Texas Assumed Name Certificate

Definition and meaning

The Texas Assumed Name Certificate is a legal document that allows a corporation, limited liability company, limited partnership, or other business entities to operate under a name that differs from its official registered name. This form is required by the Texas Business & Commerce Code to inform the public about the name under which a business is conducting its activities.

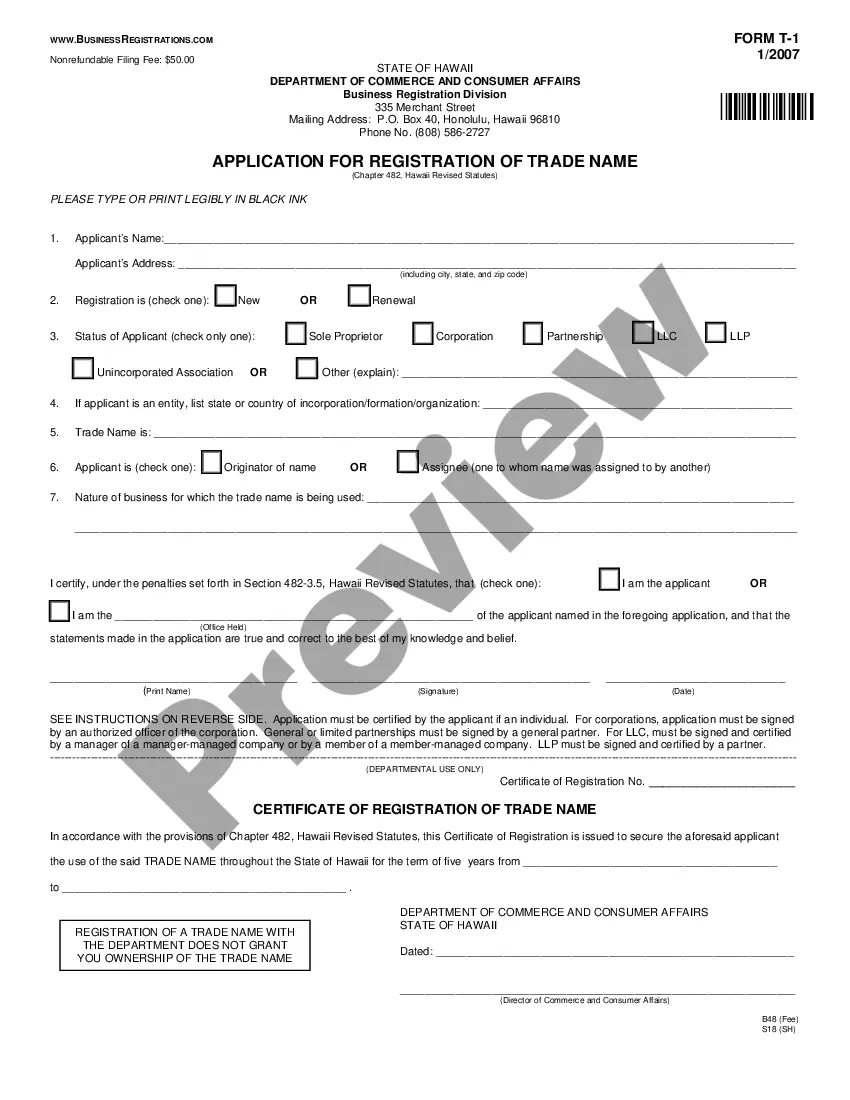

How to complete a form

Filling out the Texas Assumed Name Certificate involves several steps:

- Assumed Name: Enter the assumed name under which the business will operate.

- Entity Information: Provide the legal name of the entity, its type, and jurisdiction. Ensure you include the registered office address.

- Period of Duration: Specify the duration for which the assumed name will be in effect, not to exceed ten years.

- County of Use: Identify the counties where the assumed name will be used.

- Execution: Sign the document, ensuring that it is signed by an authorized individual.

Who should use this form

This form should be utilized by any business entity in Texas that wishes to conduct commercial activities or provide professional services under a name that is not its legal name. This includes corporations, limited liability companies, and partnerships that are seeking to maintain transparency with the public regarding their business practices.

Legal use and context

The Texas Assumed Name Certificate serves to legally document the name under which a business operates and is a requirement for compliance with state regulations. Filing this certificate does not grant exclusive rights to the name; it merely provides public notice of the assumed name usage, ensuring that other entities are aware of the business activities conducted under that name.

Common mistakes to avoid when using this form

When completing the Texas Assumed Name Certificate, be sure to avoid the following errors:

- Incomplete Information: Ensure all required fields are filled accurately to avoid delays.

- Incorrect Assumed Name: Make sure the assumed name complies with the Texas regulations and is not misleading.

- Not Filing on Time: File the form promptly to avoid penalties associated with late filing.

Key components of the form

The Texas Assumed Name Certificate includes several critical components:

- Assumed Name: The name under which the business will operate.

- Entity Identification: The legal name of the entity, type of entity, and other pertinent information.

- Duration: The specified length of time the assumed name is valid.

- County Information: The counties where the name will be utilized.

Form popularity

FAQ

To start the DBA process, you need to file an Assumed Name Certificate with the state of Texas. This is also called Form 503, and you can fill it out online or manually.

The filing fee to register an Assumed Name (DBA) for sole proprietorships and partnerships in Texas varies by county. Usually, the fee is about $15 per county. Corporations & LLCs will pay $25 to register with the Texas Secretary of State. The registration is valid for 10 years and can be renewed.

Insert "doing business as" or the acronym "dba" after the company's legal name followed by the dba. If Mike's Widgets, LLC uses the tradename "Awesome Widgets," then the contract would identify the business as "Mike's Widgets, LLC, an Arizona limited liability company dba Awesome Widgets."

A limited liability company is its own legal entity. Like a corporation or partnership, it receives a tax identification number. Instead of the owner having to do business, complete financial transactions and file paperwork in his or her own name, they can accomplish all those tasks under the LLC.

In other words, the responsibility for paying federal income taxes passes through the LLC itself and falls on the individual LLC members. By default, LLCs themselves do not pay federal income taxes, only their members do. Texas, however, imposes a state franchise tax on most LLCs.

Assumed Name Certificates in Texas An assumed business name is a name for your business that is different than its legal registered name. An assumed business name certificate is the document that serves as proof that your company has the legal right to use a specific name.

It takes 1 - 3 business days (from start to finish) to form a Texas LLC. The LLC formation process starts when a Certificate of Formation is filed with the Texas Secretary of State. The Secretary approves online filings in 1 - 3 business days (5 - 7 business days for fax filings).

How much does it cost to form an LLC in Texas? The Texas Secretary of State charges a $300 filing fee, plus an additional state-mandated 2.7% convenience fee to file an LLC Certificate of Formation.

Assumed Name Certificates in Texas An assumed business name is a name for your business that is different than its legal registered name. An assumed business name certificate is the document that serves as proof that your company has the legal right to use a specific name.