Tennessee Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute

Description

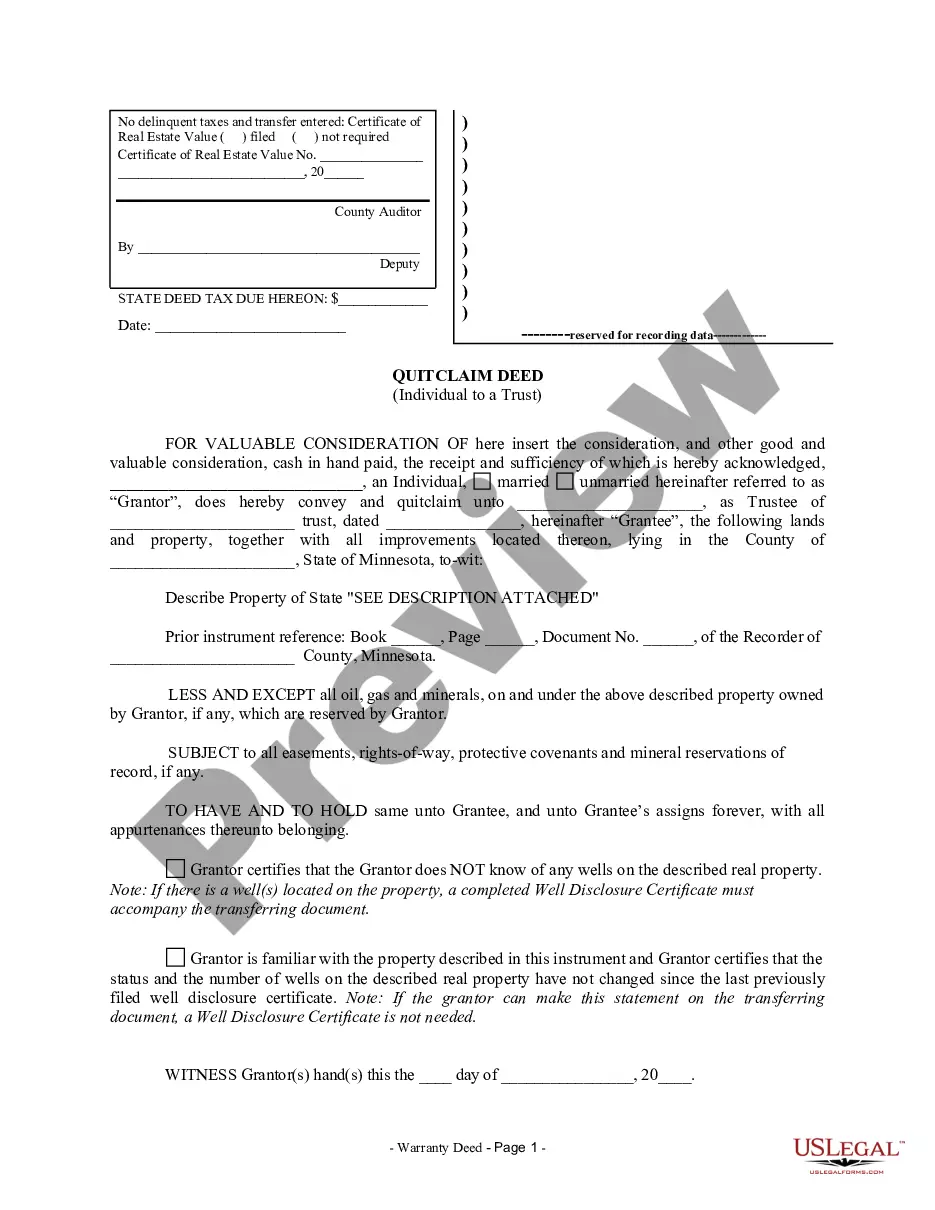

How to fill out Agreement And Plan Of Merger By Corning Inc, Apple Acquisition Corp, And Nichols Institute?

If you wish to total, down load, or printing authorized record layouts, use US Legal Forms, the greatest selection of authorized kinds, that can be found online. Make use of the site`s basic and practical research to get the papers you want. Different layouts for company and personal purposes are sorted by classes and claims, or search phrases. Use US Legal Forms to get the Tennessee Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute in a number of clicks.

If you are presently a US Legal Forms customer, log in to the bank account and then click the Acquire key to obtain the Tennessee Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute. You can also entry kinds you earlier delivered electronically from the My Forms tab of the bank account.

If you are using US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for the appropriate town/land.

- Step 2. Make use of the Preview solution to look over the form`s content material. Don`t forget about to read through the description.

- Step 3. If you are not happy with the develop, take advantage of the Research discipline on top of the display screen to discover other versions in the authorized develop design.

- Step 4. Upon having identified the form you want, go through the Acquire now key. Opt for the pricing plan you like and put your credentials to sign up for the bank account.

- Step 5. Process the financial transaction. You can utilize your charge card or PayPal bank account to perform the financial transaction.

- Step 6. Pick the format in the authorized develop and down load it on your gadget.

- Step 7. Complete, change and printing or indication the Tennessee Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute.

Each and every authorized record design you buy is yours eternally. You might have acces to every develop you delivered electronically with your acccount. Click on the My Forms portion and select a develop to printing or down load once more.

Contend and down load, and printing the Tennessee Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute with US Legal Forms. There are many expert and condition-certain kinds you can utilize to your company or personal needs.