This form is an Application for Release of Right to Redeem Property from IRS After Foreclosure. Check for compliance with your specific facts and circumstances.

Texas Application for Release of Right to Redeem Property from IRS After Foreclosure

Description

How to fill out Application For Release Of Right To Redeem Property From IRS After Foreclosure?

If you wish to finalize, download, or create legitimate document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search to find the documents you need.

Various templates for commercial and personal applications are organized by categories and states, or keywords. Access US Legal Forms to obtain the Texas Application for Release of Right to Redeem Property from IRS After Foreclosure in just a few clicks.

Every legal document format you purchase is your property indefinitely. You have access to every form you saved in your account. Click the My documents section and select a form to print or download again.

Complete and download, and print the Texas Application for Release of Right to Redeem Property from IRS After Foreclosure with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and select the Download option to retrieve the Texas Application for Release of Right to Redeem Property from IRS After Foreclosure.

- You can also access forms you have previously saved from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/region.

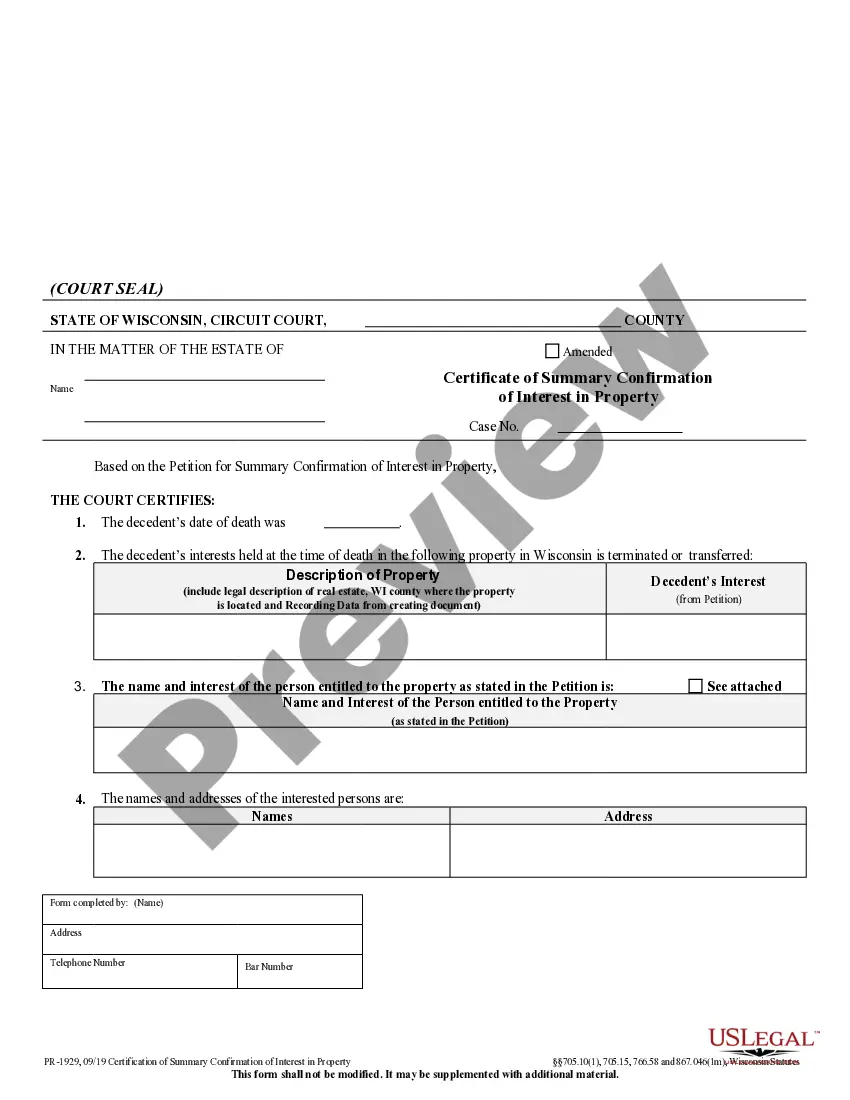

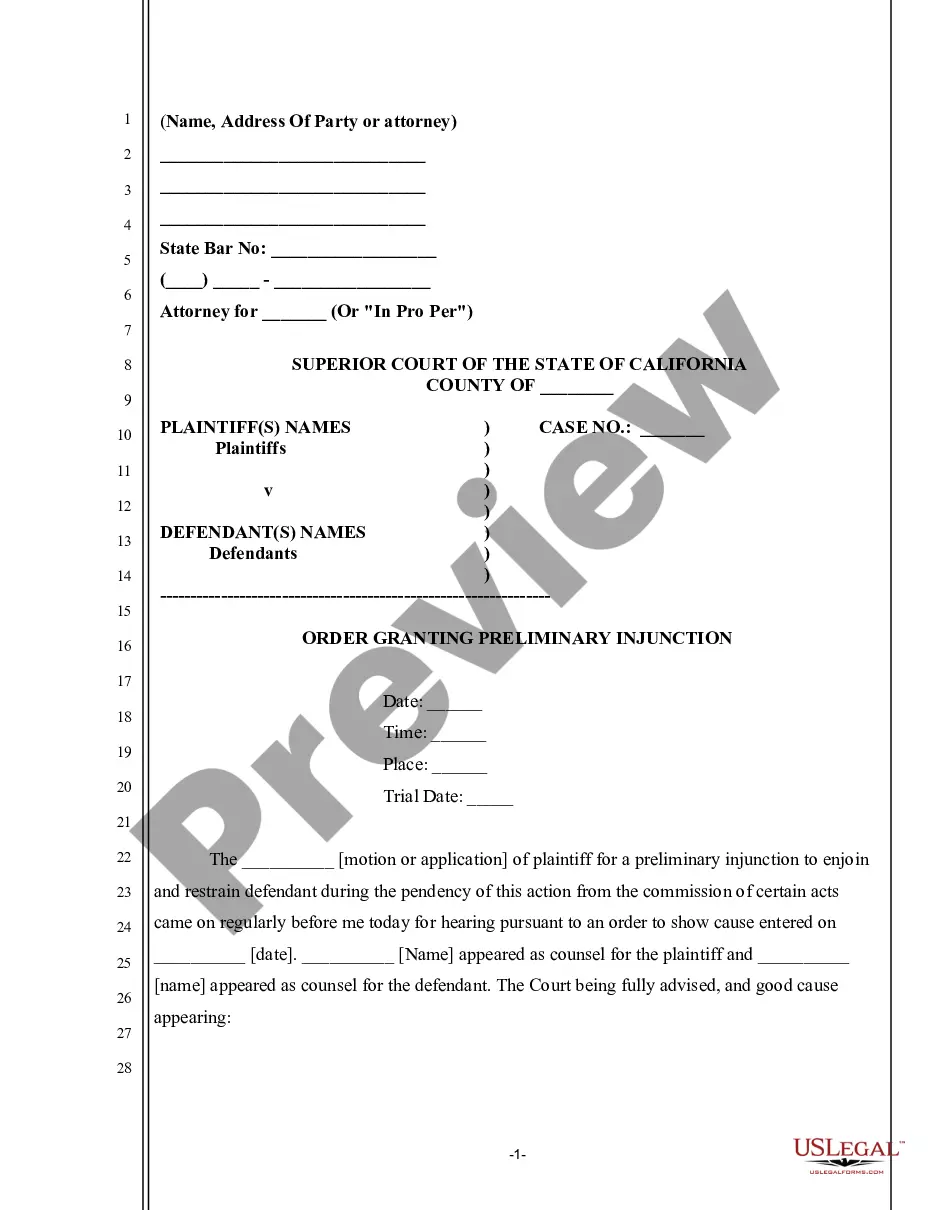

- Step 2. Use the Preview feature to review the form's details. Remember to read the information.

- Step 3. If you are not satisfied with the form, utilize the Search section at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Purchase now option. Choose the payment plan you prefer and provide your information to register for an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to process the payment.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Texas Application for Release of Right to Redeem Property from IRS After Foreclosure.

Form popularity

FAQ

The IRS right to redeem in foreclosure allows the IRS to reclaim a property sold due to unpaid federal taxes. This right lasts for 120 days following the sale, giving the IRS time to secure the owed amount. If you find yourself dealing with this situation, it may be beneficial to explore the Texas Application for Release of Right to Redeem Property from IRS After Foreclosure to understand your options and rights in this complex process.

Yes, you can sell your house during the redemption period in Texas, but it can be complex. Potential buyers may hesitate due to the ongoing foreclosure process, which can complicate the transaction. If you are in this situation, consider using a Texas Application for Release of Right to Redeem Property from IRS After Foreclosure to clarify your rights, making it easier to communicate with potential buyers.

The right to redeem property after foreclosure allows you to reclaim your home by settling the outstanding debt within a specific timeframe. This right is a protective measure for homeowners, offering a second chance after a foreclosure sale. Utilizing a Texas Application for Release of Right to Redeem Property from IRS After Foreclosure can simplify the redemption process and ensure you meet necessary requirements.

In Texas, the right of redemption gives you the opportunity to buy back your property after it has been foreclosed. This right is crucial for homeowners as it provides a chance to recover their home by paying the amount owed, plus any additional fees. To initiate this process, consider submitting a Texas Application for Release of Right to Redeem Property from IRS After Foreclosure. This application streamlines your path to reclaiming your property.

If your real estate was seized and sold, you have redemption rights. You or anyone with an interest in the property may redeem your real estate within 180 days after the sale. This includes: your heirs, executors, administrators.

If the IRS tax lien is junior to the mortgage being foreclosed, the IRS tax lien will be foreclosed through the judicial sale and the lien on the property will be extinguished after the judicial deed is issued.

After a property is sold at a sheriff's sale (foreclosure sale), there is a period of time referred to as the ?redemption period? during which you still have some rights. For most properties it is a six month period.

If a taxpayer does not make payments owed on a loan secured by property, the lender may foreclose on the loan or repossess the property. The foreclosure or repossession is treated as a sale from which the taxpayer may realize gain or loss.

Equity of redemption (also termed right of redemption or equitable right of redemption) is a defaulting mortgagor's right to prevent foreclosure proceedings on the property and redeem the mortgaged property by discharging the debt secured by the mortgage within a reasonable amount of time (thereby curing the default).

The right of redemption allows homeowners to keep their homes if they pay back what they owe even after their lender starts the foreclosure process or puts the home up for sale at public auction.