Tennessee Employer Training Memo - Payroll Deductions

Description

How to fill out Employer Training Memo - Payroll Deductions?

Choosing the right lawful document web template might be a struggle. Naturally, there are tons of web templates available on the Internet, but how will you find the lawful form you need? Make use of the US Legal Forms site. The service offers 1000s of web templates, like the Tennessee Employer Training Memo - Payroll Deductions, which can be used for company and private requires. Each of the varieties are checked out by professionals and meet federal and state requirements.

If you are presently authorized, log in for your account and click the Download button to obtain the Tennessee Employer Training Memo - Payroll Deductions. Make use of account to check from the lawful varieties you might have bought formerly. Proceed to the My Forms tab of your account and obtain another duplicate of your document you need.

If you are a whole new customer of US Legal Forms, here are easy instructions that you should follow:

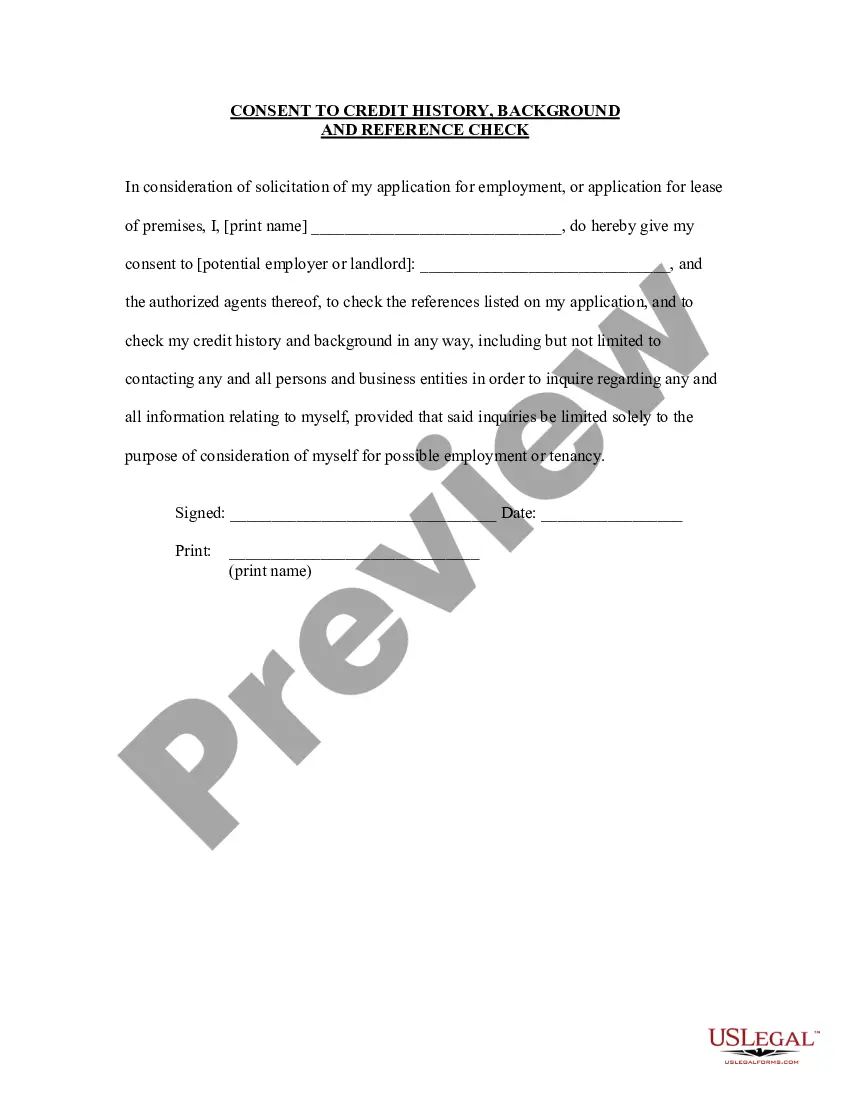

- Very first, make certain you have chosen the appropriate form for the city/area. It is possible to examine the form making use of the Review button and look at the form information to make sure it will be the right one for you.

- In case the form does not meet your expectations, take advantage of the Seach industry to find the appropriate form.

- When you are positive that the form is proper, click the Purchase now button to obtain the form.

- Pick the pricing strategy you want and enter in the needed info. Make your account and buy the transaction using your PayPal account or Visa or Mastercard.

- Choose the file file format and obtain the lawful document web template for your product.

- Total, revise and print out and indication the received Tennessee Employer Training Memo - Payroll Deductions.

US Legal Forms is definitely the largest local library of lawful varieties where you will find different document web templates. Make use of the service to obtain appropriately-produced documents that follow express requirements.

Form popularity

FAQ

The calculation of Excess Wages is based on the first $7000 paid to each employee during the calendar year (the Tennessee Taxable Wage Base applicable to the quarter being reported). Modifying the Prior Wage amount in this system does not actually modify your prior quarterly reports.

How do I certify for unemployment? Weekly Certification VideoGo to Jobs4TN.gov.Sign in to your Jobs4TN account by entering your username and password.On your dashboard, locate the "Unemployment Services" widget box.Click on "Weekly Claim Certification"Follow the prompts and enter all required information.

Employers who are liable to pay unemployment taxes include the following: An employing unit that is liable under the Federal Unemployment Tax Act (FUTA) and has at least one employee in Tennessee regardless of the number of weeks employed or amount of payroll..

Rates range from 0.01% to 2.3% for positive-rated employers and from 5% to 10% for negative-rated employers. The standard unemployment tax rate for new employers is 2.7% for fiscal 2022, unchanged from fiscal 2021.

Most employers who have workers in Tennessee are liable to pay the state unemployment insurance premiums and the Federal Unemployment Tax (FUTA).

Unemployment Insurance (UI) is a benefit program funded by Tennessee employers for workers who have lost their job by no fault of their own. Eligible claims may receive up to $275 per week in benefit payments.

The Premium Report contains fields for reporting the number of workers who were on an employer's payroll during the first, second, and third months of the quarter. Employers must report all full-time and part-time employees who worked during or received pay for the payroll period that included the 12th of the month.

SDI Rate. The SDI withholding rate for 2022 is 1.1 percent. The taxable wage limit is $145,600 for each employee per calendar year. The maximum to withhold for each employee is $1,601.60.

Online or by Phone. You can check the status of your claim online or by phone. Click "View Benefits / Update Information" link on the DLWD website. While most residents can get updates through the Telephone Information and Payment System hotline, or TIPS, at (800) 689-9799, Nashville residents must call (615) 532-1800.

Steingold, Contributing Author. If your small business has employees working in Tennessee, you'll need to pay Tennessee unemployment insurance (UI) tax. The UI tax funds unemployment compensation programs for eligible employees. In Tennessee, state UI tax is one of the primary taxes that employers must pay.