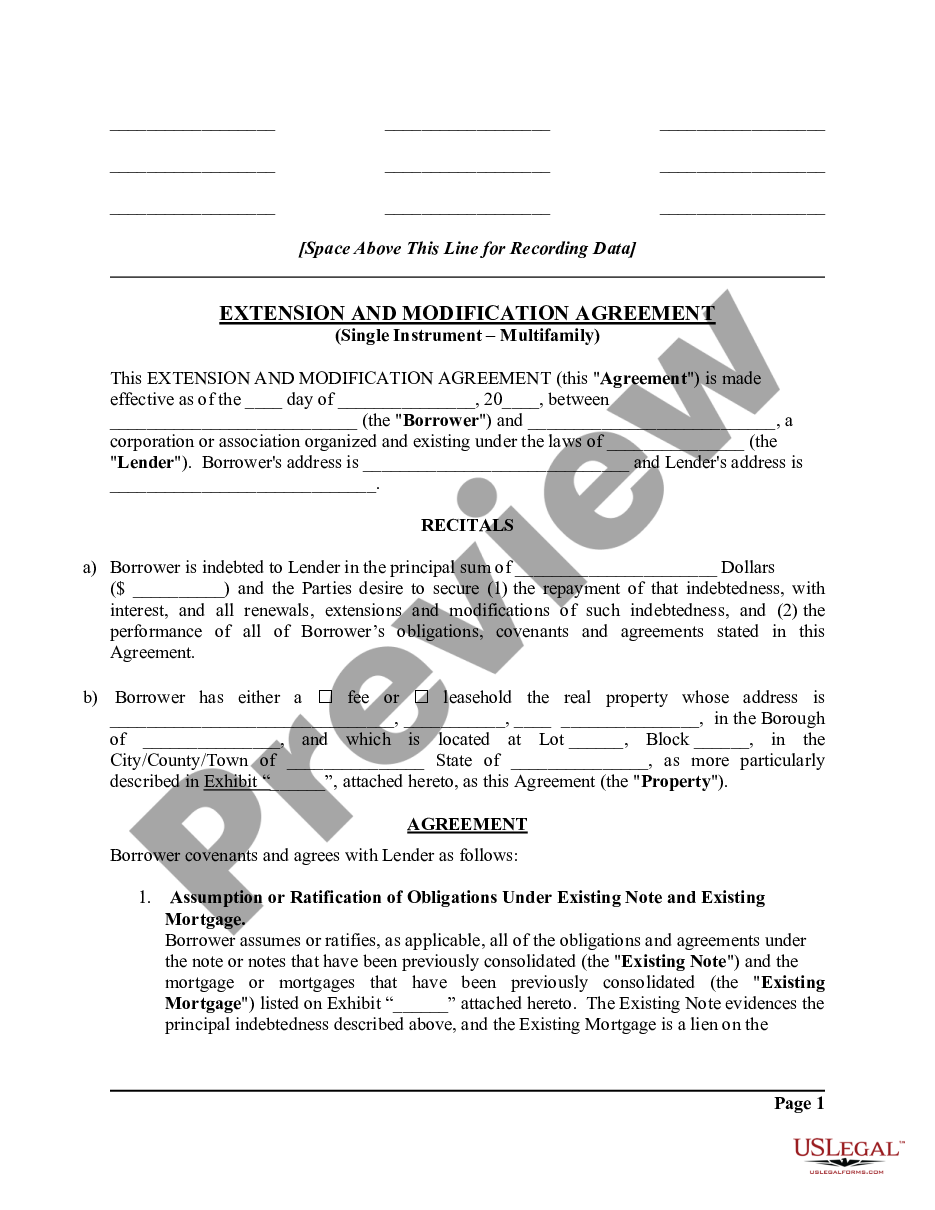

Tennessee Credit Agreement regarding extension of credit

Description

How to fill out Credit Agreement Regarding Extension Of Credit?

Choosing the right authorized papers design could be a have difficulties. Needless to say, there are plenty of web templates available online, but how will you discover the authorized develop you want? Utilize the US Legal Forms site. The services offers a huge number of web templates, including the Tennessee Credit Agreement regarding extension of credit, that you can use for organization and personal requires. Every one of the types are checked by specialists and fulfill federal and state requirements.

Should you be currently authorized, log in to your bank account and then click the Download key to obtain the Tennessee Credit Agreement regarding extension of credit. Make use of bank account to check from the authorized types you possess bought formerly. Visit the My Forms tab of your bank account and get yet another version from the papers you want.

Should you be a whole new customer of US Legal Forms, allow me to share easy instructions so that you can follow:

- Initially, be sure you have selected the proper develop for your personal area/state. You are able to look over the form using the Review key and look at the form explanation to make sure this is basically the right one for you.

- In the event the develop does not fulfill your expectations, utilize the Seach area to find the appropriate develop.

- Once you are sure that the form is suitable, go through the Purchase now key to obtain the develop.

- Opt for the costs strategy you need and enter the needed information and facts. Build your bank account and pay money for the transaction making use of your PayPal bank account or charge card.

- Select the file structure and acquire the authorized papers design to your gadget.

- Comprehensive, edit and print and signal the obtained Tennessee Credit Agreement regarding extension of credit.

US Legal Forms will be the most significant catalogue of authorized types for which you can find different papers web templates. Utilize the company to acquire professionally-created files that follow status requirements.

Form popularity

FAQ

Lenders must provide a full disclosure of all of the loan's terms in the credit agreement. That can include the annual interest rate (APR), how the interest is applied to outstanding balances, any fees associated with the account, the duration of the loan, the payment terms, and any consequences for late payments.

A credit facility agreement refers to an agreement or letter in which a lender, usually a bank or other financial institution, sets out the terms and conditions under which it is prepared to make a loan facility available to a borrower. It is sometimes called a loan facility agreement or a facility letter.

Terms of credit includes the following: i Interest rate ii Collateral iii Documentation requirement iv Mode of payment. These terms of credit vary substantially from one credit arrangement to another. They may vary depending on the nature of lender and borrower.

A credit facility agreement details the borrower's responsibilities, loan warranties, lending amounts, interest rates, loan duration, default penalties, and repayment terms and conditions.

The core elements include: Parties, Permitted Loan Amount, Payment, Interest Rate, Maturity Date, Default, Security Interest, Collateral, Warranties, Termination and Survival.

A creditor is an individual or institution that extends credit to another party to borrow money usually by a loan agreement or contract.

Extension of Credit means the right to defer payment of debt or to incur debt and defer its payment offered or granted primarily for personal, family, or household purposes.

Lenders must provide a full disclosure of all of the loan's terms in the credit agreement. That can include the annual interest rate (APR), how the interest is applied to outstanding balances, any fees associated with the account, the duration of the loan, the payment terms, and any consequences for late payments.