Tennessee Self-Employed Awning Services Contract

Description

How to fill out Self-Employed Awning Services Contract?

If you need to finalize, acquire, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's user-friendly and efficient search feature to locate the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to find the Tennessee Self-Employed Awning Services Agreement with just a few clicks.

Every legal document template you obtain is yours permanently. You have access to every form you acquired through your account. Visit the My documents section and select a form to print or download again.

Be proactive and download, and print the Tennessee Self-Employed Awning Services Agreement with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Tennessee Self-Employed Awning Services Agreement.

- You can also access forms you have previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

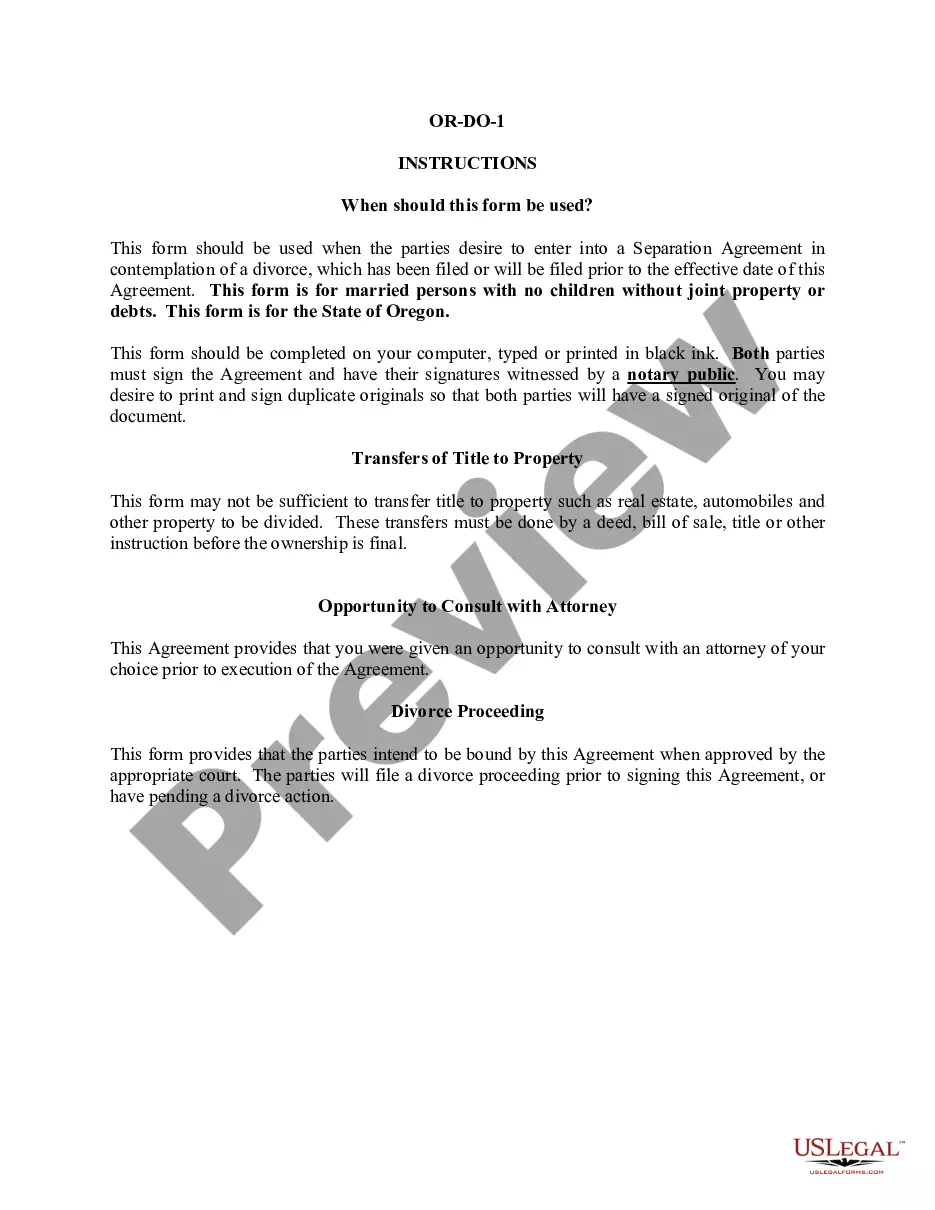

- Step 2. Use the Preview option to review the form's content. Don't forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Tennessee Self-Employed Awning Services Agreement.

Form popularity

FAQ

Yes, independent contractors in Tennessee often need to obtain a business license, depending on the type of services they offer and their location. This requirement ensures that contractors comply with state and local regulations. If you are considering starting your own Tennessee Self-Employed Awning Services business, check with your local government for specific licensing requirements. Utilizing resources from US Legal Forms can help you navigate the licensing process effectively.

An independent contractor agreement in Tennessee is a legal document that outlines the working relationship between a contractor and a client. This agreement specifies the terms of work, payment, and responsibilities, ensuring both parties are clear on their obligations. If you're entering into a Tennessee Self-Employed Awning Services Contract, having a well-drafted independent contractor agreement is crucial for protecting your interests. You can find templates and resources for these agreements on platforms like US Legal Forms.

In Tennessee, certain services are exempt from sales tax, such as specific healthcare services, educational services, and some agricultural services. However, when it comes to awning services, these typically do not fall under the exemptions. If you are planning to offer Tennessee Self-Employed Awning Services, it is essential to understand the tax regulations to ensure compliance. Consulting a tax professional or using resources from platforms like US Legal Forms can provide clarity on your obligations.

In Tennessee, you can perform certain tasks without a contractor license, but there are limits. For example, you can work on projects valued under a specific amount. However, if your work involves larger projects related to a Tennessee Self-Employed Awning Services Contract, it's wise to consult the state regulations to ensure compliance. Utilize platforms like USLegalForms to access legal documents that support your contracting needs.

The owner of Tennessee Awnings is an experienced professional dedicated to providing quality awning services. They focus on meeting the needs of clients while adhering to industry standards. If you're interested in a Tennessee Self-Employed Awning Services Contract, understanding the ownership structure can help you make informed decisions about your awning needs.

To become an independent contractor in Tennessee, start by registering your business and obtaining any necessary licenses. If you plan to offer services like awning installation, consider using a Tennessee Self-Employed Awning Services Contract to formalize your agreements with clients. Additionally, familiarize yourself with tax obligations and business insurance to protect yourself and your clients. Using platforms like uslegalforms can simplify the process of drafting contracts and ensuring compliance with state regulations.

Yes, generally, you need a contractor's license to operate as a contractor in Tennessee, especially for projects that exceed $25,000. This requirement applies to various contracting activities, including construction, renovation, and installation services. If you are considering offering services through a Tennessee Self-Employed Awning Services Contract, ensure you understand the licensing requirements that apply to your specific situation.