Tennessee Contribution Agreement Form

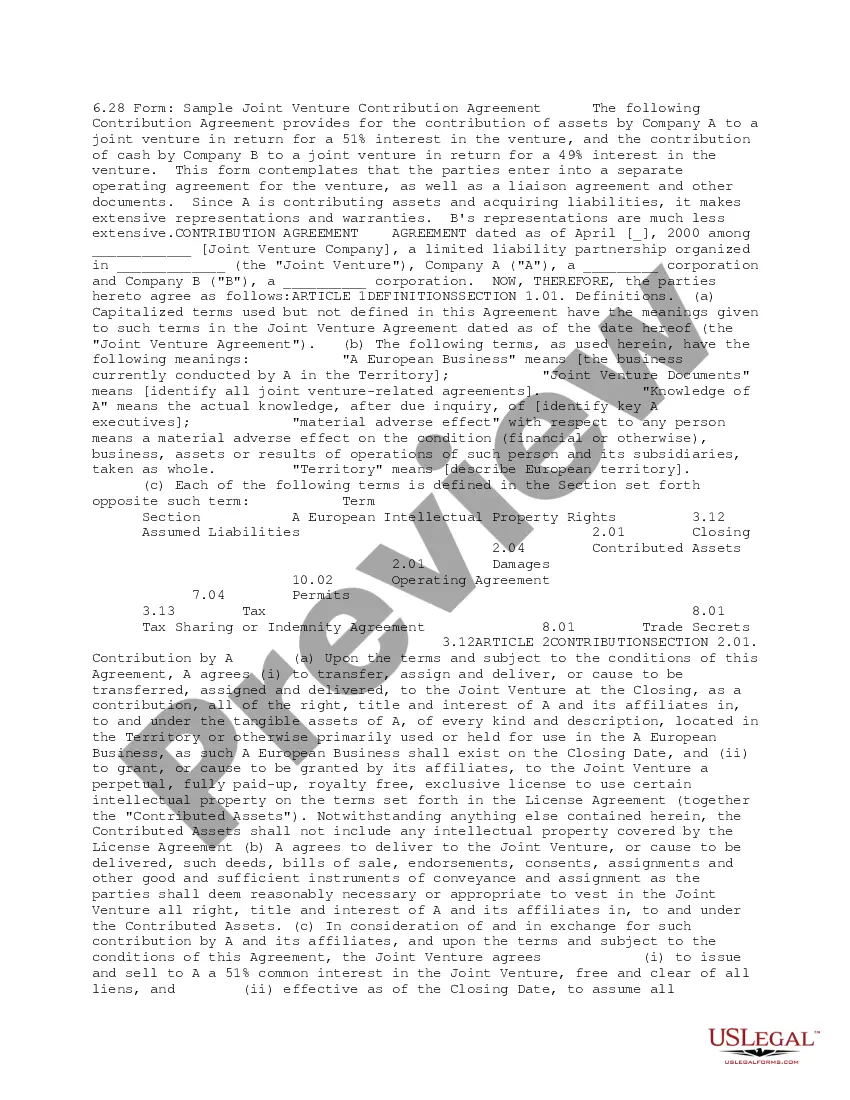

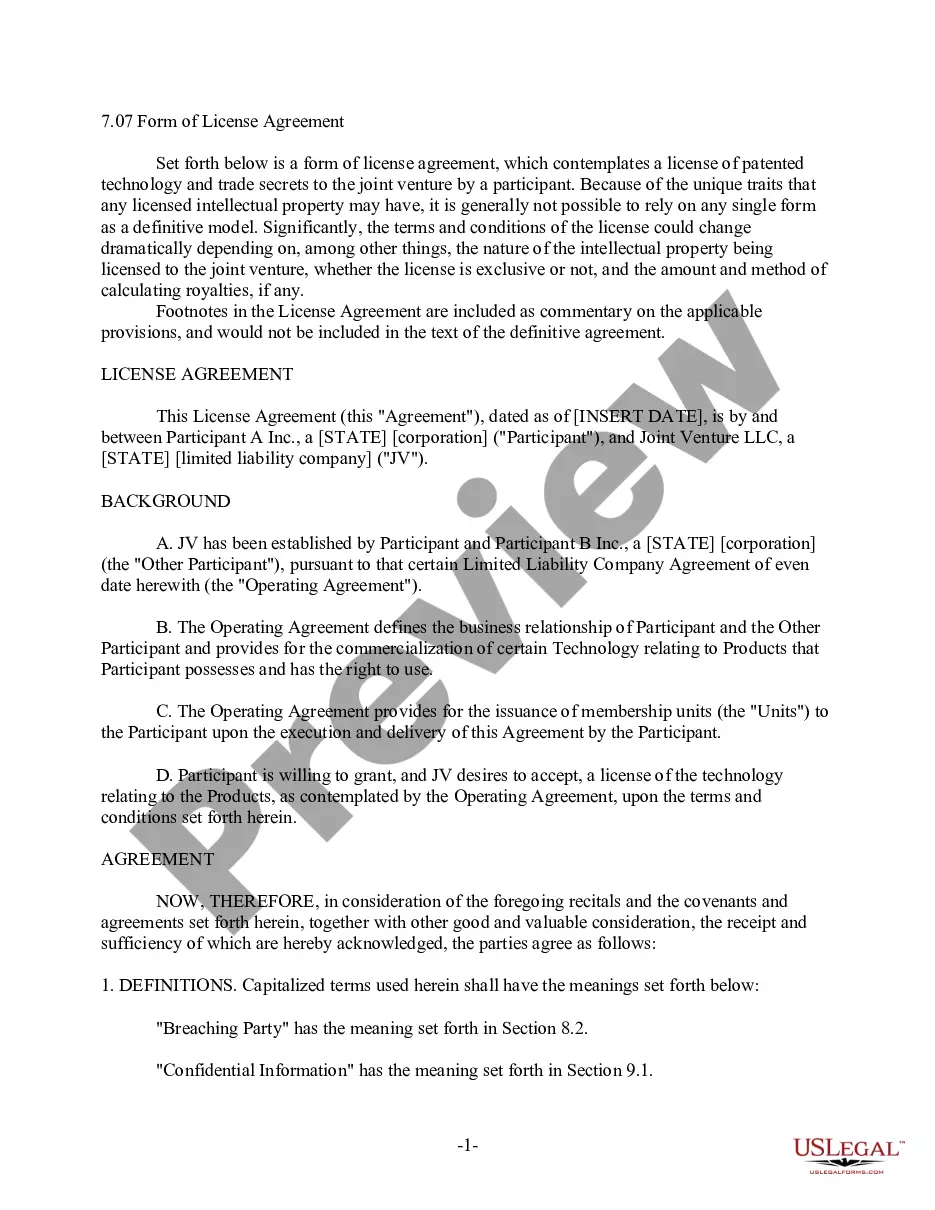

Description

How to fill out Contribution Agreement Form?

Are you currently in the place the place you need files for either business or individual functions virtually every working day? There are a variety of authorized file web templates available on the Internet, but discovering types you can trust isn`t straightforward. US Legal Forms offers thousands of develop web templates, such as the Tennessee Contribution Agreement Form, that happen to be written in order to meet state and federal specifications.

In case you are presently knowledgeable about US Legal Forms website and possess a free account, just log in. Afterward, you can acquire the Tennessee Contribution Agreement Form template.

If you do not have an account and would like to start using US Legal Forms, follow these steps:

- Get the develop you require and ensure it is for your proper city/county.

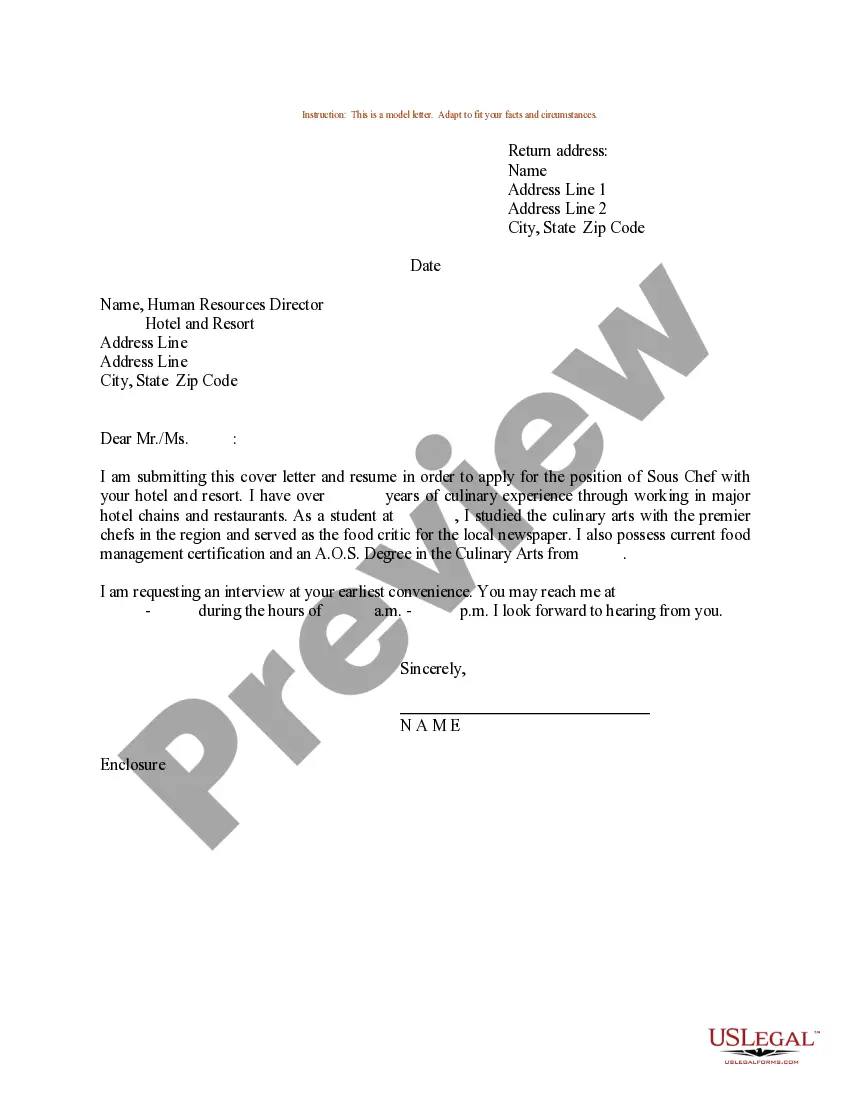

- Make use of the Preview option to analyze the form.

- Browse the explanation to actually have selected the correct develop.

- When the develop isn`t what you`re searching for, make use of the Research industry to discover the develop that meets your needs and specifications.

- Once you find the proper develop, click Get now.

- Select the pricing program you want, submit the required information to make your bank account, and pay for the transaction with your PayPal or credit card.

- Pick a convenient file file format and acquire your duplicate.

Find every one of the file web templates you may have bought in the My Forms food list. You may get a extra duplicate of Tennessee Contribution Agreement Form whenever, if necessary. Just click the required develop to acquire or print the file template.

Use US Legal Forms, by far the most extensive collection of authorized varieties, to save lots of time and stay away from faults. The services offers professionally created authorized file web templates that can be used for a range of functions. Make a free account on US Legal Forms and initiate creating your way of life a little easier.

Form popularity

FAQ

State Business Taxes in Tennessee By default, LLCs themselves don't pay income taxes, only their members do. Tennessee, unlike most other states, doesn't treat LLCs as pass-through entities. Instead, LLCs are subject to the same taxes as corporations.

The first step in terminating a Tennessee LLC is to file Form SS-4246, Notice of Dissolution (Limited Liability Company) with the Department of State, Division of Business Services (DBS). After you file notice of dissolution and wind up your business, you will have to file the appropriate Articles of Termination.

To receive a tax clearance certificate when shutting down a business, a business must file all returns to date and a final franchise and excise tax return through the date of liquidation or the date on which the business ceased operations in Tennessee.

In order to file your Tennessee Annual Report, follow these easy steps: Determine your filing due date and fees. Complete your report online OR print a paper form. Submit your annual report to the Tennessee Secretary of State.

All Tennessee LLCs need to pay $300 per year for the Annual Report. These state fees are paid to the Secretary of State. And this is the only state-required annual fee. All Tennessee LLCs have to pay ongoing fees for Annual Reports to remain in good standing.

Start your Tennessee LLC Today! Step 1: Name your Tennessee LLC. Pick an available name for your LLC. ... Step 2: Appoint a registered agent in Tennessee. ... Step 3: File Tennessee Articles of Organization. ... Step 4: Create an operating agreement for your Tennessee LLC. ... Step 5: Apply for an EIN for your LLC in Tennessee.

The annual report fee for LLCs is $300 minimum up to a maximum of $3000. The fee increases by an additional $50 per member for every member over 6 members up to a maximum of $3,000. An officer is not listed. If the business is a Tennessee for-profit corporation, the corporation must list at least one officer.

A Release says your estate does not owe TennCare any money. To find out if the estate owes money to TennCare, you must complete and submit a Request for Release Form. The form may be downloaded at: Release Form.