Tennessee Account Executive Agreement - Self-Employed Independent Contractor

Description

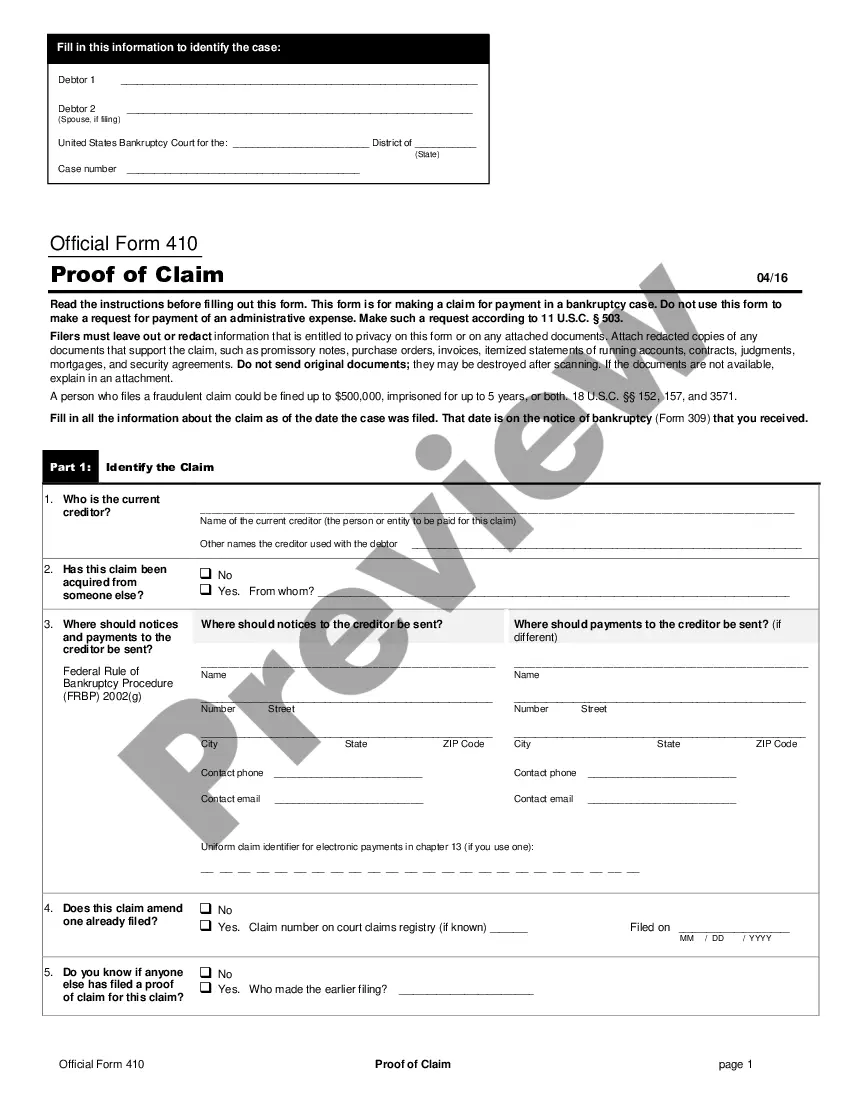

How to fill out Account Executive Agreement - Self-Employed Independent Contractor?

Locating the appropriate legal document template can be quite challenging. Clearly, there are numerous templates available online, but how do you find the official form you require? Use the US Legal Forms website. The service offers thousands of templates, including the Tennessee Account Executive Agreement - Self-Employed Independent Contractor, which you can utilize for business and personal purposes. All of the documents are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Obtain button to locate the Tennessee Account Executive Agreement - Self-Employed Independent Contractor. Use your account to browse through the legal forms you have previously purchased. Go to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions you should follow: First, ensure that you have selected the correct form for your city/region. You can preview the form using the Review option and read the form description to confirm this is the right one for you. If the form does not meet your needs, use the Search area to find the correct form. Once you are confident that the form is suitable, click the Acquire now button to get the form. Choose the pricing plan you want and enter the necessary information. Create your account and pay for the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, and print, then sign the acquired Tennessee Account Executive Agreement - Self-Employed Independent Contractor.

- US Legal Forms is the largest repository of legal forms where you can find a variety of document templates.

- Use the service to download properly crafted documents that adhere to state regulations.

- The platform provides access to thousands of templates.

- All documents undergo expert review to ensure compliance.

- Easily manage your purchased forms through your account.

- Follow straightforward steps to obtain the forms you need.

Form popularity

FAQ

Creating a Tennessee Account Executive Agreement - Self-Employed Independent Contractor is straightforward. Begin by defining the services you will provide, and clarify the payment structure and deadlines. Next, ensure you include clauses that address termination, confidentiality, and liability to protect both parties. You can streamline this process by using the US Legal Forms platform, which offers customizable templates to help you create a professional agreement that meets your specific needs.

Yes, you can work as an independent contractor on a TN visa, provided you meet the visa requirements and your work aligns with your professional qualifications. The Tennessee Account Executive Agreement - Self-Employed Independent Contractor can help define your role clearly, ensuring compliance with visa regulations. It is essential to consult legal resources or experts to confirm that your contracting work falls within the allowed activities under your visa.

In Tennessee, whether you need a business license as an independent contractor depends on your location and business type. Many contractors must obtain a business license or register their business name to comply with local regulations. When creating a Tennessee Account Executive Agreement - Self-Employed Independent Contractor, consider consulting uslegalforms for guidance on licensing requirements specific to your area and profession.

Yes, an independent contractor is typically considered self-employed. This means they operate their own business and manage their taxes, rather than being an employee of a company. Understanding this distinction is important when drafting a Tennessee Account Executive Agreement - Self-Employed Independent Contractor, as it outlines your responsibilities and rights. It helps clarify your business status and ensures proper documentation.

As an independent contractor in Tennessee, you should complete several essential forms to ensure compliance and proper structure for your work. Start by reviewing the Tennessee Account Executive Agreement - Self-Employed Independent Contractor, which clearly outlines your responsibilities and rights. Additionally, you may need to fill out tax forms such as the W-9 to provide your taxpayer information to clients. It's also beneficial to utilize platforms like US Legal Forms to access templates and guidance specific to independent contractors, simplifying the documentation process.

In Tennessee, the independent contractor agreement is a significant document detailing the working arrangements between contractors and clients. This agreement specifies the rights, responsibilities, and compensation for services rendered. Utilizing a Tennessee Account Executive Agreement - Self-Employed Independent Contractor ensures that you are professionally covered and legally compliant. Accessing resources from uslegalforms can simplify the creation of this critical agreement.

The basic independent contractor agreement is a legal document that outlines the terms of the working relationship between a contractor and a client. It typically includes important elements such as project scope, payment details, and responsibilities. If you're considering operating under a Tennessee Account Executive Agreement - Self-Employed Independent Contractor, this agreement becomes your essential framework, fostering clarity and trust between parties.

Yes, having a contract as an independent contractor is essential for defining expectations and protecting your rights. A well-structured contract, like the Tennessee Account Executive Agreement - Self-Employed Independent Contractor, outlines the scope of work, payment terms, and project timelines. This document serves as a reference point in case of disputes, ensuring clarity for both parties involved.

Legal requirements for independent contractors in Tennessee primarily revolve around taxation and compliance. Contractors must report their income accurately and manage their tax obligations, including self-employment tax. Additionally, it's vital to adhere to any requirements set forth in the Tennessee Account Executive Agreement - Self-Employed Independent Contractor. Always consult a legal expert to ensure you meet all necessary regulatory obligations.

Filling out an independent contractor agreement requires you to clearly define the relationship between the parties involved. Start by including basic information such as names, contact details, and the nature of the work. Then, include terms related to payment, project deadlines, and obligations outlined in the Tennessee Account Executive Agreement - Self-Employed Independent Contractor. Ensure both parties review and sign the document to affirm the terms.