Tennessee Schedule of Fees

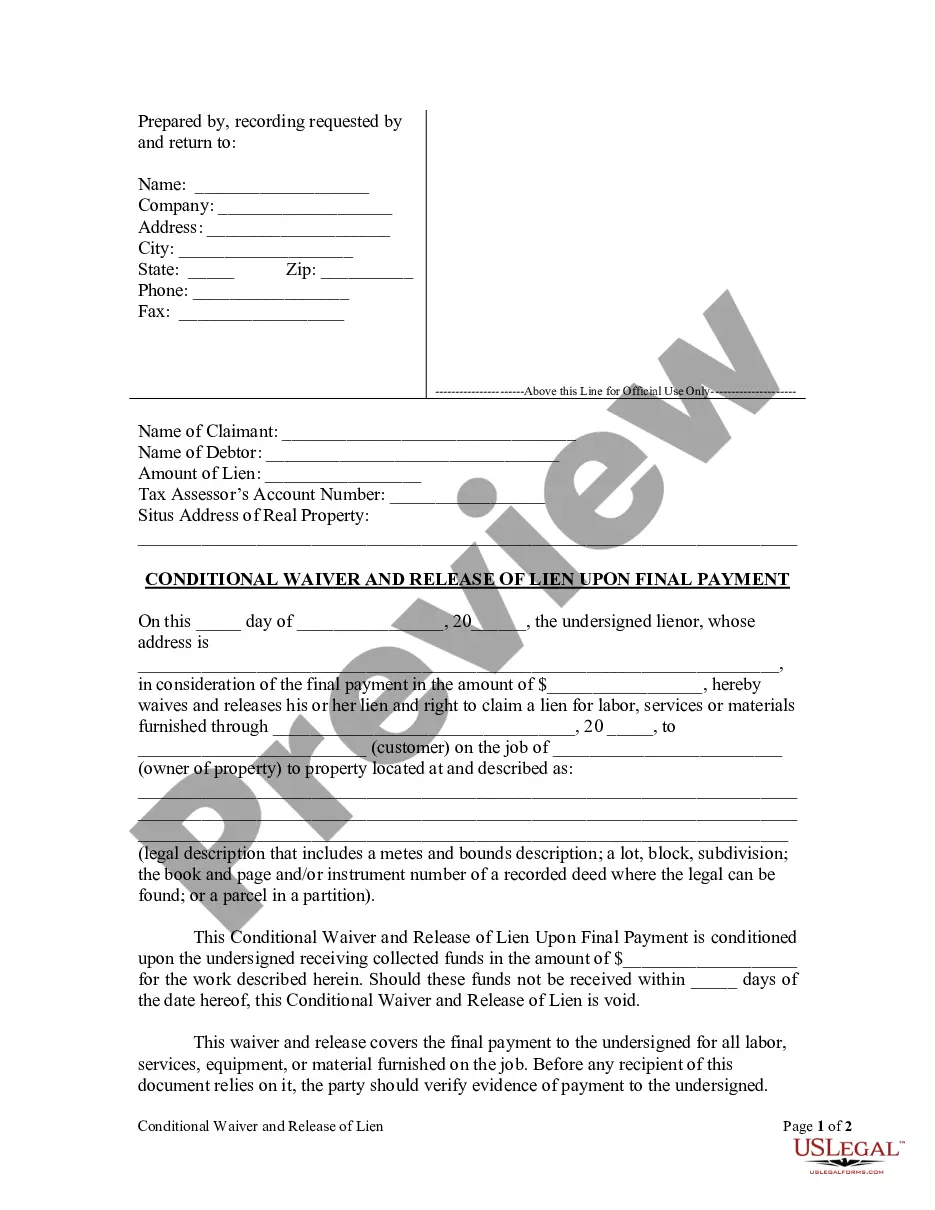

Description

How to fill out Schedule Of Fees?

If you need to full, obtain, or print out legitimate record themes, use US Legal Forms, the biggest assortment of legitimate forms, that can be found on the web. Take advantage of the site`s simple and handy research to discover the files you need. Numerous themes for organization and personal purposes are categorized by classes and states, or keywords and phrases. Use US Legal Forms to discover the Tennessee Schedule of Fees with a couple of clicks.

In case you are presently a US Legal Forms consumer, log in for your profile and then click the Download option to find the Tennessee Schedule of Fees. You may also access forms you formerly delivered electronically in the My Forms tab of your respective profile.

If you are using US Legal Forms initially, follow the instructions under:

- Step 1. Make sure you have selected the form for that correct area/land.

- Step 2. Use the Review option to check out the form`s articles. Don`t forget about to see the information.

- Step 3. In case you are unsatisfied using the kind, use the Lookup discipline towards the top of the display screen to discover other variations of your legitimate kind format.

- Step 4. Once you have located the form you need, click on the Acquire now option. Select the prices plan you choose and put your qualifications to register for the profile.

- Step 5. Process the deal. You can use your charge card or PayPal profile to perform the deal.

- Step 6. Find the formatting of your legitimate kind and obtain it on your own system.

- Step 7. Complete, change and print out or sign the Tennessee Schedule of Fees.

Each and every legitimate record format you acquire is yours forever. You possess acces to every single kind you delivered electronically with your acccount. Click the My Forms section and select a kind to print out or obtain again.

Compete and obtain, and print out the Tennessee Schedule of Fees with US Legal Forms. There are many skilled and express-specific forms you may use for the organization or personal requires.

Form popularity

FAQ

The Tennessee Workers' Compensation Medical Fee Schedule (MFS) applies to all medical services and medical equipment or supplies and is applicable to all injured employees claiming workers' compensation benefits under Tennessee's Workers' Compensation Act.

State Business Taxes in Tennessee By default, LLCs themselves don't pay income taxes, only their members do. Tennessee, unlike most other states, doesn't treat LLCs as pass-through entities. Instead, LLCs are subject to the same taxes as corporations.

All Tennessee LLCs need to pay $300 per year for the Annual Report. These state fees are paid to the Secretary of State. And this is the only state-required annual fee. All Tennessee LLCs have to pay ongoing fees for Annual Reports to remain in good standing.

The average cost of workers' compensation in Tennessee is $48 per month.

Start your Tennessee LLC Today! Step 1: Name your Tennessee LLC. Pick an available name for your LLC. ... Step 2: Appoint a registered agent in Tennessee. ... Step 3: File Tennessee Articles of Organization. ... Step 4: Create an operating agreement for your Tennessee LLC. ... Step 5: Apply for an EIN for your LLC in Tennessee.

The Centers for Medicare and Medicaid Services (CMS) determines the final relative value unit (RVU) for each code, which is then multiplied by the annual conversion factor (a dollar amount) to yield the national average fee. Rates are adjusted ing to geographic indices based on provider locality.

The annual report fee for LLCs is $300 minimum up to a maximum of $3000. The fee increases by an additional $50 per member for every member over 6 members up to a maximum of $3,000. An officer is not listed. If the business is a Tennessee for-profit corporation, the corporation must list at least one officer.

A fee schedule is a complete listing of fees used by Medicare to pay doctors or other providers/suppliers. This comprehensive listing of fee maximums is used to reimburse a physician and/or other providers on a fee-for-service basis.

TPD benefits are paid at the rate of 66?% of the difference between your average weekly wage pre-injury and your average weekly-wage post-injury (subject to the state maximum). Temporary total disability (TTD) benefits apply when you're temporarily unable to work at all.

In order to file your Tennessee Annual Report, follow these easy steps: Determine your filing due date and fees. Complete your report online OR print a paper form. Submit your annual report to the Tennessee Secretary of State.