Application for Reinstatement of Limited Liability Partnership Status- Form to be used by a Texas partnership when applying to reinstate its registration as a limited liability partnership following the termination of the registration for failure to file

Description

How to fill out Application For Reinstatement Of Limited Liability Partnership Status- Form To Be Used By A Texas Partnership When Applying To Reinstate Its Registration As A Limited Liability Partnership Following The Termination Of The Registration For Failure To File?

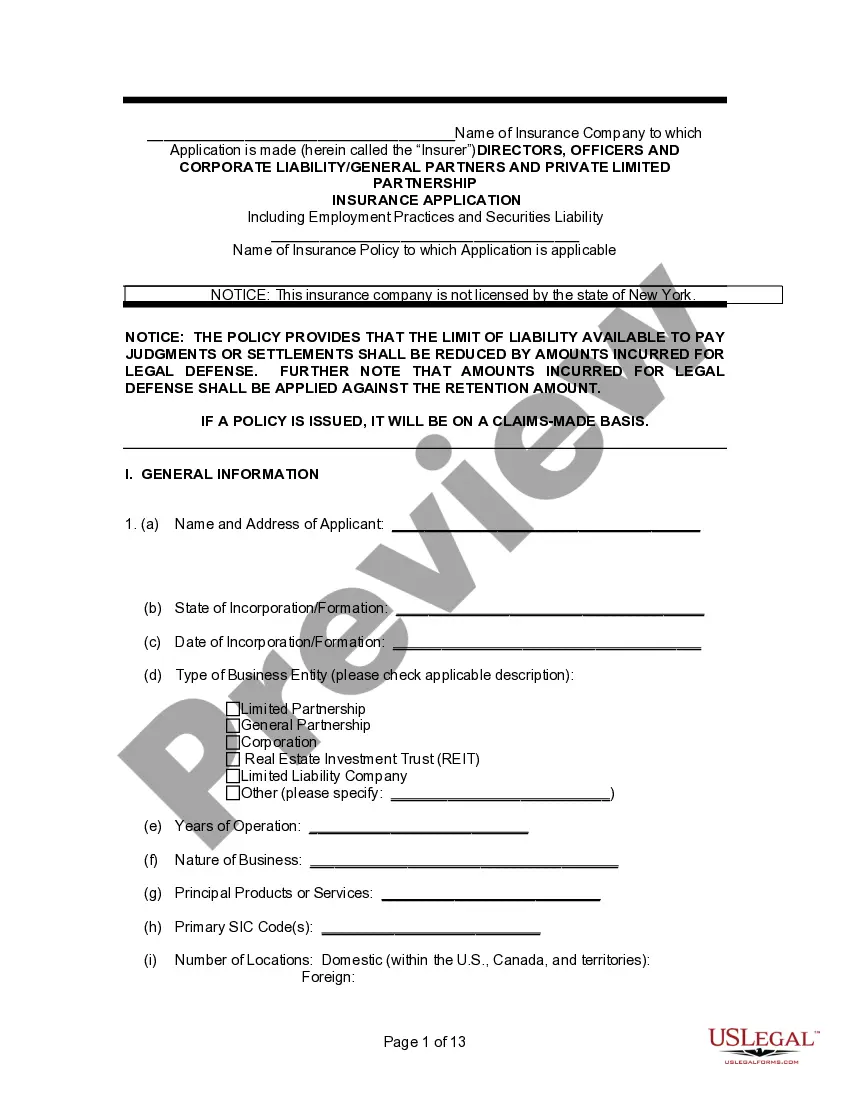

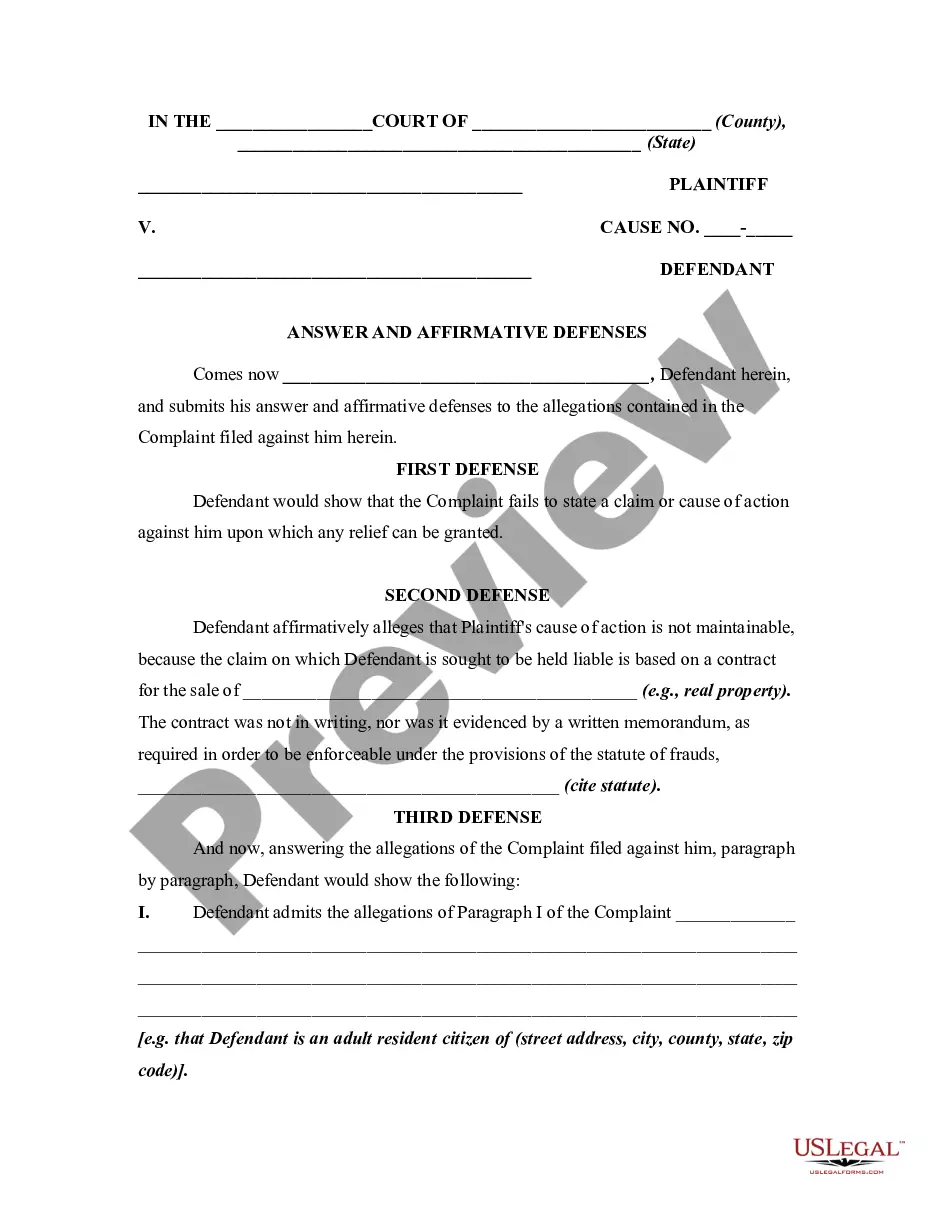

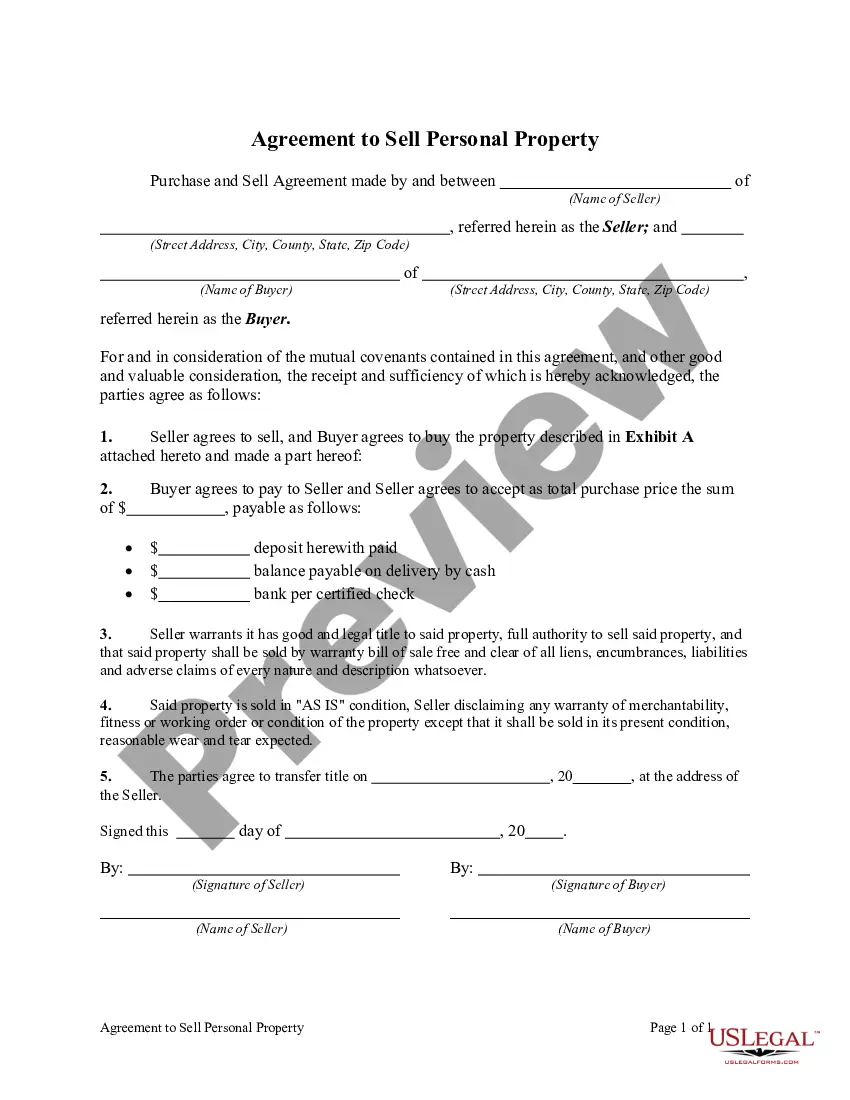

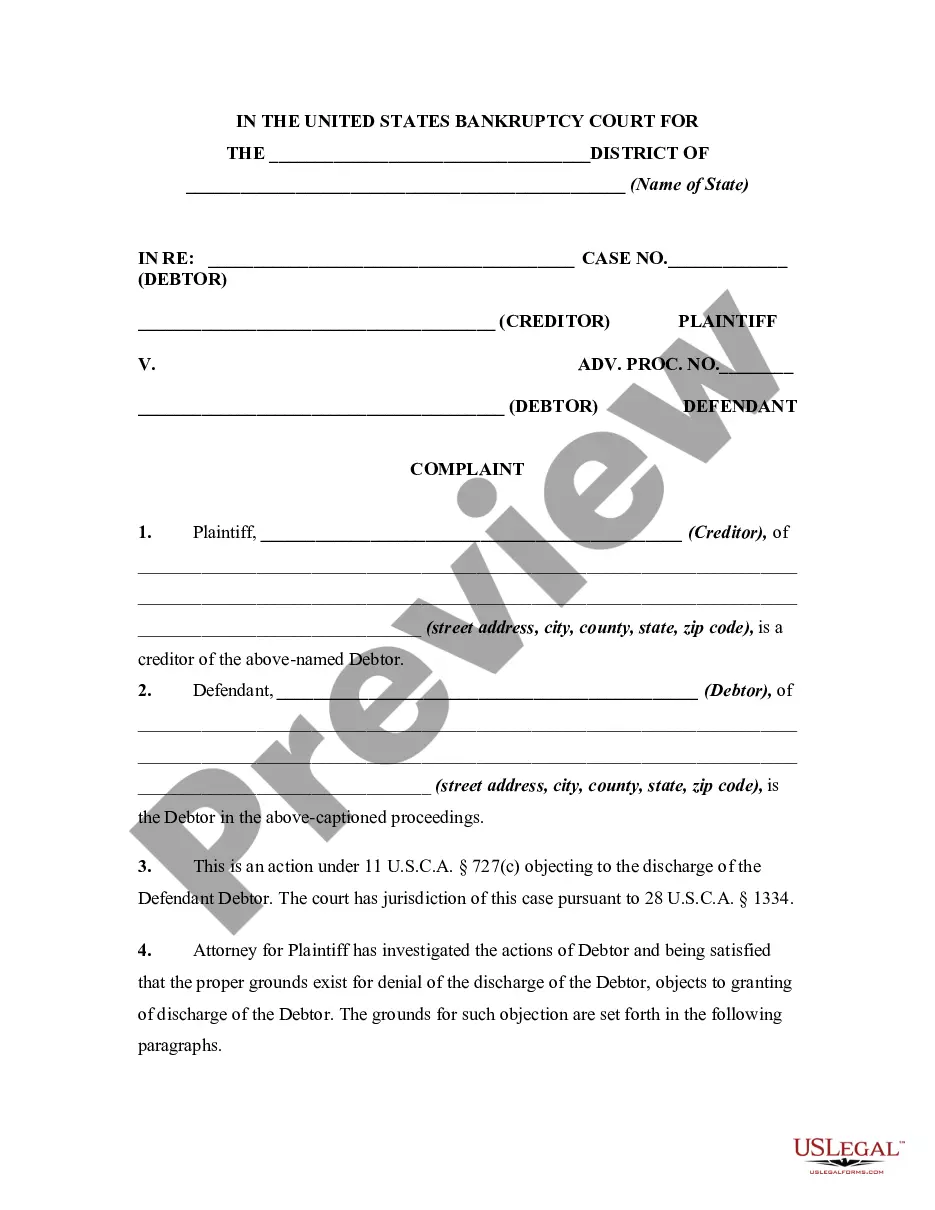

Preparing legal paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them correspond with federal and state laws and are examined by our specialists. So if you need to prepare Application for Reinstatement of Limited Liability Partnership Status- Form to be used by a Texas partnership when applying to reinstate its registration as a limited liability partnership following the termination of the registration for failure to file, our service is the best place to download it.

Obtaining your Application for Reinstatement of Limited Liability Partnership Status- Form to be used by a Texas partnership when applying to reinstate its registration as a limited liability partnership following the termination of the registration for failure to file from our catalog is as simple as ABC. Previously authorized users with a valid subscription need only log in and click the Download button after they find the proper template. Afterwards, if they need to, users can take the same blank from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few moments. Here’s a quick guide for you:

- Document compliance verification. You should carefully examine the content of the form you want and make sure whether it suits your needs and complies with your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab above until you find a suitable blank, and click Buy Now when you see the one you need.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Application for Reinstatement of Limited Liability Partnership Status- Form to be used by a Texas partnership when applying to reinstate its registration as a limited liability partnership following the termination of the registration for failure to file and click Download to save it on your device. Print it to complete your papers manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to obtain any formal document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

How Much Will It Cost To Reinstate? LLC ? The filing fee for reinstating an administratively dissolved LLC in Texas is $75. Expedited service requires an additional $25. Corporation ? An administratively dissolved corporation in Texas has to pay $75 in order to be reinstated.

Concept of "limited liability partnership" The LLP is a separate legal entity, is liable to the full extent of its assets but liability of the partners is limited to their agreed contribution in the LLP.

A limited partner is only responsible for the investment they made into the business. General partners are responsible for the partnership's debts and control the day-to-day operations. Both general and limited partnerships treat income as personal income.

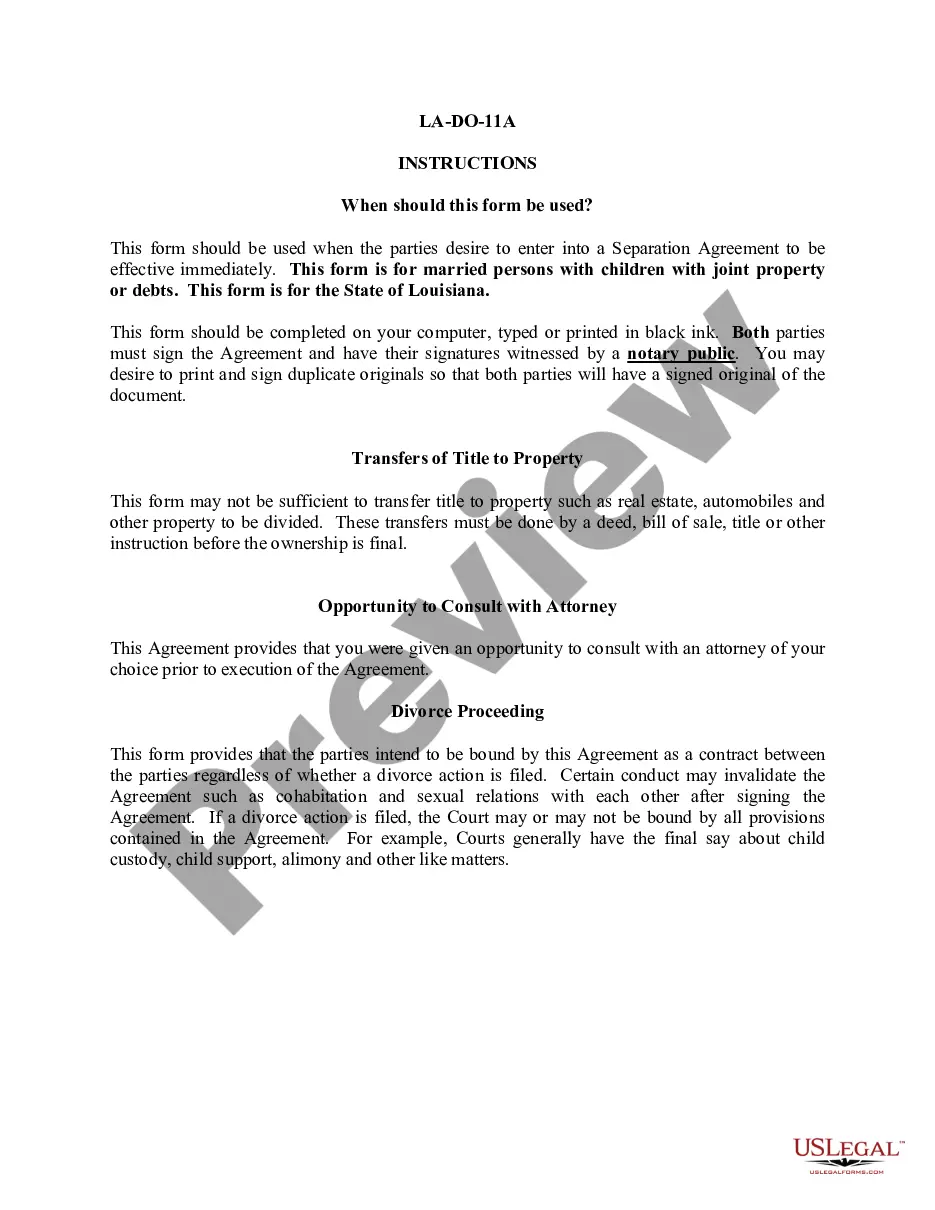

An entity forfeited under the Tax Code can reinstate at any time (so long as the entity would otherwise continue to exist) by (1) filing the required franchise tax report, (2) paying all franchise taxes, penalties, and interest, and (3) filing an application for reinstatement (Form 801 Word 178kb, PDF 87kb),

A limited liability company, or LLC, is a business entity that is formed under state law that combines characteristics of a corporation and a partnership. They are similar to corporations in that an LLC's members are not liable for the debts of the business, provided that certain formalities are observed.

An LLC offers personal liability protection from any debts or lawsuits filed against the business for all individual members. With an LLP, partners are personally liable, but only for their own negligence. This means that one partners is not held responsible for the actions of another partner.

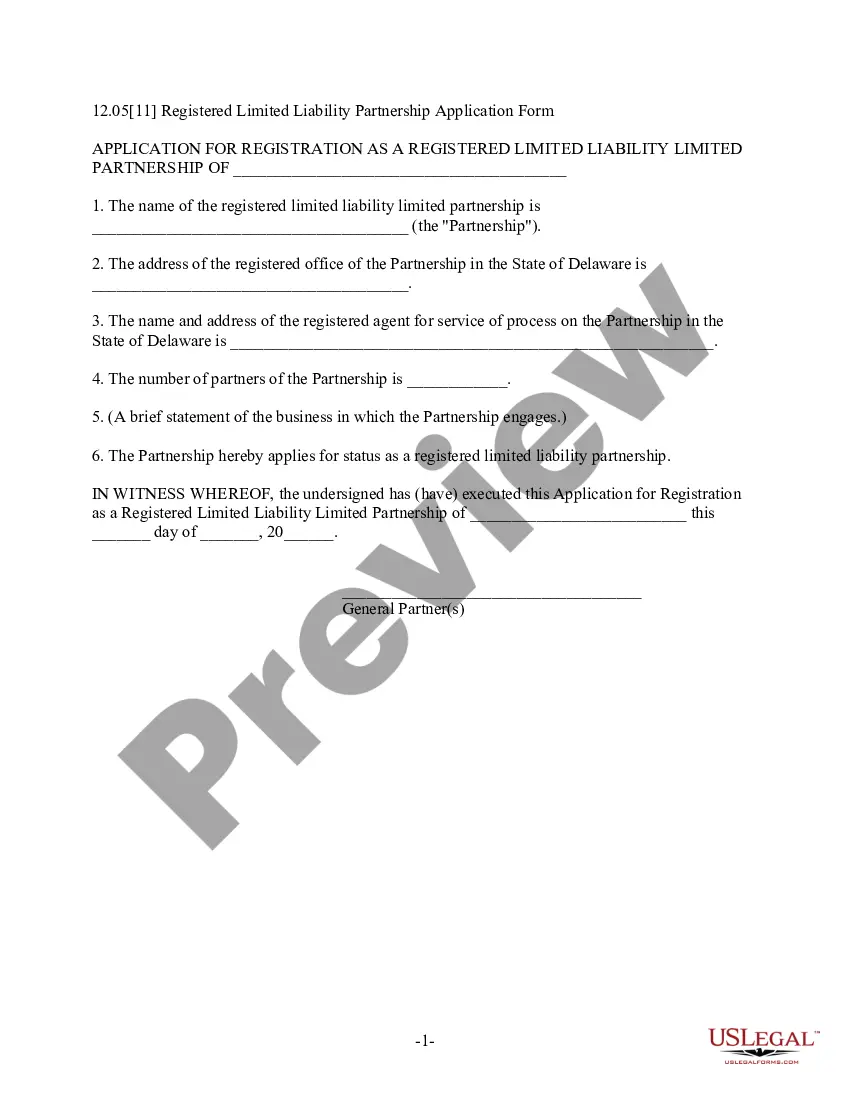

We'll walk you through the process. Choose a business name. First, you need to choose a name for your limited partnership.Appoint a Texas registered agent.Complete your Texas Certificate of Formation.Create a Limited Partnership Agreement.Obtain an EIN from the IRS.File the Texas Franchise Tax and reports.

A limited liability partnership is similar to a limited liability company (LLC) in that all partners are granted limited liability protection. However, in some states the partners in an LLP get less liability protection than in an LLC. LLP requirements vary from state to state.