Tennessee Notice of Assignment by Seller to Holder of Preferential Purchase Right

Description

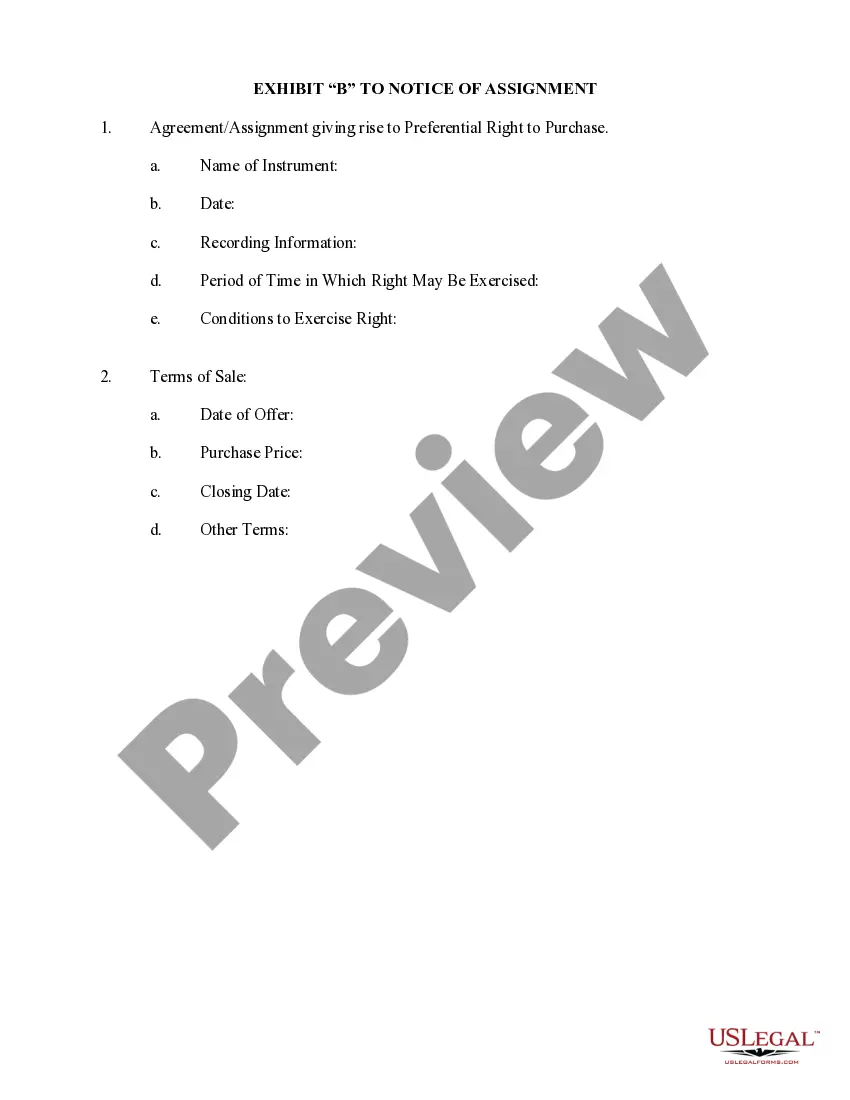

How to fill out Notice Of Assignment By Seller To Holder Of Preferential Purchase Right?

If you wish to total, down load, or produce authorized papers templates, use US Legal Forms, the largest assortment of authorized varieties, which can be found on the web. Use the site`s simple and easy convenient search to get the documents you require. A variety of templates for company and personal purposes are sorted by types and suggests, or search phrases. Use US Legal Forms to get the Tennessee Notice of Assignment by Seller to Holder of Preferential Purchase Right in a couple of mouse clicks.

In case you are already a US Legal Forms customer, log in to your account and then click the Acquire button to get the Tennessee Notice of Assignment by Seller to Holder of Preferential Purchase Right. You can also entry varieties you earlier saved in the My Forms tab of your own account.

If you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Be sure you have selected the shape for that right area/country.

- Step 2. Utilize the Preview solution to look through the form`s content material. Don`t overlook to read through the description.

- Step 3. In case you are unsatisfied with the develop, make use of the Lookup industry near the top of the display to discover other types from the authorized develop web template.

- Step 4. When you have located the shape you require, click on the Purchase now button. Choose the prices prepare you favor and add your credentials to register to have an account.

- Step 5. Process the deal. You may use your Мisa or Ьastercard or PayPal account to accomplish the deal.

- Step 6. Select the file format from the authorized develop and down load it on your product.

- Step 7. Comprehensive, modify and produce or signal the Tennessee Notice of Assignment by Seller to Holder of Preferential Purchase Right.

Each authorized papers web template you acquire is your own property permanently. You may have acces to each develop you saved in your acccount. Go through the My Forms section and pick a develop to produce or down load once more.

Remain competitive and down load, and produce the Tennessee Notice of Assignment by Seller to Holder of Preferential Purchase Right with US Legal Forms. There are many professional and express-particular varieties you may use to your company or personal requires.

Form popularity

FAQ

Certain entities under specific circumstances are exempt from paying the business tax. These may include, but are not limited to, people acting as employees, manufacturers, religious and charitable entities selling donated items, direct-to-home satellite providers, and movie theaters.

Doing business in Tennessee" or "doing business within this state" means any activity purposefully engaged in, within Tennessee, by a person with the object of gain, benefit, or advantage, consistent with the intent of the general assembly to subject such persons to the Tennessee franchise, excise tax to the extent ...

In line with the previous law, the Tennessee Revised Limited Liability Company Act declares that members, managers, or directors of LLCs are not responsible for the company's acts, whether in relation to tort or contract.

With a few exceptions, all businesses that sell goods or services must pay the state business tax. This includes businesses with a physical location in the state as well as out-of-state businesses performing certain activities in the state.

Good news, Tennessee doesn't require a ?general? business license at the state-level for Sole Proprietors.

A standard business license is needed from your county and/or municipal clerk if your gross receipts are $100,000* or more. You are not allowed to operate until your required license is obtained and posted in your business' location.

Tennessee Personal Rights Protection Act (?TPRPA?) Tennessee recognizes a statutory invasion of privacy claim arising from the property right in one's likeness/image where a person can show a causal connection between the infringement and a direct benefit going to the infringing party.

When a contract vests one party with a degree of discretion in performance (example: applying for a loan, performing inspections, negotiating repairs), there is an obligation of Good Faith to observe reasonable limits in exercising that discretion consistent with common standards of decency, fairness and reasonableness ...