Tennessee Proposal to amend certificate of incorporation to authorize a preferred stock

Description

How to fill out Proposal To Amend Certificate Of Incorporation To Authorize A Preferred Stock?

US Legal Forms - one of several biggest libraries of legal varieties in the USA - provides a wide array of legal record layouts you are able to download or printing. While using website, you can find thousands of varieties for enterprise and person reasons, categorized by groups, says, or keywords and phrases.You will discover the latest models of varieties such as the Tennessee Proposal to amend certificate of incorporation to authorize a preferred stock within minutes.

If you already possess a membership, log in and download Tennessee Proposal to amend certificate of incorporation to authorize a preferred stock in the US Legal Forms collection. The Obtain option will show up on every single develop you perspective. You get access to all in the past acquired varieties from the My Forms tab of your respective account.

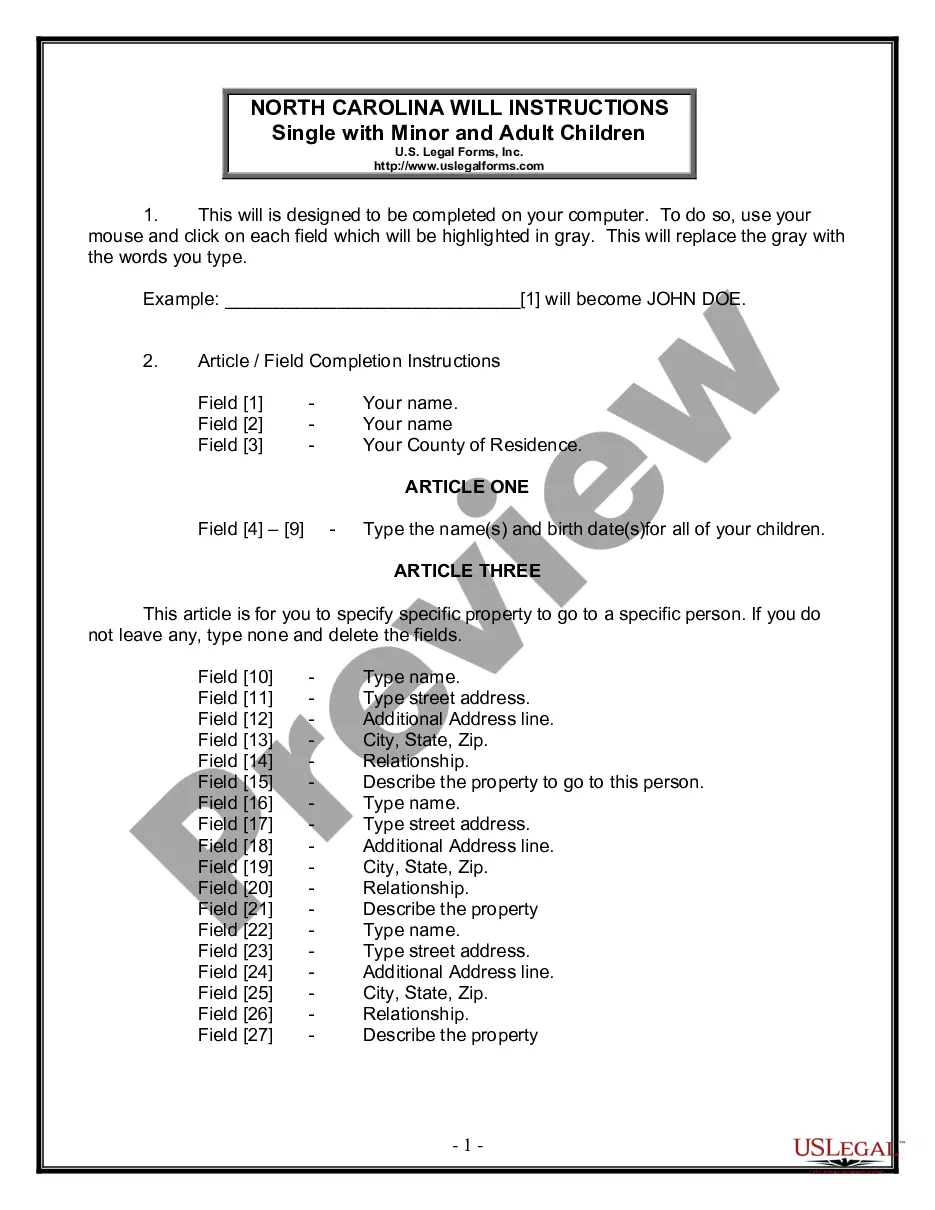

If you would like use US Legal Forms initially, allow me to share straightforward instructions to get you started off:

- Ensure you have selected the right develop for the area/area. Select the Preview option to check the form`s information. Browse the develop description to actually have chosen the correct develop.

- In case the develop does not fit your demands, utilize the Research discipline at the top of the screen to discover the one that does.

- If you are content with the form, validate your selection by simply clicking the Acquire now option. Then, opt for the rates strategy you prefer and provide your credentials to sign up for the account.

- Method the deal. Use your bank card or PayPal account to accomplish the deal.

- Select the formatting and download the form on the system.

- Make adjustments. Load, change and printing and indication the acquired Tennessee Proposal to amend certificate of incorporation to authorize a preferred stock.

Each web template you included with your bank account lacks an expiry day and it is your own for a long time. So, if you wish to download or printing one more copy, just visit the My Forms section and click in the develop you will need.

Get access to the Tennessee Proposal to amend certificate of incorporation to authorize a preferred stock with US Legal Forms, one of the most considerable collection of legal record layouts. Use thousands of expert and express-specific layouts that meet your organization or person demands and demands.

Form popularity

FAQ

Issuance of Preferred Stock: When a company issues preferred stock, it debits (increases) the cash account on the balance sheet for the total value received and credits (increases) the ?preferred stock? account in the equity section of the balance sheet.

The most common issuers of preferred stocks are banks, insurance companies, utilities and real estate investment trusts, or REITs. Companies issuing preferreds may have more than one offering for you to vet. Often you may find several different offerings of preferreds from the same issuer but with different yields.

Board approval, either by written consent or at a board meeting (for more about the differences between board consents and board meetings, please see our article), is required for every issuance of a security, whether that security is common stock, preferred stock, a warrant, an option or a note that is convertible ...

Issuing new shares typically requires approval from the company's shareholders. This may involve holding a vote at a shareholder meeting or obtaining written consent from a majority of shareholders. The approval process will depend on the company's bylaws and state laws governing the issuance of new shares.

Under current Section 312.03(b), shareholder approval is required when a company sells shares to a related party if the amount to be issued exceeds 1% of the number of shares or voting power outstanding before issuance.