Tennessee Deed and Assignment from individual to A Trust

Description

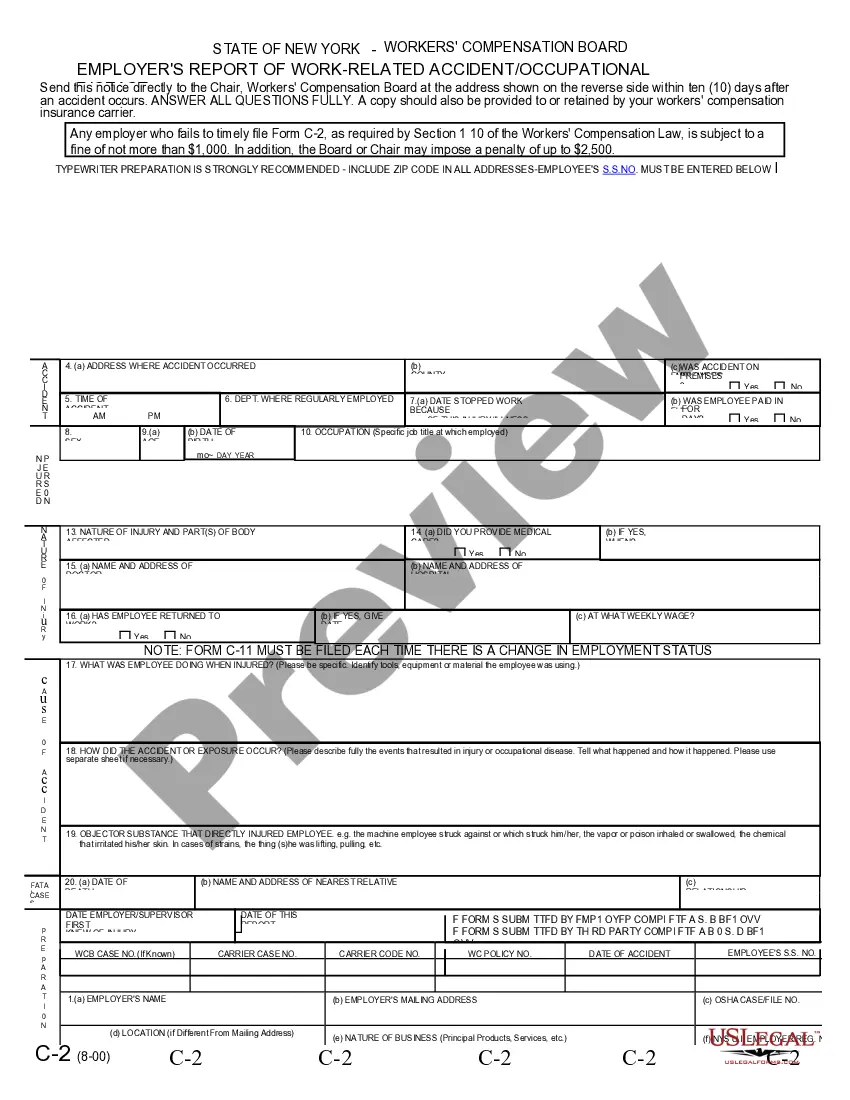

How to fill out Deed And Assignment From Individual To A Trust?

If you want to full, obtain, or printing legal document web templates, use US Legal Forms, the largest assortment of legal kinds, which can be found on the web. Take advantage of the site`s easy and practical research to get the documents you will need. A variety of web templates for company and individual uses are sorted by types and says, or keywords. Use US Legal Forms to get the Tennessee Deed and Assignment from individual to A Trust in a couple of mouse clicks.

If you are presently a US Legal Forms buyer, log in in your bank account and click on the Down load key to find the Tennessee Deed and Assignment from individual to A Trust. Also you can entry kinds you earlier acquired in the My Forms tab of your respective bank account.

Should you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the form for that proper metropolis/region.

- Step 2. Take advantage of the Review option to check out the form`s articles. Never overlook to read through the information.

- Step 3. If you are not happy together with the type, make use of the Research area towards the top of the display screen to get other types of the legal type template.

- Step 4. When you have discovered the form you will need, click on the Purchase now key. Select the pricing plan you prefer and include your credentials to register to have an bank account.

- Step 5. Approach the financial transaction. You can utilize your bank card or PayPal bank account to perform the financial transaction.

- Step 6. Find the formatting of the legal type and obtain it on the gadget.

- Step 7. Full, change and printing or signal the Tennessee Deed and Assignment from individual to A Trust.

Each legal document template you get is the one you have for a long time. You might have acces to every type you acquired with your acccount. Select the My Forms segment and pick a type to printing or obtain again.

Be competitive and obtain, and printing the Tennessee Deed and Assignment from individual to A Trust with US Legal Forms. There are many specialist and state-certain kinds you may use for your company or individual demands.

Form popularity

FAQ

To create a living trust in Tennessee, prepare a written trust agreement and sign it in the presence of a notary. The trust is not effective until you transfer ownership of your assets into it. Living trusts can provide flexibility and benefits that are not available with other estate planning options.

In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another. This usually happens when the beneficiary of a trust deed sells their loan to another lender.

How to Fund a Trust: Bank Accounts and Other Financial Accounts Contact your bank to see what's required to transfer your accounts to the Trust. Your bank will provide any necessary forms. Complete, sign and return forms to your bank. ... Have the bank change the title to the Trustee of the Trust.

For instance, personal property is relatively simple to transfer into a trust. It merely requires a signed statement that lists the assets being transferred. If the personal property is titled in the grantor's name, such as a boat or a motor vehicle, it must be transferred with the correct type of deed.

This is done by updating your deed(s) so that it includes your name and lists you as the trustee; for example, ?John Doe, Trustee for the Doe Living Trust.? Tangible personal property includes your car, furniture, boat, jewelry, art, antiques, coin collections, and other personal property.

Your Assets Might Not Be Protected: Another crucial point to note is that not all trusts offer protection from creditors. For instance, in revocable trusts, the assets are not protected from creditors as the grantor retains control of the assets. Potential Tax Burdens: Finally, trusts can carry potential tax burdens.

How do I transfer the shares I own to my trust? You will need to inform the company issuing the shares that you will be holding them through a trust and also provide your trust's details. This is necessary to ensure the company's internal records reflect this change.

A grantor may place a mortgaged home in a living trust by signing a warranty or quitclaim deed from the current owners to the trust. In this case, the deed would name the living trust as grantee and would be and recorded just like any other property transfer.