Tennessee Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions

Description

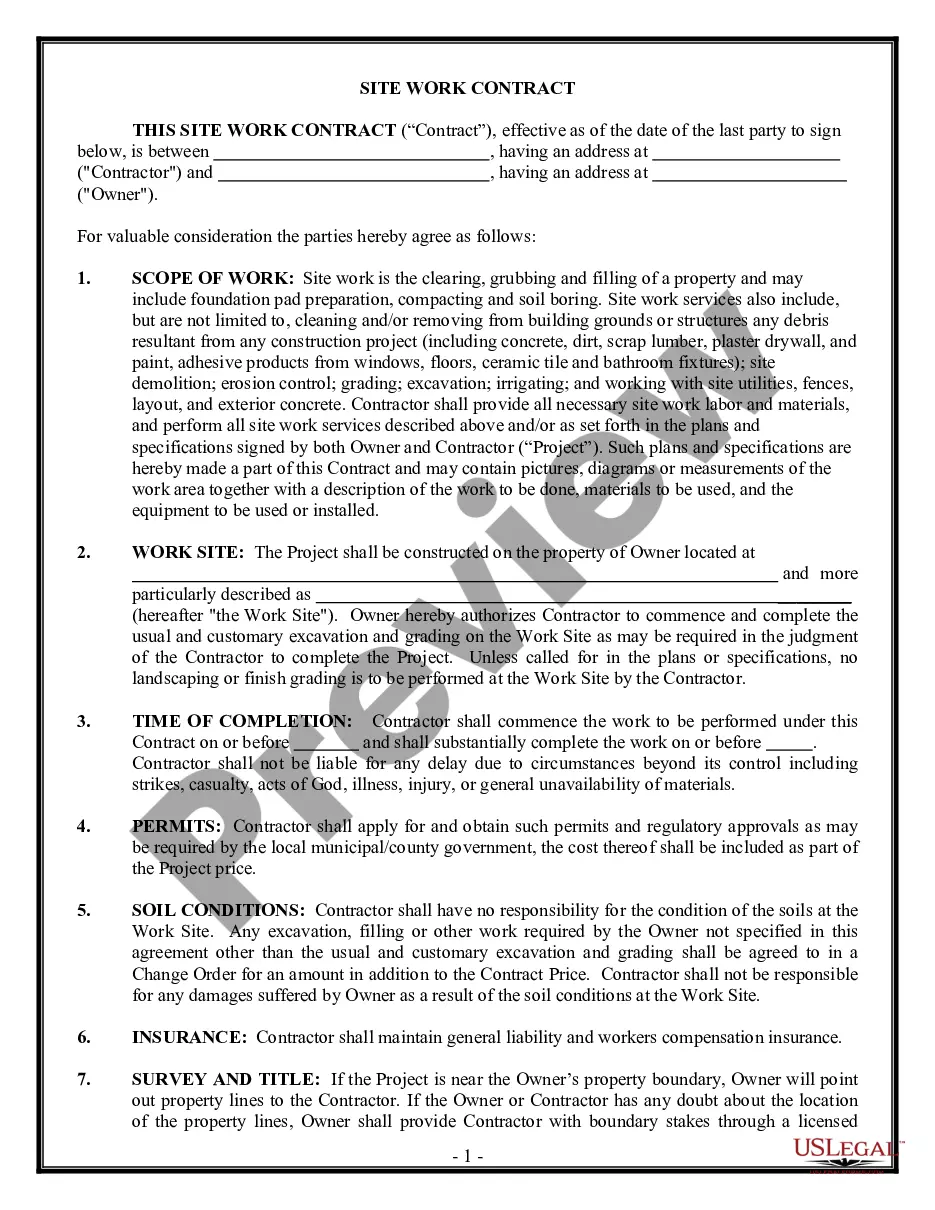

How to fill out Second Amended And Restated Credit Agreement Among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks And Financial Institutions?

Finding the right authorized document design can be quite a have difficulties. Needless to say, there are a lot of templates accessible on the Internet, but how would you find the authorized type you will need? Take advantage of the US Legal Forms internet site. The support provides thousands of templates, for example the Tennessee Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions, which you can use for organization and personal requirements. All the forms are checked out by experts and meet federal and state requirements.

Should you be presently listed, log in to your bank account and click the Down load key to get the Tennessee Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions. Utilize your bank account to search with the authorized forms you possess bought previously. Proceed to the My Forms tab of the bank account and have yet another backup of the document you will need.

Should you be a whole new user of US Legal Forms, listed below are straightforward instructions for you to adhere to:

- Very first, ensure you have selected the right type for your city/state. It is possible to check out the shape making use of the Preview key and read the shape outline to guarantee it will be the best for you.

- In case the type does not meet your preferences, take advantage of the Seach area to obtain the correct type.

- Once you are sure that the shape would work, go through the Buy now key to get the type.

- Pick the costs prepare you would like and type in the needed information. Build your bank account and pay for the transaction making use of your PayPal bank account or credit card.

- Choose the data file structure and down load the authorized document design to your gadget.

- Total, modify and print and sign the acquired Tennessee Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions.

US Legal Forms will be the biggest catalogue of authorized forms in which you can find different document templates. Take advantage of the company to down load appropriately-produced documents that adhere to condition requirements.