Tennessee Notice To Users Of Consumer Reports - Obligations Of Users Under The FCRA

Description

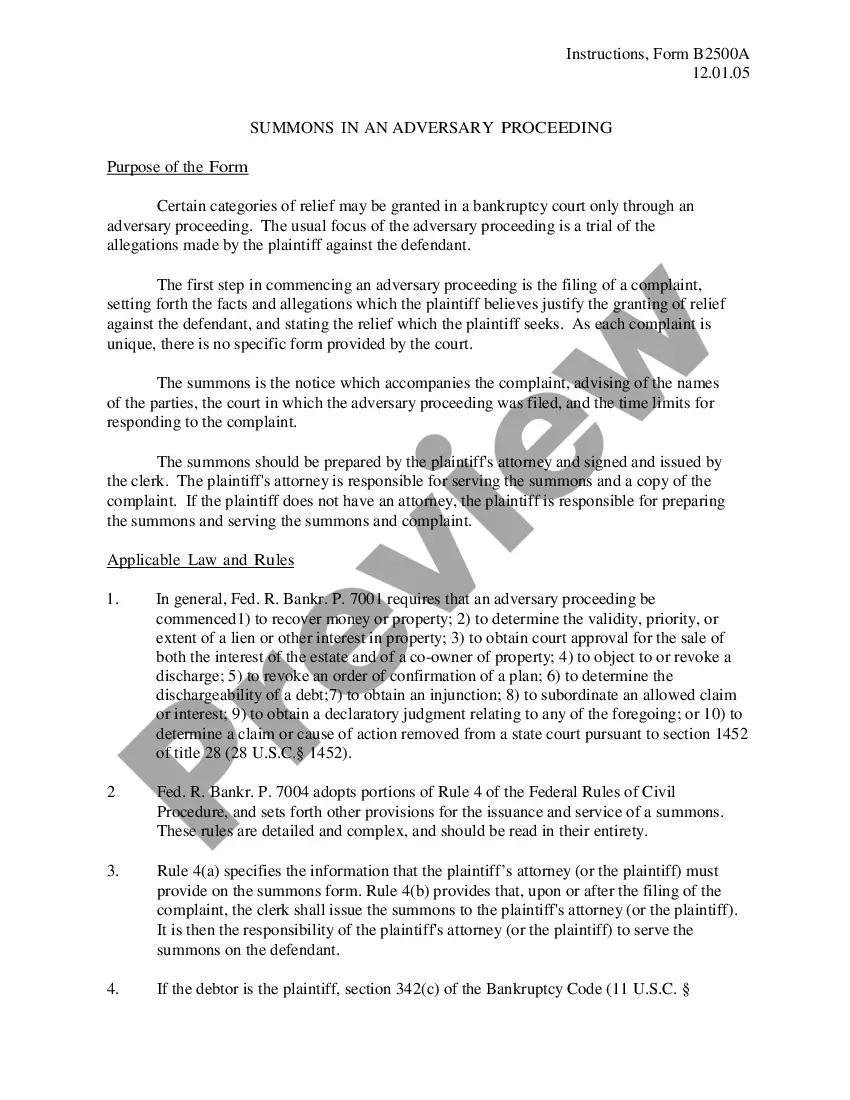

provided to inform users of consumer reports of their legal obligations. The first section of this summary sets forth the responsibilities imposed by the FCRA on all users of consumer reports. The subsequent sections discuss the duties of users of reports that contain specific types of information, or that are used for certain purposes, and the legal consequences of violations.

How to fill out Notice To Users Of Consumer Reports - Obligations Of Users Under The FCRA?

If you have to full, acquire, or produce lawful papers web templates, use US Legal Forms, the largest selection of lawful types, that can be found on the Internet. Utilize the site`s easy and practical research to find the papers you want. A variety of web templates for enterprise and individual purposes are sorted by categories and suggests, or keywords and phrases. Use US Legal Forms to find the Tennessee Notice To Users Of Consumer Reports - Obligations Of Users Under The FCRA in just a couple of click throughs.

If you are currently a US Legal Forms customer, log in in your account and then click the Down load button to find the Tennessee Notice To Users Of Consumer Reports - Obligations Of Users Under The FCRA. You can even gain access to types you in the past acquired from the My Forms tab of your account.

Should you use US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the shape for the appropriate city/nation.

- Step 2. Make use of the Review method to look through the form`s information. Do not forget to read through the information.

- Step 3. If you are not satisfied with the develop, use the Research field at the top of the monitor to locate other models in the lawful develop web template.

- Step 4. Upon having discovered the shape you want, go through the Purchase now button. Opt for the pricing program you prefer and include your qualifications to sign up on an account.

- Step 5. Procedure the purchase. You should use your bank card or PayPal account to complete the purchase.

- Step 6. Choose the format in the lawful develop and acquire it on your own system.

- Step 7. Full, edit and produce or signal the Tennessee Notice To Users Of Consumer Reports - Obligations Of Users Under The FCRA.

Each lawful papers web template you get is yours forever. You might have acces to each develop you acquired inside your acccount. Select the My Forms section and pick a develop to produce or acquire again.

Contend and acquire, and produce the Tennessee Notice To Users Of Consumer Reports - Obligations Of Users Under The FCRA with US Legal Forms. There are thousands of specialist and status-specific types you may use for your enterprise or individual requirements.

Form popularity

FAQ

Under the Fair Credit Reporting Act (FCRA), potential lenders are required to provide you with an adverse action notice when they deny you credit based on information in your credit report.

The Fair Credit Reporting Act (FCRA) is a federal law that helps to ensure the accuracy, fairness and privacy of the information in consumer credit bureau files. The law regulates the way credit reporting agencies can collect, access, use and share the data they collect in your consumer reports.

The FCRA gives you the right to be told if information in your credit file is used against you to deny your application for credit, employment or insurance. The FCRA also gives you the right to request and access all the information a consumer reporting agency has about you (this is called "file disclosure").

The Fair Credit Reporting Act (FCRA) is designed to protect the privacy of consumer report information ? sometimes informally called ?credit reports? ? and to guarantee that information supplied by consumer reporting agencies (CRAs) is as accurate as possible.

Most Frequent Violations of the Fair Credit Reporting Act A user of your information fails to notify you about a negative decision based on your credit report. Failure to notify you of your right to obtain a free credit report. Failure to notify you of the results of an investigation into a debt dispute.

The FCRA requires the Bureau to establish and maintain guidelines for furnishers regarding the accuracy and integrity of furnished information and to prescribe regulations requiring furnishers to establish reasonable policies and procedures to implement these guidelines. 15 U.S.C. §1681s-2(e).

A creditor must notify the applicant of adverse action within: 30 days after receiving a complete credit application. 30 days after receiving an incomplete credit application. 30 days after taking action on an existing credit account.

The Fair Credit Reporting Act or (FCRA) is a federal law and requires creditors, also known as furnishers, and the crediting reporting agencies to do several things regarding the accuracy of the credit reports. In Tennessee, you have the right to sue them for damages and get your day in court.

Thus, under the FCRA, certain consumer information will be subject to two opt-out notices, a sharing opt-out notice (Section 603(d)) and a marketing use opt-out notice (Section 624). These two opt-out notices may be consolidated.

When information has been used against a consumer, such as being used as a basis to deny employment or loan acceptance, the consumer must be notified. The party using the information against the consumer must tell the consumer which agency gave them the information.