Texas Application For Payment of Unclaimed Funds

Description

How to fill out Texas Application For Payment Of Unclaimed Funds?

If you’re searching for a way to properly complete the Texas Application For Payment of Unclaimed Funds without hiring a legal professional, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every personal and business scenario. Every piece of documentation you find on our web service is created in accordance with nationwide and state regulations, so you can be certain that your documents are in order.

Follow these straightforward instructions on how to get the ready-to-use Texas Application For Payment of Unclaimed Funds:

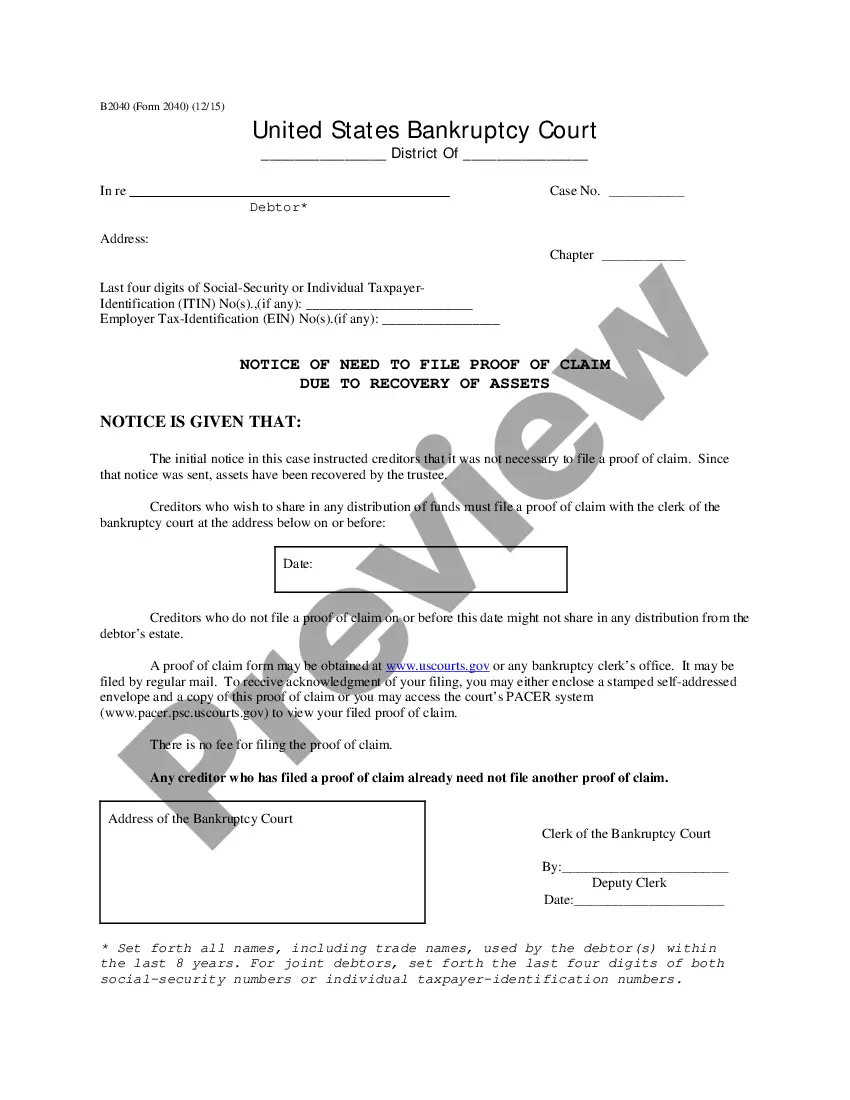

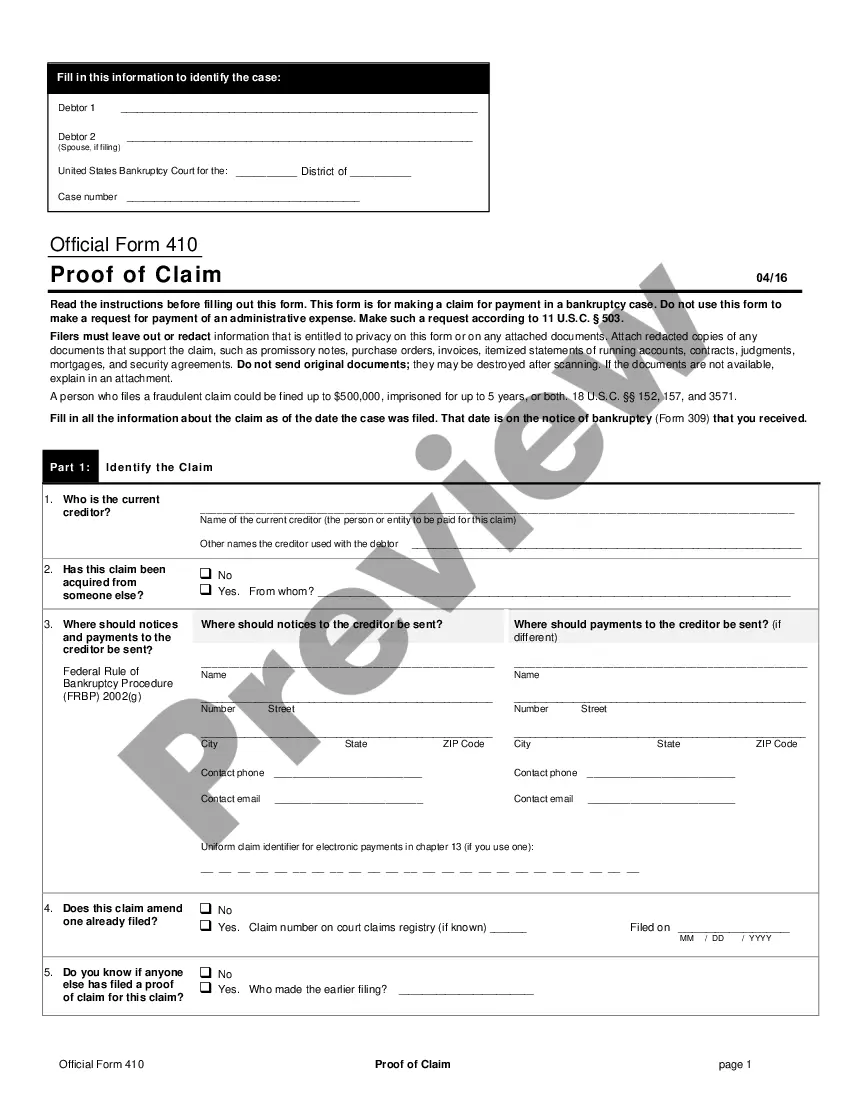

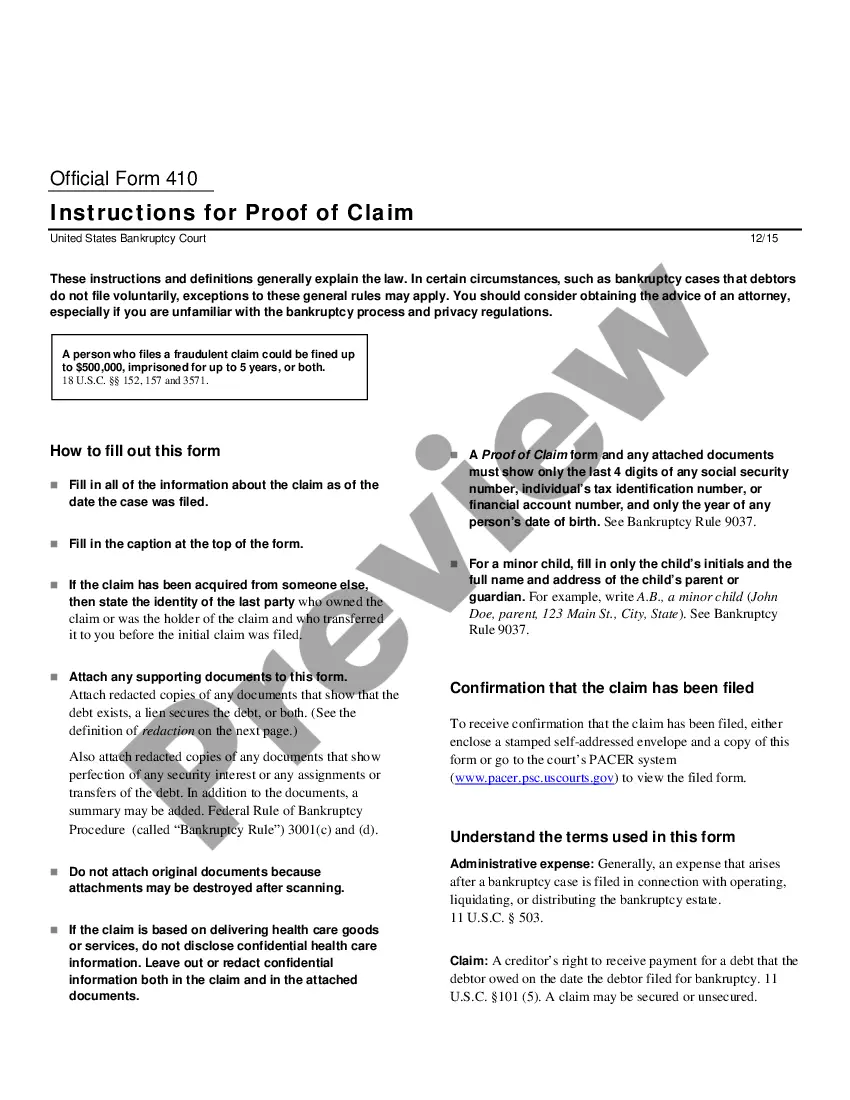

- Make sure the document you see on the page corresponds with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Enter the form title in the Search tab on the top of the page and choose your state from the dropdown to locate another template if there are any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Create an account with the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to get your Texas Application For Payment of Unclaimed Funds and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it rapidly or print it out to prepare your paper copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded templates in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

How do I search for unclaimed property? Business and individuals can search for their unclaimed property at ClaimItTexas.gov.

Step 1: Go to the Property Search Page.Step 2: Type Name to Search for Property.Step 3: Add Property and Click "CONTINUE TO FILE CLAIM"

Use the IRS Where's My Refund? search tool if you have not received your tax refund. SEC enforcement funds ? Search the Securities and Exchange Commission (SEC) database for money from an investment enforcement case. Bank failures ? Search the FDIC database for unclaimed funds from closed financial institutions.

Texas law has no statute of limitations on unclaimed property. This property always belongs to its owners or their legal heir(s). You can also search to see if your business has unclaimed property at .ClaimItTexas.org.

Remember, you can have unclaimed property more than once. The Texas Comptroller of Public Accounts will process original owner claims in 60 to 90 days after receipt, if no additional information is needed.

How to Claim Excess Tax Funds Gather the Required Documents. There are a number of documents that you'll need to gather and submit along with your claim form.Complete the Claim Form. Once you have your documents gathered, you can fill out the claim form.Submit Your Claim.

There is no statute of limitations for unclaimed property. Funds reported will remain here indefinitely until returned to their rightful owner. The Texas Comptroller has authority to manage the State of Texas Unclaimed Property Program under Title 6 of the Texas Property Code (opens in a new tab).