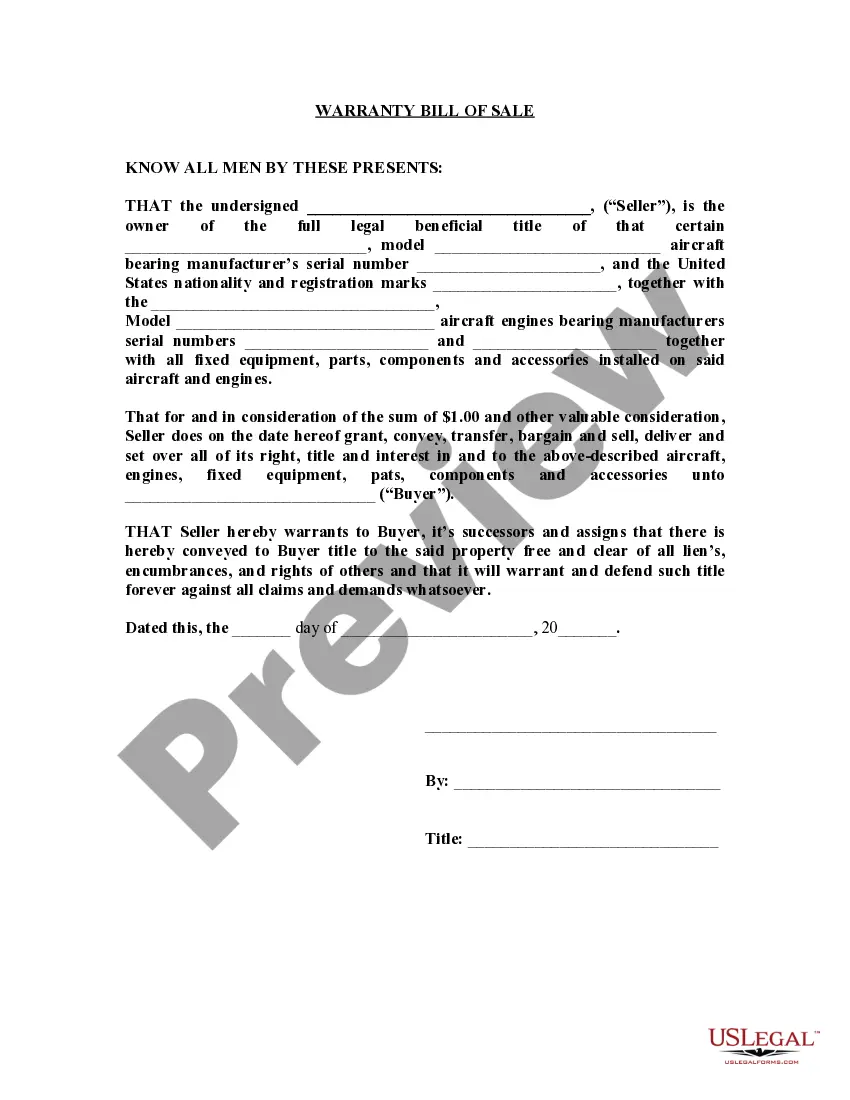

You can view the document using the Review button and read the document description to confirm it is the right one for you.

- All of the forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Obtain button to access the Texas Agreement for Donation of Land to City.

- You can use your account to review the legal forms you have previously purchased.

- Navigate to the My documents section in your account and download an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct document for your city/region.

Form popularity

FAQ

Section A. Donated Property of $5,000 or Less and Publicly Traded SecuritiesList in this section only an item (or a group of similar items) for which you claimed a deduction of $5,000 or less. Also list publicly traded securities and certain other property even if the deduction is more than $5,000.

A Deed of Donation transfers property from the owner (the donor) to another person (the donee) by way of donation. The Deed of Donation is usually executed for the love, gratuity and affection the donor has for the donee (e.g. from a parent to a child).

Purpose of Form. Donee organizations use Form 8282 to report information to the IRS and donors about dispositions of certain charitable deduction property made within 3 years after the donor contributed the property.

Form 8283 is filed by individuals, partnerships, and corporations. C corporations. C corporations, other than personal service corporations and closely held corporations, must file Form 8283 only if the amount claimed as a deduction is more than $5,000 per item or group of similar items.

Your basis for figuring a loss is the FMV of the property at the time the donor made the gift, plus or minus any required adjustments to basis while you held the property.

Donor's tax in the Philippines for donations to strangers is at 30% of the gross amount of taxable donation and the tax is paid every after donation without need of the aggregation as compared to donations to relatives. Taxation is the rule, exemption is the exception applies to donor's tax.

Mandatory Requirements:Notarized Deed of Donation but only photocopied documents shall be retained by BIR; (One (1) original copy and two (2) photocopies) TIN of Donor and Donee/s; One (1) original copy for presentation only) Proof of claimed tax credit, if applicable; (One (1) original copy and two (2) photocopies)

A Deed of Donation is used when you will donate property to another person. Philippine law requires the donation of (a) immovable property (e.g. land, house); and (b) movable property (e.g. jewelry, car) worth more than PHP 5,000.00 to be in writing and notarized in certain cases.

Mandatory Requirements:Notarized Deed of Donation but only photocopied documents shall be retained by BIR; (One (1) original copy and two (2) photocopies)TIN of Donor and Donee/s; One (1) original copy for presentation only)Proof of claimed tax credit, if applicable; (One (1) original copy and two (2) photocopies)More items...

Formal Requirements in Donating Real Property in the PhilippinesIt must be made in a public instrument.Specify in the deed of donation the description of the property to be donated.Specify in the deed of donation the value of charges which the donee must satisfy, if any.More items...?