Texas Chapter 13 Plan

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Texas Chapter 13 Plan?

How much time and resources do you typically spend on composing formal paperwork? There’s a greater way to get such forms than hiring legal specialists or spending hours browsing the web for an appropriate template. US Legal Forms is the premier online library that provides professionally designed and verified state-specific legal documents for any purpose, like the Texas Chapter 13 Plan.

To acquire and complete an appropriate Texas Chapter 13 Plan template, follow these simple steps:

- Look through the form content to ensure it complies with your state laws. To do so, check the form description or use the Preview option.

- In case your legal template doesn’t satisfy your needs, locate another one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Texas Chapter 13 Plan. Otherwise, proceed to the next steps.

- Click Buy now once you find the right document. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is absolutely secure for that.

- Download your Texas Chapter 13 Plan on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously acquired documents that you safely store in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as often as you need.

Save time and effort preparing formal paperwork with US Legal Forms, one of the most trusted web services. Join us now!

Form popularity

FAQ

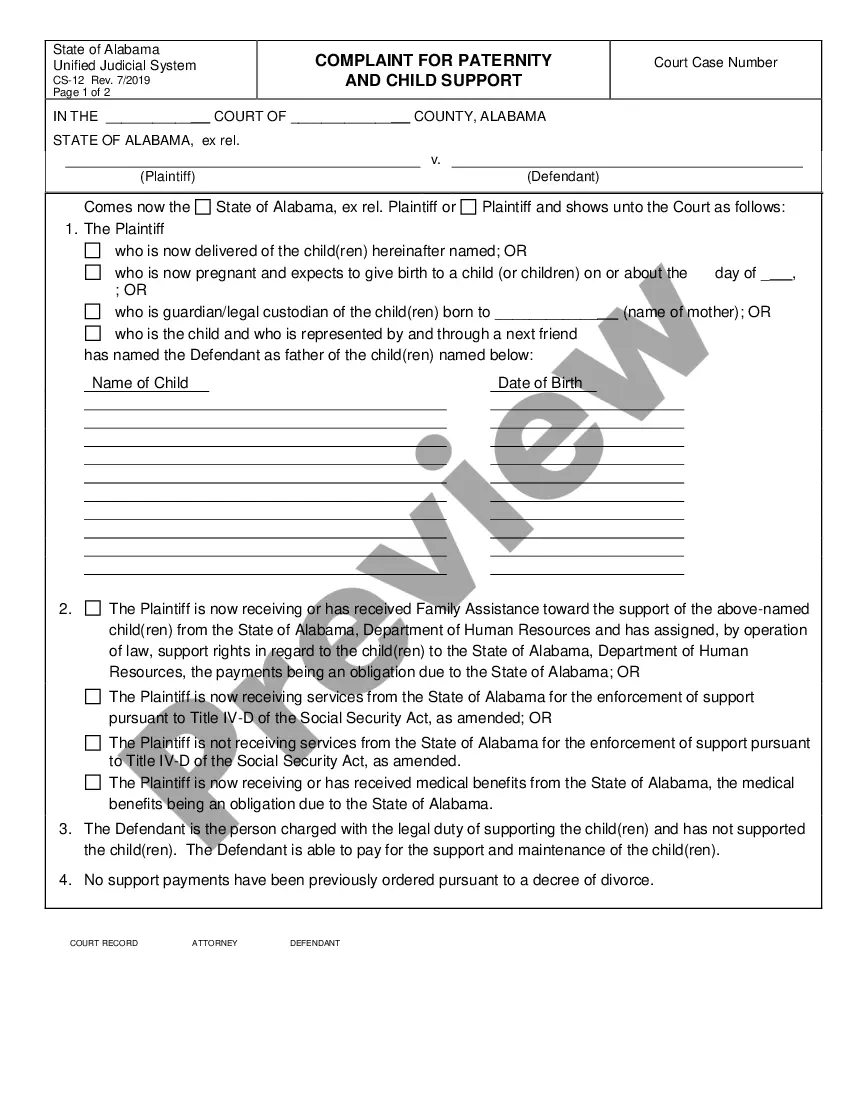

The Chapter 13 Plan must: provide for payments of fixed amounts to the trustee on a regular basis, typically monthly. provide for the full payment of all claims entitled to priority under section 507 such as taxes and child support (unless the holder of a particular claim agrees to different treatment of a claim)

Items that can be exempt include sporting equipment, up to two firearms, family heirlooms, home furnishings, animals, clothing and food, burial plots, health aids, health savings accounts, and jewelry (limited to one-quarter of the exemption).

Also do not not incur debt, use credit, credit cards, or enter into leases while in Chapter 13 without Bankruptcy Court approval, except in the case of an emergency for the protection and preservation of life, health or property. Contact your attorney if you need to sell property or incur debt.

Although a Chapter 13 bankruptcy stays on your record for years, missed debt payments, defaults, repossessions, and lawsuits will also hurt your credit and may be more complicated to explain to a future lender than bankruptcy.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

Who can file for Chapter 13? People above the median income must file under Chapter 13 unless most of their debt is business debt. It is presumed that if someone over-income files Chapter 7, they are abusing the system. For people below the median income, there is no presumption of abuse.