Tennessee Close Account Letter by Consumer

Description

How to fill out Close Account Letter By Consumer?

If you need to complete, acquire, or create valid document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search function to find the documents you need.

Numerous templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to locate the Tennessee Close Account Letter by Consumer in just a few clicks.

Every legal document template you purchase is yours forever. You have access to all the forms you saved in your account. Click the My documents section and select a form to print or download again.

Be proactive and download, and print the Tennessee Close Account Letter by Consumer with US Legal Forms. There are millions of professional and state-specific templates you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to retrieve the Tennessee Close Account Letter by Consumer.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

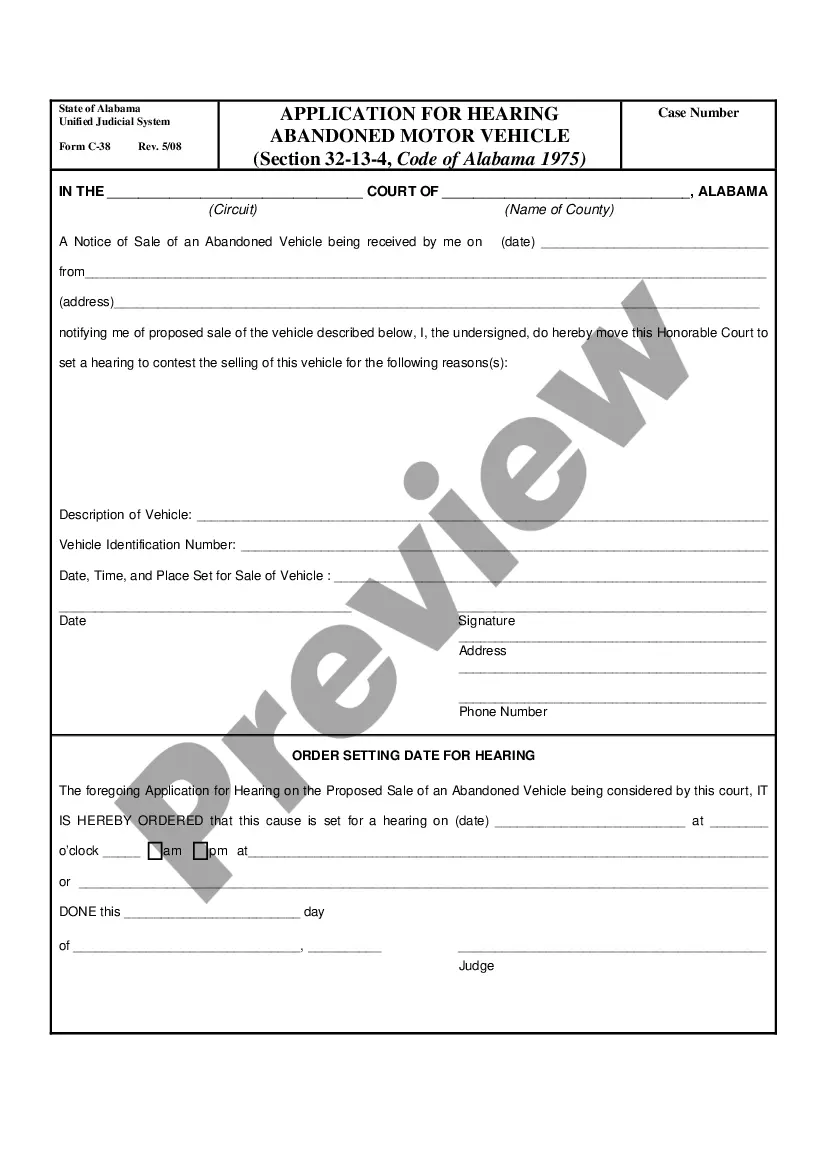

- Step 2. Use the Review option to browse through the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other types of your legal form template.

- Step 4. Once you have found the form you need, click on the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Tennessee Close Account Letter by Consumer.

Form popularity

FAQ

To support your complaint, you should gather all relevant evidence, including receipts, emails, and notes from conversations with the company. This documentation is crucial in illustrating your case. If your complaint involves a close account, having a well-prepared Tennessee Close Account Letter by Consumer can serve as key evidence to back up your claim.

The best way to file a consumer complaint is to start with the business involved, providing them with a clear description of your issue. If that doesn't resolve the matter, escalate your complaint to local consumer protection agencies or the attorney general's office. For those facing account closure issues, drafting a Tennessee Close Account Letter by Consumer can be an effective tool to present your concerns formally.

The Consumer Protection Act in Tennessee aims to protect consumers from unfair and deceptive practices. This law covers a wide range of issues, including false advertising and unfair debt collection practices. If you're dealing with issues related to account closures, knowing your rights under this act can empower you to take appropriate action, including utilizing a Tennessee Close Account Letter by Consumer.

Going to consumer court can be an effective way to resolve disputes when other avenues have failed. It allows you to present your case in front of a judge who makes a binding decision. If your complaint involves a close account issue, consider preparing a Tennessee Close Account Letter by Consumer to outline your case and provide necessary documentation to strengthen your position.

Filing a complaint with the attorney general can be a valuable step in addressing consumer issues. This action can help raise awareness of problematic practices and may lead to investigations into the business. If you are facing issues related to account closures, utilizing a Tennessee Close Account Letter by Consumer can strengthen your complaint and provide a clear record of your experience.

When you decide to file a consumer complaint, the first step is to gather all relevant information related to your issue. This includes documentation, receipts, and any correspondence you’ve had with the company. If you're dealing with a close account situation, using a Tennessee Close Account Letter by Consumer can help clarify your intentions and provide a formal record of your complaint.

Yes, complaints filed with the Consumer Financial Protection Bureau (CFPB) are public records. This allows consumers to review complaints against financial institutions and assess how they handle issues. If you are dealing with a financial service and need to close an account, a Tennessee Close Account Letter by Consumer can help you navigate the process smoothly.

Client complaints are tracked through various systems, including state agencies and consumer protection organizations. These entities collect, categorize, and analyze complaints to identify trends in business practices. If you're facing a situation requiring a formal response, a Tennessee Close Account Letter by Consumer can serve as an effective tool to communicate your grievances.

Consumer complaints are indeed public, allowing anyone to view them. This openness helps consumers make informed decisions about their interactions with businesses. If you need to address a complaint, consider using a Tennessee Close Account Letter by Consumer to formally communicate your concerns.

To find out if a business has complaints, you can search online databases or state consumer protection websites. Many agencies compile complaints and make them accessible to the public. Additionally, using services like US Legal Forms can help you obtain a Tennessee Close Account Letter by Consumer, which may streamline your process if you encounter issues with a business.